The worldwide cryptocurrency market cap has misplaced $40 billion over the previous 24 hours amid the sustained market-wide turbulence that has seen a number of property, resembling Bitcoin (BTC) and Ethereum (ETH) drop by surprising margins.

This downtrend, which began on Jan. 12 following the preliminary hype surrounding the spot Bitcoin ETF approval, has endured amid a number of selloffs from institutional and retail traders alike. It has led to a slew of selloffs that has compounded into panic throughout the market.

Bitcoin triggers market-wide massacre

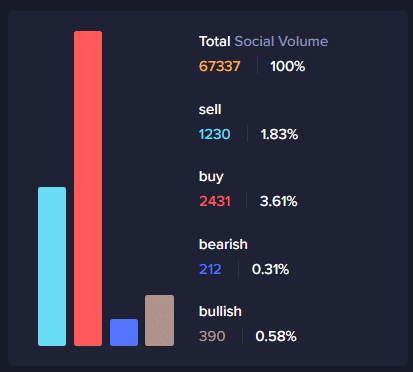

In consequence, market sentiment has dipped considerably, per knowledge from Santiment. Santiment’s whole social quantity metric means that, whereas social exercise has elevated over the previous week, the crypto neighborhood has targeted totally on purchase and promote mentions.

Nonetheless, regardless of the downtrend, market individuals are leaning towards “purchase the dip” tendencies, as “purchase” mentions improve to 2,431, taking 3.61% of the full social quantity. As well as, mentions of “promote” have risen to 1,230, accounting for 1.83% of social quantity.

The market confronted a substantial setback yesterday following Bitcoin’s collapse beneath the pivotal $40,000 assist threshold. The asset had defended the $40,000 degree for the reason that begin of the yr till Jan. 22, when it slumped to $39,700.

Bitcoin recovered the $40,000 assist virtually instantly. Nonetheless, a resurgence of bearish stress has triggered an identical market drop, with the asset at present altering fingers at $39,734. BTC declined by 3.7% during the last 24 hours.

The BTC dip has affected the remainder of the market, with ETH dropping by 4.11% previously 24 hours to $2,307 on the reporting time. ETH recorded a large 5.11% intraday loss yesterday, because the bears goal the $2,300 assist in an try to set off additional declines.

The GBTC selloffs

This market massacre has been exacerbated by large selloffs from the Grayscale Bitcoin Belief (GBTC) shortly after the ETF approval. Apparently, after the SEC’s ETF approval, Alameda, FTX’s sister agency, just lately withdrew its case in opposition to Grayscale.

Nonetheless, knowledge means that FTX additionally bought off 22 million GBTC shares, compounding the bearish stress on Bitcoin and the broader market. In addition to the FTX sale, institutional traders have continued to dump their GBTC shares, leading to extra BTC selloffs.

Grayscale just lately moved $1.3 billion to Coinbase, the custody service supplier for GBTC. Amid an outflow of $2 billion from the ETF, a market analyst identified that the product’s 1.5% excessive payment and the absence of its large low cost have triggered the investor exodus.

In the meantime, because the onslaught endures, CryptoQuant knowledge confirms that change internet flows just lately pivoted to bullish grounds, with deposits on exchanges at present decrease than the weekly common. This sample entails that the selloff marketing campaign could be slowing down.