Discover the traits and sentiment inside Polygon’s market, uncovering the components influencing Polygon (MATIC) worth prediction.

Polygon (MATIC), the biggest layer-2 blockchain platform with a market capitalization of over $8 billion, has skilled vital fluctuations in its worth for the reason that starting of 2024.

MATIC reached a month-to-month excessive of $0.955 on Jan. 11 as Bitcoin (BTC) spot ETFs obtained approval from the U.S. SEC, and market momentum turned constructive.

Nevertheless, amid ongoing volatility, MATIC’s worth declined to $0.6933 on Jan. 23. As of Feb. 9, MATIC is buying and selling at round $0.84.

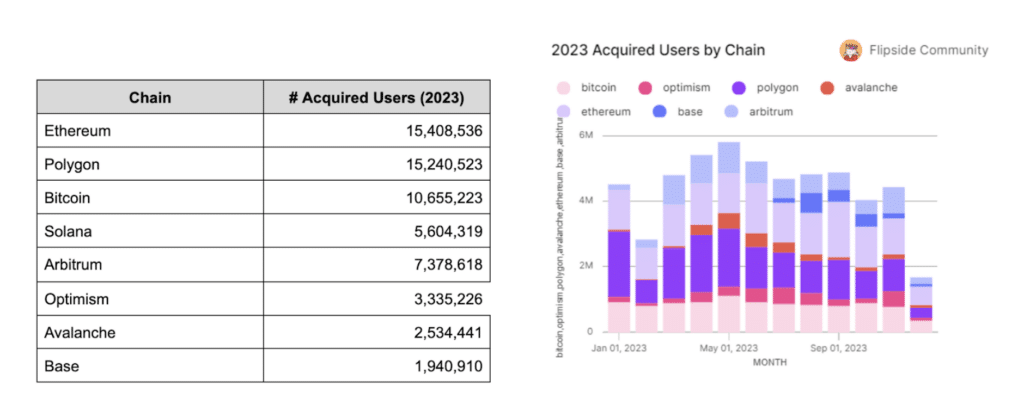

A current discovering reveals that in 2023, Polygon witnessed a considerable improve in person addresses, totaling 15.2 million, cementing its place as a number one blockchain platform after Ethereum (ETH).

In comparison with Bitcoin, which acquired 10.6 million new person addresses in the identical interval, Polygon’s development exceeded it by 50% by way of person addresses.

Arbitrum (ARB), Optimism (OP), and Base additionally made notable appearances within the high eight initiatives for person development, highlighting the emergence of layer-2 scaling initiatives as one of many fastest-growing sectors inside the crypto trade.

Let’s delve deeper and discover the present ecosystem of Polygon to know higher the way it impacts Polygon worth prediction.

Introduction to AggLayer V1

Polygon plans to roll out AggLayer V1 in Feb. 2024. This introduction goals to bridge the hole between present blockchain architectures.

Presently, the blockchain trade faces scalability, interoperability, and fragmented liquidity challenges. Conventional blockchain architectures will be broadly categorized into two sorts:

- Monolithic architectures: These are characterised by a single, built-in layer dealing with all blockchain operations, together with transaction processing, consensus mechanisms, and knowledge storage. Whereas they provide simplicity and cohesive liquidity, they wrestle with scalability and excessive transaction charges because the community grows.

- Modular architectures: These separate the varied capabilities of a blockchain into distinct layers or modules, which might function independently. This method affords improved scalability and suppleness however typically results in fragmented liquidity and a disjointed person expertise throughout totally different blockchain networks.

AggLayer V1 proposes an answer to those challenges by introducing an “aggregated” blockchain structure.

This structure goals to mix the strengths of monolithic and modular methods utilizing ZK proofs, a kind of cryptographic proof that enables one occasion to show to a different {that a} assertion is true with out revealing the assertion itself.

Right here’s how AggLayer intends to handle the core points:

- Interoperability: By aggregating ZK proofs from linked chains, AggLayer permits seamless cross-chain transactions, enhancing interoperability throughout the blockchain panorama.

- Scalability: AggLayer facilitates a unified liquidity pool and scalable transactions throughout totally different chains with out compromising on safety or sovereignty of particular person blockchains.

- Consumer expertise: For end-users, AggLayer guarantees a smoother and extra built-in expertise, mitigating the necessity for complicated bridging mechanisms between totally different chains.

AggLayer V1 is just the preliminary model. AggLayer v2, which is anticipated to help asynchronous cross-chain transactions, is anticipated to be launched later this 12 months.

Current dapp developments and updates on Polygon

Polygon’s ecosystem has witnessed noticeable development through the years, that includes a number of new dapps and updates aimed toward bettering utility and person expertise.

As of Feb. 9, there are 980 energetic decentralized purposes (dapps) on Polygon as per Alchemy, together with some that function throughout a number of chains.

One noteworthy improvement is the partnership between API3 and Polygon. API3 plans to launch a particular chain utilizing the Polygon Chain Improvement Package (CDK), permitting dapps and customers to learn from oracle extractable worth (OEV). OEV refers back to the revenue that oracles can earn from transactions on account of their distinctive place as knowledge sources.

The OEV Community goals to seize this worth from all dApps using API3 knowledge feeds throughout numerous chains and redistribute it again to the protocols.

Sandeep Nailwal, the co-founder of Polygon, mentioned within the announcement:

“The strong safety and customizable nature of Polygon CDK encourages modern use instances for groups which can be hyper-focused on fixing distinctive issues. API3 has all the time been on the forefront of distinctive drawback fixing, and the OEV community is an enormous worth unlock for builders throughout the ecosystem.”

In the meantime, Fox Company launched a beta model of Confirm, an open-source protocol constructed on Polygon PoS. Confirm is designed to handle the challenges posed by AI-generated content material, guaranteeing authenticity and trustworthiness in digital media. It permits publishers to register content material, guaranteeing its origin is traceable via cryptographic signatures on-chain.

Initially launched through the Fox Information GOP debate, Confirm has already signed 89,000 items of content material from numerous Fox sources. Now open-sourced, Confirm invitations public contributions and affords shoppers a device to confirm content material origins.

TVL efficiency and market dynamics

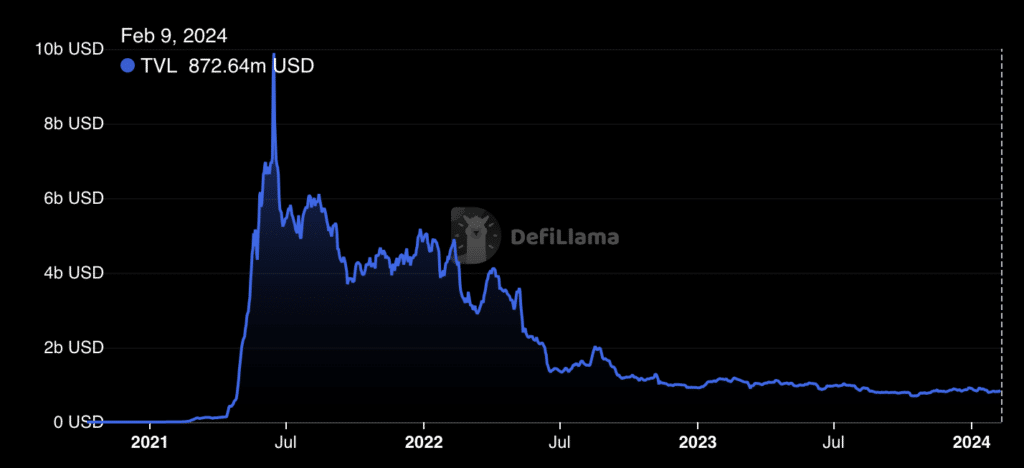

The whole worth locked (TVL) within the Polygon ecosystem has been fluctuating not too long ago.

In Jan. 2024, Polygon recorded a TVL exceeding one billion {dollars}, marking its highest determine since at the least early October 2022. Nevertheless, as of Feb. 9, Polygon’s TVL has declined to round $872 million.

The trajectory of Polygon’s TVL could also be influenced by components equivalent to growing adoption and its position within the decentralized finance (defi) sector, notably in gentle of its strategic pivot in the direction of embracing zkEVM Validium L2 to strengthen its market positioning.

Moreover, in response to knowledge from Token Terminal, Polygon ranks second in every day energetic customers, with a determine surpassing 650,000, trailing behind Binance Chain (BNB), which boasts over 1.3 million energetic customers.

Polygon (MATIC) worth prediction: short-term view

Since Might 2023, the crypto market has witnessed an approximate 100% uptrend, with MATIC being a notable exception, experiencing a 15% decline in the identical timeframe.

A vital evaluation revealed via a tweet signifies a 2-year bullish pennant sample for MATIC, historically seen as a precursor to vital worth actions.

This sample suggests a possible 400% worth improve post-breakout. Nonetheless, the MA 100 serves as a near-term resistance, with a rejection at this degree probably resulting in prolonged consolidation inside the pennant formation.

In the meantime, CoinCodex (CC) affords a Polygon coin worth prediction for Feb. 20, projecting a worth of $1, which interprets to a 21% improve from present ranges.

Nevertheless, do not forget that technical evaluation and MATIC coin worth predictions are usually not assured outcomes. At all times analysis and take into account your monetary state of affairs and danger tolerance earlier than investing in crypto belongings.

Polygon (MATIC) worth prediction: long-term view

Delving into the Polygon crypto worth prediction throughout numerous timelines, projections counsel a dynamic future for MATIC.

2024

In response to DigitalCoinPrice (DCP), the Polygon worth prediction for 2024 is optimistically set at $1.81. This determine signifies a bullish outlook within the close to time period, underscoring a possible uptrend from present ranges.

2025

As we prolong our horizon to 2025, forecasts change into extra various. CC presents a spread between $0.833653 (low) and $3.34 (excessive), suggesting vital volatility and alternative. Concurrently, DCP initiatives a extra conservative estimate of $2.01 for the Polygon worth prediction for 2025.

2030

Wanting additional forward, the Polygon worth prediction for 2030 diverges notably. CC anticipates a spectrum from $1.601698 to $6.92, whereas DCP affords a promising outlook with a projection of $5.93.

Take into accout

- Cryptocurrency investments carry a excessive degree of danger and may end up in the lack of your total funding. At all times carry out due diligence.

- Worth predictions are speculative and shouldn’t be the only real foundation for any funding resolution.

- Market volatility is a continuing within the crypto house, and exterior components can dramatically influence worth actions.

In conclusion, whereas Polygon’s worth forecast affords thrilling prospects, traders ought to method with warning, armed with analysis and an acute consciousness of market dangers.

Disclosure: This text doesn’t symbolize funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.

FAQs

Is Polygon (MATIC) an excellent funding?

Polygon (MATIC) has proven vital development and utility inside the blockchain ecosystem, particularly with its upcoming AggLayer V1 launch and growing dapp developments. Nevertheless, investing in cryptocurrencies like MATIC entails excessive danger, and it’s essential to do your analysis and take into account your monetary state of affairs and danger tolerance earlier than investing.

Will MATIC go up or down?

Current traits counsel potential development for MATIC, particularly with constructive developments just like the bullish pennant sample indicating a doable worth improve. Nevertheless, market volatility and exterior components can influence costs unpredictably. It’s advisable to remain knowledgeable on market traits and carry out thorough evaluation earlier than making funding choices.

Ought to I spend money on Polygon?

Investing in Polygon might provide potential returns, given its promising developments and strategic positioning within the defi sector. Nevertheless, the crypto market is extremely unstable, and investments can fluctuate broadly. At all times conduct complete analysis, assess your danger tolerance, and take into account searching for recommendation from monetary consultants earlier than making funding choices. Keep in mind, it’s best to by no means make investments greater than you’ll be able to afford to lose.