As we dive into the core subject of at the moment’s “SDEX crypto” article, we’ll first ensure you know what the SmarDex crypto venture is all about. That is the place we’ll intently look at the venture’s fundamentals, roadmap, platform, and use instances. Then, we’ll focus our consideration on the SDEX coin. We’ll clarify what the SDEX token is all about and check out its tokenomics.

Nonetheless, since most of you need to know whether or not or not you should purchase the SmarDex token, we’ll additionally analyze the SDEX value. As such, you’ll get to be taught what value ranges the SDEX coin already lined and what probably the most vital ranges of help and resistance are. Plus, utilizing the Fibonacci retracement device and evaluating SmarDex with the main DeFi initiatives, we’ll additionally supply some SDEX value predictions for the upcoming bull run.

Nonetheless, you’ll additionally study Moralis Cash and the way it might help you resolve if and when you should purchase the SDEX crypto asset. We’ll additionally reply the place and tips on how to purchase $SDEX.

What’s SmarDex?

SmarDex is a brand new DEX that launched within the spring of 2023. It primarily caters to liquidity suppliers because it introduces a fine-tuned algorithm to remove impermanent loss (IL). Actually, in lots of cases, this enhanced DEX algorithm even introduces impermanent achieve (IG).

After all, this new decentralized alternate’s observe file can’t examine with the main DEXs, akin to Uniswap. Nonetheless, the SmarDex crypto crew created a simulation that compares IL for Uniswap’s algorithm and SmarDex’s fine-tuned one. That is the chart that presents the ends in relationship to the ETH value from 2018 as much as 2023:

You possibly can discover the above chart extra intently on the venture’s official web site (smardex.io). There, you can even discover the “Simulate the algorithm now” button, which lets you examine the efficiency of SmarDex in opposition to the opposite aggressive DEXs.

When exploring the above chart, understand that the unfavourable percentages symbolize IL, whereas the optimistic percentages symbolize IG. So, the bigger the unfavourable worth, the bigger IL, and the bigger the optimistic worth, the bigger IG.

Furthermore, if the above simulation is legit, it’s clear that SmarDex outperforms Uniswap and gives a fairly vital IG. Why is that so vital? Nicely, on the one hand, this gives liquidity suppliers extra income and, subsequently, additionally incentives them to make use of their crypto funds with SmarDex. Alternatively, it additionally allows SmarDex to supply decrease charges and, in flip, entice extra merchants.

So, whether or not you’re a dealer or a liquidity supplier, you’ll be able to already use the SmarDex crypto platform. There are various methods to entry it; nonetheless, probably the most legit path to take action is by hitting the “Launch App” button on the venture’s official web site.

SmarDex Crypto Fundamentals

As a crypto investor, you have to familiarize your self with basic evaluation (FA). That is the place you look intently on the venture’s web site, whitepaper, crew, VCs, tokenomics, and extra. Primarily, your purpose is to dive deep and decide if the venture is sound and whether it is fixing any precise issues.

An in depth FA of the SDEX crypto venture exceeds the scope of this text. Nonetheless, we’ll offer you an honest overview. The latter ought to suffice for these of you who’ll resolve to commerce the SDEX coin. Nonetheless, in the event you plan on offering liquidity on SmarDex, or utilizing its staking and farming options, we extremely suggest you dive deeper.

A part of the basics have already been lined above. As such, you already know that the SmarDex crypto is a venture that goals to supply a DEX that not solely overcomes impermanent loss however even supplies impermanent positive factors.

By the way in which, IL happens when one of many asset pairs within the liquidity pool will increase in comparison with the opposite one. If a liquidity supplier is to gather their property in such a case, the income can be decrease than if the liquidity supplier have been to carry the asset of their pockets.

Word: We encourage you to learn SmarDex’s whitepaper. It correctly describes the SmarDex know-how and in addition features a good instance that may show you how to grasp the idea of IL.

The gist of SmarDex is its protocol, which makes use of the normal DEX mannequin. The latter makes use of the fixed product (okay), which the SmarDex protocol modifies. Because of this, the protocol mechanically adjusts the steadiness of the reserve and, in flip, at all times ensures the very best swap. These automated changes make the protocol good; therefore, “Sensible + DEX = SmarDex.”

Roadmap

After scavenging by the venture’s web site, documentation, and whitepaper, we couldn’t discover any official roadmap. Nonetheless, on the time of writing, the venture already gives an energetic DEX app the place customers can swap tokens, present liquidity, use the farming function, and stake the SDEX token.

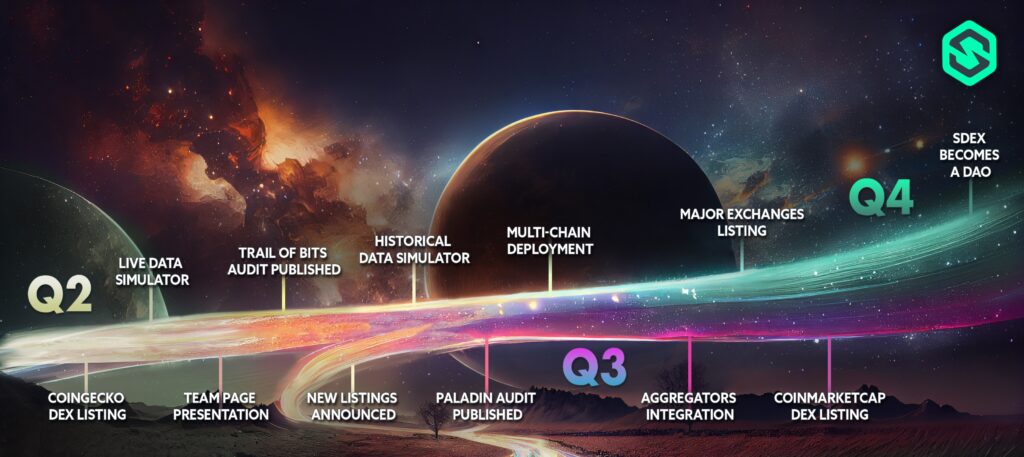

Nonetheless, we did handle to search out some graphic roadmaps that have been most certainly used for promotional functions. That is the one outlining main milestones for 2023:

Right here’s the one that’s all about hyping the SmarDex venture:

Platform

As identified above, the SmarDex platform is already reside. So, anybody with a Web3 pockets (e.g., MetaMask) can begin interacting with it.

To entry the platform, you need to use the aforementioned “Launch App” button or just choose “Swap,” “Liquidity,” “Farming,” or “Staking” from the highest menu of the venture’s official web site.

The platform appears to be user-friendly and is operating easily, as per our fast test. Nonetheless, please notice that we haven’t carried out any of the on-chain transactions required to execute any of the above-outlined core options of SmarDex.

Use Instances of SmarDex

We are going to deal with the SDEX coin and its utility in one of many following sections, however as for the SmarDex platform, its apparent use case is that it serves as a decentralized alternate. As such, it gives a P2P, decentralized device to commerce cryptocurrencies.

After all, to ensure that there to be ample liquidity for merchants to truly use this DEX, there should be dedicated liquidity suppliers. And the core use case of SmarDex is the truth that through its fine-tuned algorithm, the DEX gives higher incentives for its liquidity suppliers.

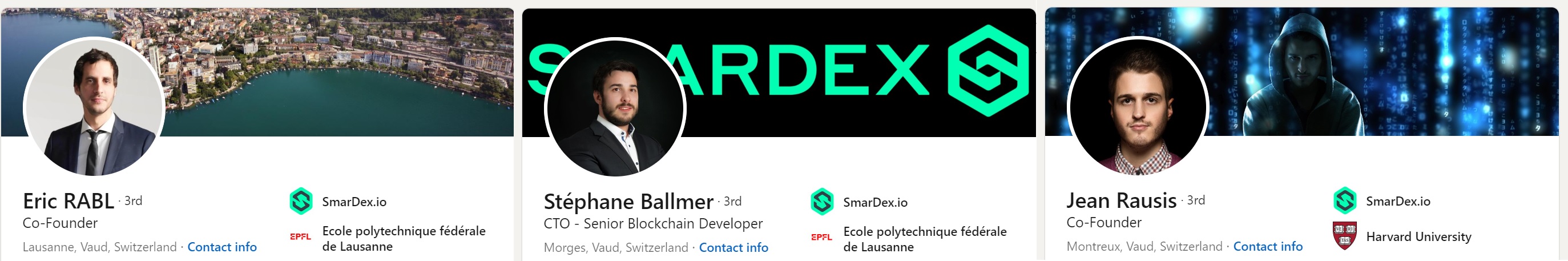

We like the truth that the crew behind the venture – which by the way in which, is doxxed – open-sourced their algorithm. This invitations different current and upcoming DEXs to discover and implement higher circumstances for liquidity suppliers in addition to merchants.

All in all, these are a few of the highlights of our fast SDEX crypto FA:

- Claims backed by an in depth whitepaper and simulations.

- Functioning utility.

- Doxxed crew.

- The venture and its good contract have been audited by Paladin and Path of Bits.

What’s the SDEX Coin?

The SDEX coin is the SmarDex crypto venture’s native token that was minted on March 9, 2023. Moreover, it’s an ERC-20 cryptocurrency, which suggests it lives on the Ethereum chain and follows the commonest customary for fungible tokens. Nonetheless, it’s price declaring that SmartDex helps a number of chains, so you can even discover the SDEX token on BNB Chain, Polygon, and Arbitrum.

Because the above roadmap suggests, the crew plans to create SDEX DAO. So, it’s secure to presume that the SDEX coin will function a governance token at that time.

Nonetheless, the SDEX token already has a use case. In spite of everything, SDEX crypto holders can use the above-presented SmarDex platform to stake this cryptocurrency. By doing so, they’re able to earn passive revenue from farming rewards and protocol charges.

Tokenomics of the SDEX Token

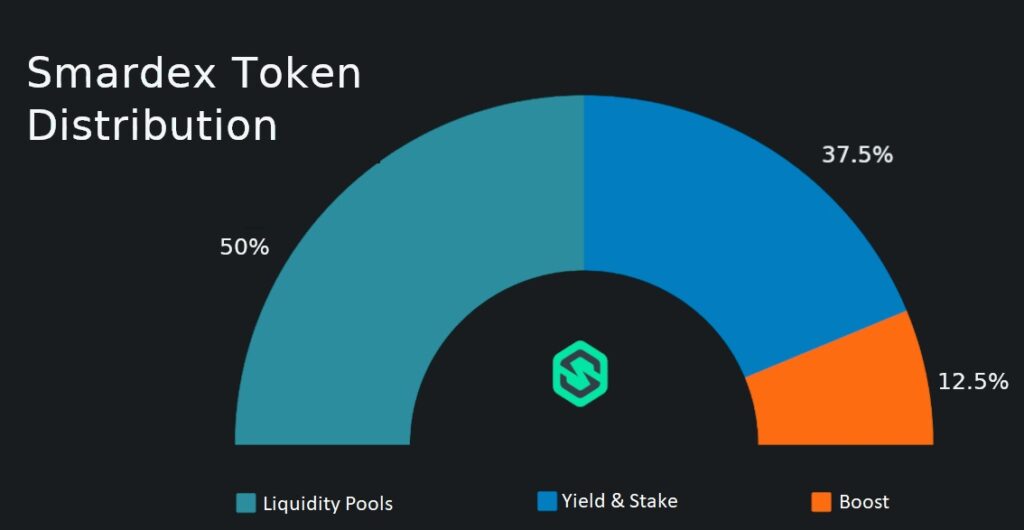

The SmarDex token has a capped provide of ten billion $SDEX. Furthermore, the token was allotted into three liquidity-providing pillars:

- Liquidity swimming pools (50%).

- Lengthy-term farming yield and staking rewards (37.5%).

- Increase interval farming yield and staking rewards (12.5%).

Word: You’ll find extra particulars concerning the long-term and increase interval farming within the SDEX crypto documentation.

So, there aren’t any locked SDEX tokens and no crew allocation. Primarily, everybody who needs to get a bag of the SDEX coin wants to purchase it.

SDEX Coin Evaluation

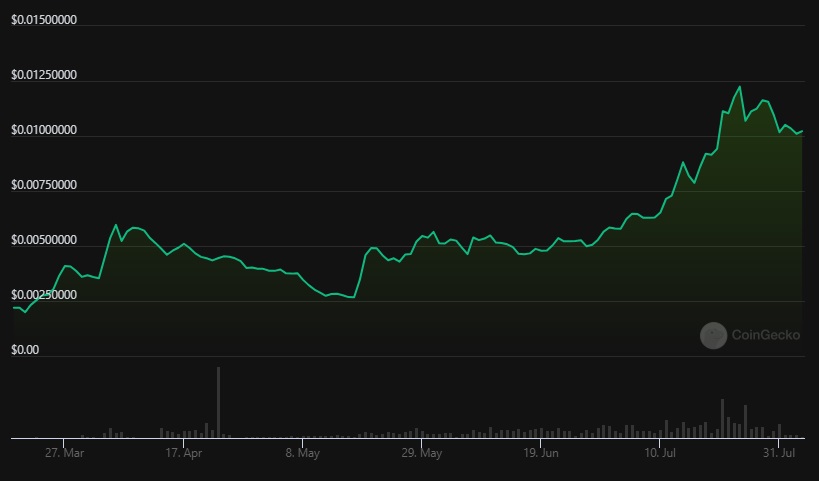

There are numerous platforms the place you’ll be able to monitor the SDEX value chart. Nonetheless, because the token initially began buying and selling on SmarDex, which was on the time simply getting began, most charts don’t embody the SmarDex token’s whole value motion. Nonetheless, we managed to discover a line chart on CoinGecko that covers nearly all of the SDEX value path.

So, after itemizing at roughly $0.002, the token went on a noticeable rally. The latter ended on April 5, 2023, with the SmarDex token reaching almost $0.006. After that native excessive, the value underwent a 42-day-long correction. However the SDEX value discovered help at $0.0027-ish and bounced from that stage again into the $0.005-ish area.

$SDEX stayed in that area till the tip of June 2023, when it lastly broke to the upside. Since then and till July 24, 2023, the SDEX crypto has been in a transparent uptrend. And, on that day, the SDEX coin marked its present all-time excessive (ATH), which sits at $0.0124-ish.

Following its ATH, the SmarDex token pulled again roughly 25% and is at present buying and selling just under $0.01.

SDEX Value Prediction – What’s the Value Prediction for SDEX?

With regards to short-term SDEX value prediction, you’ll be able to have a look at the above day by day chart. The latter marks all a very powerful ranges of help and resistance for the SDEX crypto. Nonetheless, by the appears to be like of the chart, a decreased quantity throughout the ongoing pullback, the area between $0.00889 and $0.00928, is fairly prone to maintain. After all, presuming that all the crypto market doesn’t expertise any main corrections.

So, if these ranges have been to carry, the value of $SDEX might make a transfer towards a brand new ATH. As such, we are able to use the Fibonacci retracement device to find out a few of the most certainly ranges within the value discovery area. Essentially the most optimistic stage (the “4.236” extension) factors to $0.022-ish.

As for the long-term SDEX value prediction that would happen throughout the high of the upcoming bull run (2024-2025), we have to take a extra speculative method. So, let’s say that the SDEX crypto’s protocol continues to work correctly and finally ends up attracting liquidity suppliers. If that have been to occur, the SDEX coin would most certainly find yourself benefiting as effectively.

Moreover, we are able to say that it might doubtlessly attain the identical market cap ranges as a few of the main DEX native tokens previously, akin to UNI, SUSHI, and CAKE. Thus, we are able to take the ATH market cap ranges of these tokens and divide them by SDEX crypto’s complete token provide. This offers us the next value predictions:

- $0.684 – if $SDEX have been to succeed in $CAKE’s ATH market cap.

- $2.151 – if $SDEX have been to succeed in $SUSHI’s ATH market cap.

- $2.261 – if $SDEX have been to succeed in $UNI’s ATH market cap.

Ought to You Purchase the SDEX Coin from SmarDex?

Should you learn the introduction of at the moment’s article fastidiously, you may need observed that we already hinted that it’s as much as you to reply the above query. In spite of everything, we aren’t monetary advisors. Plus, we aren’t aware of your monetary state of affairs and your threat tolerance.

So, use the above-provided details about the SDEX crypto venture and the SDEX coin to find out in case you are on this altcoin. If not, then it is best to begin discovering different altcoin alternatives instantly. And, there’s no higher device to search out up-and-coming crypto tokens than the Moralis Cash core function: Token Explorer.

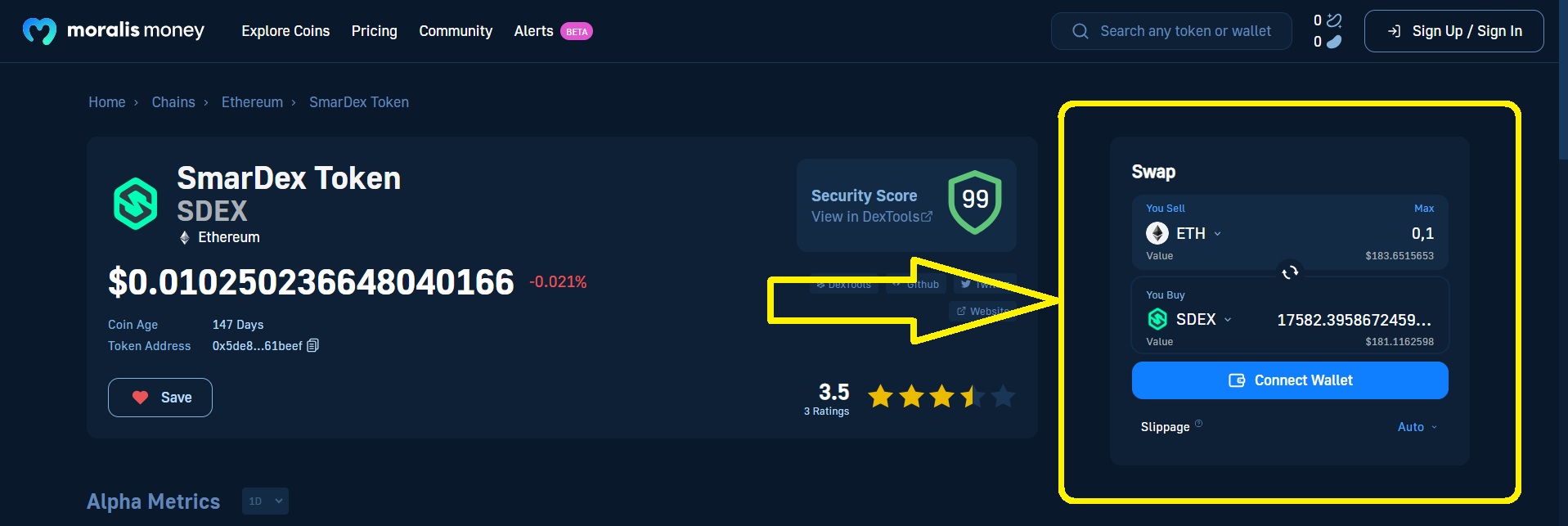

Alternatively, if $SDEX caught your consideration, you should analysis this alt additional. In that case, you may need to go to Moralis Cash’s SmarDex ($SDEX) token web page. All these token pages give you all of the hyperlinks, instruments, and assets you should resolve whether or not a token is a worthy funding.

Plus, in the event you resolve that you should purchase $SDEX, this web page can even show you how to get your timing proper. How? Nicely, close to the highest of the web page, you could find so-called alpha metrics. These are the token’s real-time, on-chain metrics that let you know whether or not the coin is gaining or dropping on-chain momentum. And, since on-chain exercise at all times precedes value motion, these insights permit you to enter your place at an applicable time.

So, go to the above hyperlink or use the interactive widget beneath and decide if and when you should purchase the SmarDex token.

The place Can I Purchase SmarDex Tokens?

There are a number of paths you’ll be able to take to purchase SmarDex. The three finest ones embody the SmarDex platform’s swap, Uniswap, and the Moralis Cash instantaneous crypto swap function. And, since you’ll already be on the above-outlined web page, it’s by far the most secure and most sensible choice to make use of the Moralis Cash swap.

This selection will not be solely secure and sensible, however due to the facility of the 1inch aggregator, it additionally ensures you get the most effective out there value. Actually, these benefits make Moralis Cash’s token pages top-of-the-line Ethereum swap websites.

Learn how to Purchase $SDEX

In case you might be new to swapping cryptos, you might need to try our step-by-step information on tips on how to swap ERC-20 tokens. It’ll show you how to put together all you should get going. It’ll additionally information you thru each step alongside the way in which. That mentioned, the next record and GIF ought to show you how to get going instantly:

- Get your Web3 pockets prepared.

- Add funds (e.g., ETH) to your pockets.

- Join Your Pockets to Moralis Cash.

- Go to the above-presented $SDEX token web page.

- Analysis the token.

- Choose the ERC-20 token you want to swap for $SDEX and enter the quantity.

- Full the swap by confirming the on-chain transaction.

Ought to You Purchase the SmarDex Crypto? Full SDEX Coin Evaluation – Key Takeaways

- The SDEX crypto venture is all about introducing an improved algorithm that helps scale back impermanent loss (IL) and even creates impermanent achieve (IG).

- By lowering IL and creating IG, the SmarDex crypto venture creates stronger incentives for liquidity suppliers. As such, it has the potential to change into a preferred DEX.

- The venture additionally has its native token: the SDEX coin. Other than buying and selling it, customers can already use the venture’s staking and farming options to earth yield in $SDEX.

- $SDEX’s value hasn’t but elevated as a lot as it might for brand new DeFi initiatives. As such, now should still be a superb time to get a bag of this crypto.

- Use Moralis Cash’s SmarDex token web page to analysis this token additional and to find out if and when you should purchase it.

- Begin operating Token Explorer methods to search out tokens earlier than they pump.

- If you’re critical about your altcoin investing and need to spot the most effective alts earlier than it is too late, think about upgrading to the Starter or Professional plan. By doing so, you’ll be a part of the parents within the know which have already made some insane positive factors on tokens like BOBO, MTE, POP, the well-known PEPE, and lots of others.