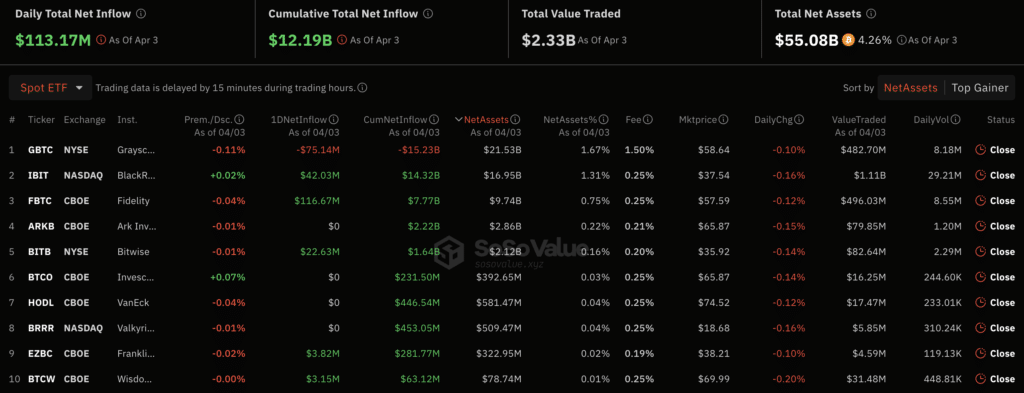

On April 3, internet day by day capital inflows within the spot Bitcoin ETF sector reached over $113 million.

Based on SoSo Worth, capital inflows have picked up considerably after falling into the purple zone. The chief within the inflow of funds is Constancy’s spot Bitcoin ETF (FBTC), which ended at $116.6 million. Following Constancy’s providing is iShares Bitcoin Belief (IBIT), which logged $42 million.

Capital outflows from the Grayscale Bitcoin Belief ETF (GBTC) reached $75.1 million, a brand new low from the tip of February.

On April 2, internet outflows from the ARK Make investments (ARKB) Bitcoin ETF reached $87.5 million, surpassing GBTC for the primary time. The entire internet influx into spot Bitcoin ETFs amounted to $40.3 million. Many of the influx got here from the BlackRock fund, which acquired one other $150 million. In second place was Constancy, which notched $44 million.

Unfavourable dynamics have been noticed in GBTC, because the fund has led outflows because the launch of spot BTC ETFs within the American market in January of this yr. The entire determine has since already damaged the $15 billion mark.

Nonetheless, the dynamics of outflows within the spot Bitcoin ETF market started to vary. Based on the day’s outcomes, $87.5 million flowed out of ARKB, whereas $81.9 million flowed out of GBTC.

The rash of outflows started on the primary day of April when buyers withdrew round $300,000 from the ARK Make investments fund.