Discover the anticipated subsequent crypto bull market in 2024-2025, its key driving elements, and decide which technique is perfect for you.

The crypto market has skilled a number of bull and bear cycles since Bitcoin’s (BTC) inception in 2009 giving cues for the following crypto bull run 2024-2025.

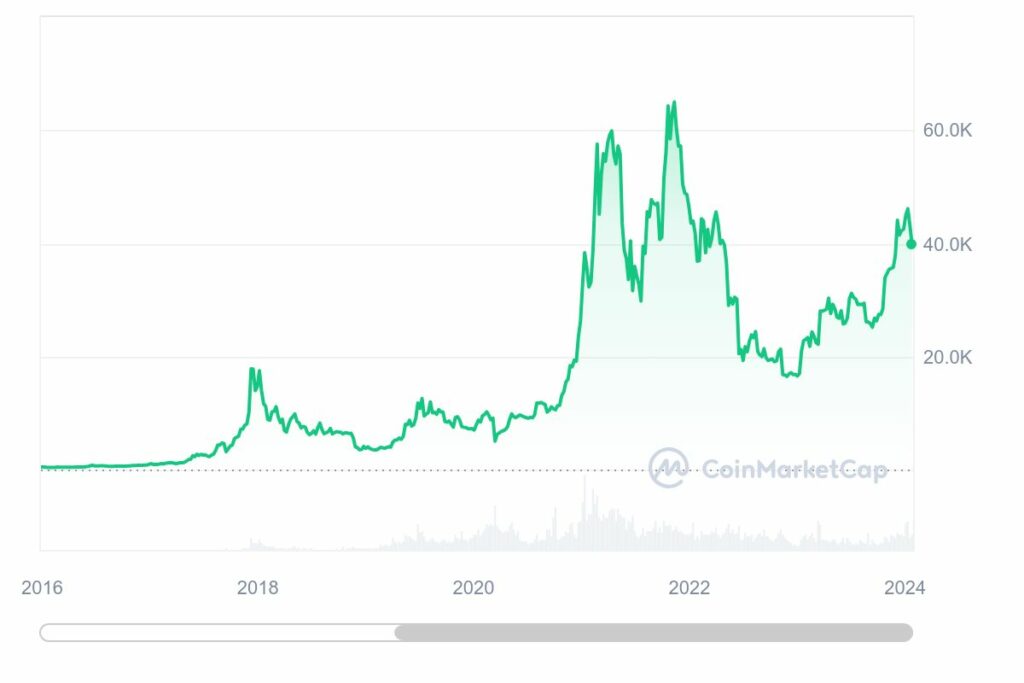

One of many earliest vital bull runs occurred in 2017, when Bitcoin noticed a close to 20x value improve, peaking near $20,000 ranges.

This was adopted by a steep decline in what was later termed the “crypto winter” and noticed BTC lose over 80% of its worth, bottoming at round $3,200.

One other outstanding section was the 2020-2021 bull run. Submit a interval of decline and stagnation, BTC, together with different main altcoins like Ethereum (ETH), surged to new heights.

Throughout this era, Bitcoin’s worth reached roughly $69,000 by Nov. 2021, whereas the general market cap ballooned over $2.5 trillion earlier than cooling off.

As we gaze into the long run, a number of elements counsel one other bull run could possibly be on the horizon. So, when is the following predicted crypto bull run, and the way must you put together for it?

Elements that would set off the following crypto bull run in 2024-2025

Mainstream acceptance of BTC ETFs

The launch of Bitcoin ETFs marks a major step within the mainstream acceptance of cryptocurrencies.

These ETFs provide a regulated possibility for each retail and institutional traders to realize publicity to Bitcoin, probably resulting in broader adoption and elevated liquidity.

At present, the market has seen the introduction of a number of Bitcoin ETFs, together with notable ones like Blackrock’s iShares Bitcoin Belief (IBIT), ARK 21Shares Bitcoin ETF (ARKB), and many others.

Since their introduction, these ETFs have amassed substantial holdings, reflecting rising investor curiosity.

As an example, the 11 U.S. ETFs monitoring Bitcoin’s value have collectively accrued over 644,860 Bitcoins, valued at greater than $27 billion, signaling a shift in Bitcoin’s place in mainstream finance.

Traditionally, the introduction of ETFs in different markets, like gold, has performed a vital position in making the asset extra accessible to a broader vary of traders, contributing to cost appreciation.

For instance, the launch of the primary gold ETF in 2003 coincided with the start of a 10-year bull market in gold, the place its value rose by greater than 350%. Within the first yr post-launch, Gold Value elevated by 20% with a yearly influx of $15 billion into totally different ETFs.

Drawing parallels, the introduction of Bitcoin ETFs may have an identical affect, providing a extra direct and controlled funding avenue into Bitcoin.

BTC halving

Traditionally, Bitcoin halving occasions have tremendously impacted its value and market dynamics. The halving happens roughly each 4 years, decreasing the block reward for miners by half, resulting in elevated shortage of Bitcoin.

The subsequent halving is anticipated in April 2024, and if historical past is any information, it could possibly be a significant catalyst for the following crypto bull run 2024-2025.

Analyzing previous halvings, every occasion has been adopted by a notable improve in Bitcoin’s value. As an example, after the 2016 halving, Bitcoin’s value surged considerably the next yr. The 2020 halving additionally preceded the outstanding bull run of 2020-2021, the place Bitcoin reached new highs.

The 2024 halving, due to this fact, is being watched carefully, with expectations of it triggering an identical optimistic affect on the crypto market.

ETH’s Dencun improve and its affect on the crypto market

Ethereum’s Dencun improve, a significant step within the community’s improvement, has been efficiently carried out on the Goerli testnet.

This improve, that includes the implementation of EIP-4844 (proto-danksharding), is targeted on rising knowledge availability for layer-2 rollups and enhancing Ethereum’s scalability.

The first part, proto-danksharding, permits for the non permanent storage of off-chain knowledge, which is anticipated to considerably scale back transaction charges for decentralized functions (dapps), notably benefiting layer 2 rollup chains.

The Dencun improve is anticipated to decrease rollup transaction prices by as much as 10 occasions, relying on blob house demand. This discount in fuel charges and quicker transaction speeds are poised to open alternatives for extra advanced functions on layer 2 options.

With these technical achievements, Ethereum may turn out to be a extra scalable and environment friendly blockchain, making ETH and ETH-based functions a powerful contender to flourish in worth within the coming months and years.

Macroeconomic elements influencing the anticipated crypto bull run

When is the following crypto bull run? The crypto market’s trajectory could possibly be closely influenced by numerous world financial elements.

Geopolitical tensions, notably in areas vital to the world’s meals and power provide, like Japanese Europe and the Center East, are main threat elements confronting the worldwide financial system.

Any escalation in these conflicts may result in disruptions in power markets and provide chains, impacting world financial development and investor sentiment in direction of riskier belongings like cryptocurrencies.

As an example, an escalation within the Center East affecting oil manufacturing may result in surging oil costs, which can stoke inflation and result in risk-off sentiment amongst traders, probably negatively impacting riskier belongings like cryptocurrencies.

Furthermore, a analysis report by blockchain analytics agency TRM Labs confirmed that just about 80% of jurisdictions around the globe have carried out measures to tighten crypto laws in 2023.

Within the absence of a complete regulatory construction for cryptocurrencies in the US, TRM Labs foresees vital selections from federal courts in 2024 relating to the potential classification of sure crypto belongings as securities.

In 2023, The European Union (EU) made vital strides in regulating the crypto market by establishing Markets in Crypto-Belongings Regulation (MiCA), setting uniform guidelines for crypto-assets, together with shopper safety and environmental safeguards.

The EU has additionally targeted on anti-money laundering (AML) measures. New pointers issued by the European Banking Authority (EBA) emphasize the necessity for crypto-asset service suppliers to handle dangers associated to cash laundering and terrorist financing successfully.

These developments may have a major affect on investor confidence and market stability, each of that are essential elements in figuring out when the following crypto bull run will happen.

The way to put together for the following predicted crypto bull run

As we stand getting ready to what many anticipate to be the crypto bull run information of 2024-2025, it’s essential to have a well-rounded technique.

Reddit-inspired gradual promoting technique

One investor’s strategy entails ceasing crypto purchases after April 2024 and implementing a gradual promoting technique from September 2024. This plan suggests promoting a set proportion of holdings every month, beginning at 4% and finally reaching 10%. Moreover, 25% of the proceeds go into shopping for Bitcoin and 75% right into a high-interest financial savings account. This technique emphasizes self-discipline, particularly throughout risky market intervals.

Diversification technique

Diversification is essential in any funding strategy, particularly in a risky market like cryptocurrencies. This entails spreading your investments throughout numerous kinds of crypto belongings, resembling Bitcoin, altcoins, and tokens primarily based on totally different applied sciences or with totally different use instances, and even contemplating non-crypto investments like shares or actual property. The thought is to not put all of your eggs in a single basket, decreasing the affect of any single asset’s efficiency in your general portfolio.

Automated buying and selling and dollar-cost averaging

Automated buying and selling algorithms and dollar-cost averaging (DCA) can provide a extra hands-off strategy to your buying and selling technique. DCA entails investing a set quantity into a specific asset at common intervals, no matter its value, decreasing the affect of volatility. Furthermore, you’ll be able to arrange automated trades utilizing algorithmic buying and selling instruments primarily based on particular market situations or indicators, serving to you’re taking emotion out of the buying and selling course of.

Conclusion

Every of those methods has its deserves and could be tailor-made to your threat tolerance and monetary objectives. The bottom line is to remain knowledgeable, adapt to market adjustments, and keep a disciplined strategy.

As all the time, it’s smart to seek the advice of a monetary advisor to align these methods together with your monetary state of affairs. Investing greater than you’ll be able to afford to lose is rarely a great technique.