On-chain information confirms that outdated Bitcoin (BTC) whales have been divesting their BTC tokens to conventional institutional traders, because the firstborn cryptocurrency continues to command rising curiosity in Wall Road.

Ki Younger Ju, the founder and CEO of CryptoQuant, highlighted this phenomenon in a current evaluation, drawing consideration to a comparative evaluation of Bitcoin’s demand and provide throughout outdated and new whale addresses.

The information means that the Bitcoin community is experiencing a surge in demand from rising whale entities, coinciding with heightened promoting exercise amongst established whale addresses.

This noticed sample might point out older addresses in search of to capitalize on income from their Bitcoin holdings, significantly amid the present value discovery part, which has seen BTC surge above $73,000.

The metric reveals that the current sample was noticed available in the market within the final two cycles. Remarkably, this development emerged in early 2017, coinciding with the onset of the 2017 bull cycle. Subsequently, Bitcoin surged from $966 in January 2017 to its peak of $19,666 in December 2017.

Through the bull market at the moment, the numerous change in possession endured for 332 days. Members available in the market, significantly bullish traders who entered in 2017, resumed this sample within the 2021 bull run, divesting their BTC to new whale entities over a interval of 136 days.

Knowledge signifies the emergence of a cohort of latest whale entities throughout the present bull market. Nonetheless, an intriguing deviation from the sample this time is that these new whales predominantly include conventional institutional traders who’re exhibiting heightened curiosity in BTC.

That is primarily because of the approval and success of the spot Bitcoin ETFs. These funding merchandise have launched BTC to Wall Road. Following a interval of sustained outflows, spot Bitcoin ETFs have recorded two consecutive day by day inflows this week, indicating a resurgence of curiosity.

Bitcoin exhibits extra room for progress

In the meantime, the continued shift in possession has traditionally aligned with intervals of market peaks. In consequence, the metric signifies that Bitcoin would possibly nonetheless have room for extra substantial progress, because the rising accumulation development stays minimal on the reporting time.

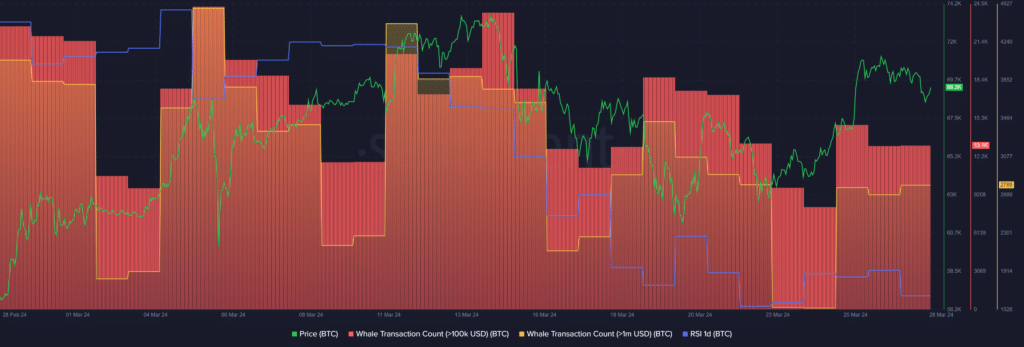

Furthermore, regardless of Bitcoin’s present place above the $70,000 mark, its day by day relative power index (RSI) stands at 45, indicating that the cryptocurrency stays properly beneath overbought ranges. This reaffirms the notion that the asset has ample potential for additional ascent.

In accordance with information supplied by Santiment, the variety of whale transactions consisting of a minimum of $100,000 price of BTC has been consolidating across the 13,100 mark over the previous two days.

The variety of transactions consisting of a minimum of $1 million price of BTC elevated by 3.8% — rising from 2,691 to 2,789 distinctive transactions per day.

The excessive quantity of whale exercise at this level may doubtlessly put Bitcoin in a barely unstable zone.

Bitcoin is presently buying and selling at $70,759, up 1.61% over the previous 24 hours. The crypto asset has gained by greater than 4% within the final week, because it seems to be to get well the losses of the previous few days.