In the course of the 2024 presidential race, the dialogue on a U.S. CBDC turns into extra intense. Candidates’ contrasting views mirror wider considerations about privateness and authorities management.

As of Jan. 2024, the scenario relating to central financial institution digital currencies (CBDCs) within the U.S. is characterised by warning and gradual development, particularly when in comparison with the developments made by different nations.

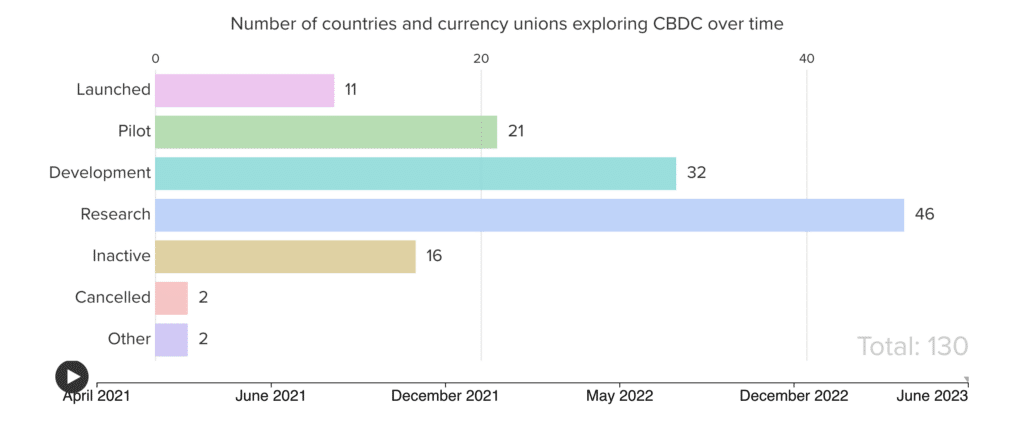

At present, 11 nations have totally carried out digital currencies, whereas China, India, and several other different nations are within the pilot part.

Within the U.S., the event of a retail CBDC (direct-to-consumer) has seen little progress. Nevertheless, there may be ahead motion on a wholesale CBDC, which focuses on bank-to-bank transactions.

Amid this, the Federal Reserve is approaching the concept of a digital greenback with a level of warning. Fed Chair Jerome Powell expressed curiosity in a digital greenback in 2022 but in addition acknowledged the necessity for cautious consideration because of the international significance of the greenback.

At present, the U.S. is emphasizing analysis and growth on this space, with tasks just like the joint effort between the Financial institution of Boston and the MIT Digital Forex Initiative’s Challenge Hamilton, and the Financial institution of New York’s Challenge Cedar, exploring the technical points of CBDCs.

In the meantime, the U.S. stance on CBDCs has additionally develop into a subject of curiosity within the political area, notably within the context of the 2024 presidential election.

Considerations have arisen relating to privateness and the potential for a CBDC to function a software for presidency surveillance, resulting in opposition from some political figures.

To delve deeper into this subject, it is very important perceive the views of the presidential candidates on CBDCs and whether or not the U.S. even wants a CBDC.

US presidential candidates’ stance on CBDCs

The difficulty of CBDCs has emerged as a big subject amongst U.S. presidential candidates within the 2024 election cycle. There’s a clear division in views, particularly amongst distinguished figures within the Republican Get together.

Former President Donald Trump has taken a powerful stance in opposition to CBDCs. Throughout his marketing campaign, he vowed to stop the creation of a U.S. CBDC if reelected, labeling it a “harmful menace to freedom.”

Trump’s considerations are centered across the potential for a CBDC to provide the federal authorities intensive management over residents’ funds, together with the power to watch and probably seize funds with out people’ information.

This attitude aligns with different Republican candidates, together with Florida Governor Ron DeSantis. DeSantis has proposed laws in Florida to ban the usage of CBDCs, framing it as an try by the federal authorities to extend surveillance and management over monetary transactions.

One other vital voice within the Democratic area, Robert F. Kennedy Jr., has additionally expressed reservations about CBDCs. He warns of the potential for CBDCs to develop into social surveillance and management instruments, citing the dearth of anonymity related to such digital currencies.

Kennedy raises considerations concerning the authorities’s skill to watch non-public monetary affairs and implement transaction restrictions, suggesting that CBDCs may result in larger authorities intrusion into particular person lives.

Then again, President Joe Biden confirmed a cautious however forward-looking method in direction of CBDCs throughout his time period.

In April 2022, he signed Government Order #14067, which licensed the Fed to start a proper strategy of assessing the dangers and alternatives of the U.S. CBDC.

Nevertheless, no formal design for a U.S. CBDC has been launched, nor has a launch date been introduced beneath Biden’s administration.

Does the US want a CBDC mannequin?

Economically, the introduction of a CBDC within the U.S. may have far-reaching implications. It may streamline cost programs, scale back transaction prices, and remodel financial coverage implementation.

As an example, in instances of financial disaster, CBDCs may allow faster and extra direct implementation of measures akin to stimulus funds. This was evidenced in the course of the COVID-19 pandemic when stimulus funds have been delayed attributable to logistical points in distributing funds.

Nevertheless, it additionally raises questions concerning the position of business banks and the dynamics of cash provide and demand.

The potential for a CBDC to bypass conventional banking intermediaries may disrupt present monetary fashions, impacting financial institution deposits and lending actions.

Furthermore, the worldwide monetary panorama, the place the U.S. greenback holds a dominant place, might be influenced by the introduction of a U.S. CBDC.

There’s a debate on the way it may have an effect on the greenback’s position because the world’s reserve foreign money, particularly within the face of competitors from digital currencies like China’s digital yuan.

Some specialists argue {that a} well-designed U.S. CBDC may reinforce the greenback’s international standing, whereas others warning in opposition to potential dangers to its long-established place.

The continued analysis and exploration by the Fed and different establishments are essential in figuring out essentially the most acceptable plan of action for the U.S. because it instantly impacts the world financial system and the worldwide state of affairs.