Will the crypto market maintain its upward trajectory in 2024? Uncover professional insights and predictions.

The crypto business could also be gearing up for a major yr of transformation. Distinguished figures like Michael Saylor and Cathie Wooden are bullish, highlighting the potential impression of Bitcoin halving in Apr. 2024 and the anticipated inflow of institutional investments by ETFs.

Saylor particularly factors to a “provide shock” that, coupled with ETF approvals, might create a “excellent storm” for Bitcoin’s valuation.

Regardless of the scars of a bruising crypto winter in 2022 and early 2023, the current good points in sure crypto property counsel a progress potential.

For example, Bitcoin (BTC) reached a brand new milestone in March 2024, when its worth surpassed $70,000. Ethereum’s worth reached the $4,000 mark regardless of widespread liquidations throughout the market and the U.S. SEC delaying selections on ETH ETF filings from Blackrock and Constancy.

The altcoin sector, too, is underneath the highlight, with Solana (SOL), Polygon (MATIC), and Polkadot (DOT) registering notable good points over the weeks.

What does this momentum counsel for crypto predictions for 2024? Let’s discover out.

Developments dominating crypto forecast for 2024

Let’s delve into the particular elements that might have a possible impression on crypto predictions for 2024.

Launch of spot Bitcoin ETFs

The launch of spot Bitcoin ETFs in Jan. 2024 has been a vital second for the crypto business, marking an enormous step towards institutional acceptance and investor accessibility.

Since their inception, these ETFs have garnered substantial consideration, accumulating a complete market cap of over $66 billion as of March 11.

Main the pack is Grayscale, with its Bitcoin Belief ETF (GBTC) amassing over $42 billion in market cap.

The Block reported that Customary Chartered Financial institution has forecasted that Bitcoin might expertise related magnitude good points to gold, which noticed its worth enhance over 4 occasions within the seven to eight years post-ETF launch.

With expectations that between 437,000 and 1.32 million new Bitcoins might be held in U.S. spot ETFs by the tip of 2024, representing an influx of $50-100 billion, the outlook for Bitcoin’s worth stays bullish.

BTC halving

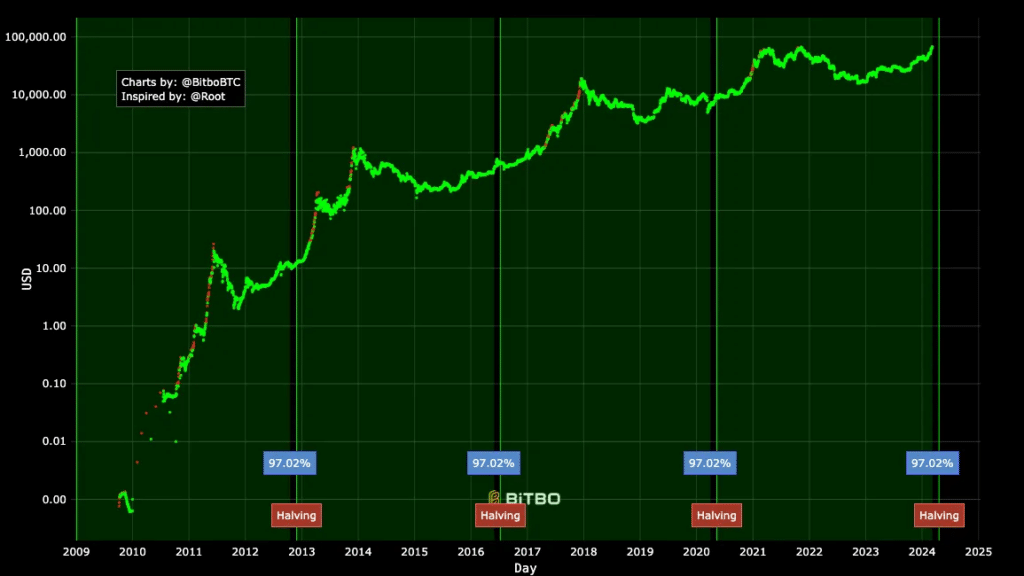

The Bitcoin halving is a major occasion that cuts the reward for mining Bitcoin transactions in half. This occasion happens roughly each 4 years. The following one is anticipated in April 2024.

The halving reduces the speed at which new Bitcoins are generated, straight impacting miners’ rewards and not directly influencing Bitcoin’s worth because of adjustments in provide dynamics. The 2024 halving will cut back the mining reward from 6.25 BTC to three.125 BTC per block.

Traditionally, halving occasions have been related to intervals of worth enhance within the months following the occasion, though previous efficiency doesn’t essentially point out future outcomes.

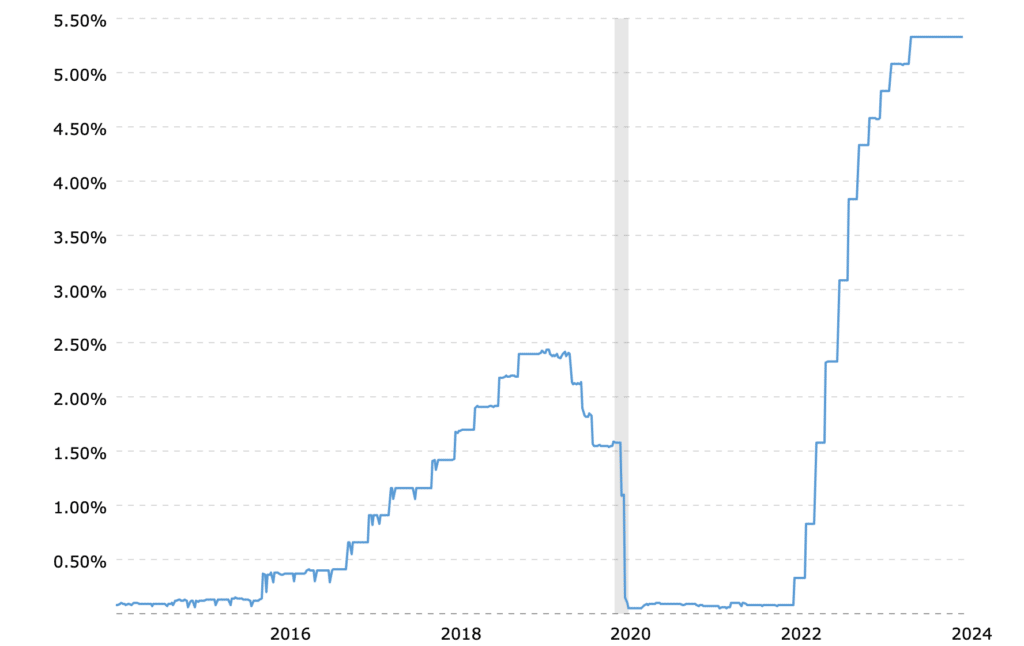

Federal Reserve rates of interest

The following Federal Open Market Committee (FOMC) assembly, scheduled for March 20, will stay essential.

The Fed has maintained the rates of interest at a variety of 5.25% – 5.50% for a number of months, offering a semblance of stability to the banking sector and the inventory market amid prevailing financial strains. This regular price setting displays the central financial institution’s efforts to steadiness curbing inflation whereas supporting financial progress and stability.

The Fed’s rate of interest coverage has far-reaching implications, not only for conventional monetary markets but additionally for the crypto market.

Traditionally, decrease rates of interest have made danger property, together with crypto, extra engaging to buyers in search of increased returns, as conventional financial savings and bonds provide decrease yields. Conversely, increased charges can result in a stronger greenback, probably dampening the enchantment of cryptocurrencies.

Subsequently, the Fed’s stance on rates of interest is a important issue that might affect investor sentiment and decision-making within the crypto house as we strategy the Bitcoin halving in 2024.

Crypto forecast and predictions for 2024

Bitwise’ predictions

In 2023, Bitcoin’s efficiency outshined all main asset courses with a formidable 128% enhance, starkly contrasting the S&P 500’s 21%, gold’s 12%, and bonds’ modest 2% returns.

Bitwise anticipates this upward trajectory to persist into 2024, projecting Bitcoin to breach the $80,000 mark and set up new all-time highs.

This optimism is underpinned by their inner research suggesting that spot Bitcoin ETFs might seize 1% of the $7.2 trillion U.S. ETF market, translating to $72 billion inside 5 years—a milestone almost achieved with near $50 billion amassed in underneath two months.

In the meantime, Bitwise considers Coinbase’s conservative income progress projections, pegged at 9% year-over-year from $2.8 billion to $3.1 billion by Wall Avenue, considerably understated.

Predicting at the very least a doubling in income for Coinbase, Bitwise highlights three neglected elements: the continuing bull market’s impression on buying and selling volumes, the traction gained from a set of latest merchandise, together with perpetual futures and controlled futures contracts, and Coinbase’s potential as the first custodian for many Bitcoin ETFs.

Amid this, Bitwise foresees 2024 as a vital yr for stablecoins, predicting they are going to surpass Visa in settled quantity.

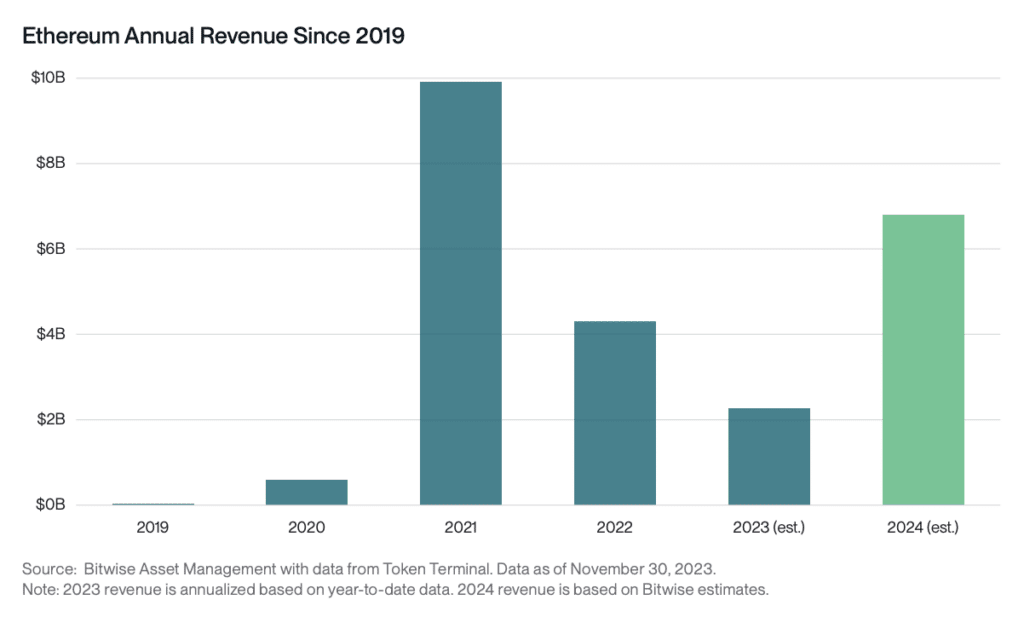

Ethereum’s ecosystem can also be anticipated to witness vital progress, with community charges projected to double from $2.3 billion in 2023 as crypto functions turn out to be mainstream.

Moreover, Bitwise predicts that Ethereum’s improve, EIP-4844, aimed toward drastically lowering transaction prices, might catalyze the primary wave of mainstream crypto functions by enabling new use instances like micropayments and large-scale gaming.

CoinShares predictions

The crypto market outlook for 2024, as analyzed by CoinShares, signifies a yr of transformation and alternative.

In line with CoinShares, the macroeconomic setting, significantly financial coverage and the U.S. greenback’s stability, might proceed to stay important in valuing Bitcoin.

Rising rates of interest have traditionally nudged buyers in the direction of various worth shops like U.S. Treasuries. Nonetheless, with inflation charges in developed nations declining and expectations of a Fed rate of interest lower in early 2024, property with a set provide, similar to Bitcoin and gold, might even see elevated attract.

Additional complicating the greenback’s dominance are world geopolitical shifts and the burgeoning issues over U.S. debt sustainability, mirrored within the rising prices of Credit score Default Swaps—a sign of rising investor unease.

These elements, mixed with the potential for a disaster of confidence in U.S. debt or banking system instability, might bolster Bitcoin’s fame as a dependable safe-haven asset.

On the technological entrance, CoinShares highlights the important function of knowledge availability (DA) within the crypto panorama, with Solana poised to guide on this enviornment because of its superior information throughput capabilities.

This shift is anticipated to disrupt the present defi market dynamics, probably difficult Ethereum’s dominance by providing a extra scalable and cost-efficient various for functions requiring excessive information capability.

The street forward

As we glance ahead, the introduction of spot Bitcoin ETFs and the anticipated Bitcoin halving might considerably affect investor sentiment and market dynamics.

These occasions, coupled with technological advances, might improve the performance and attain of digital currencies, fostering better adoption throughout varied sectors of the financial system.

Nonetheless, the broader financial setting, similar to financial insurance policies and the worldwide monetary panorama, stays a important determinant of the crypto market’s route.

As rates of interest fluctuate and the soundness of conventional monetary establishments is examined, the crypto business’s response can be telling of its resilience and flexibility.

The journey into 2024 and past will undoubtedly require cautious consideration of each the alternatives and hurdles that lie in wait.

Disclosure: This text doesn’t symbolize funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.

FAQs

What’s the way forward for crypto within the subsequent 5 years?

The way forward for crypto within the subsequent 5 years seems promising. Advances in know-how, elevated institutional funding by ETFs, and key occasions just like the Bitcoin halving might drive market progress. Moreover, the event and integration of blockchain in varied sectors might result in broader utility and acceptance of crypto property.

Does crypto have a future?

Sure, crypto seemingly has a vivid future forward. The resilience proven throughout previous market downturns, mixed with the current surge in costs and institutional curiosity, highlights the sector’s potential. But, regulation and the broader financial context, together with financial insurance policies and the worldwide monetary panorama, stay pivotal in shaping the trajectory of the crypto market.

Will the crypto market get better in 2024?

The crypto market might get better in 2024, pushed by a number of key elements. The Bitcoin halving occasion is anticipated to create a provide shock, probably growing Bitcoin’s worth. Moreover, the introduction of spot Bitcoin ETFs has already attracted vital funding, indicating sturdy market confidence. Predictions from specialists like Michael Saylor and establishments like Customary Chartered Financial institution additionally counsel a bullish outlook, with expectations of considerable worth good points and elevated institutional participation.