HBAR worth rose 15% on Feb. 6 to achieve a 20-day peak of $0.78, hours after the Hedera staff confirmed a $250 million settlement with the Saudi Arabian Ministry of Funding.

Hedera’s current five-year partnership settlement with the Saudi Arabian authorities has initiated constructive worth motion. However notably, an important market metric suggests derivatives merchants may scuttle the HBAR worth rally.

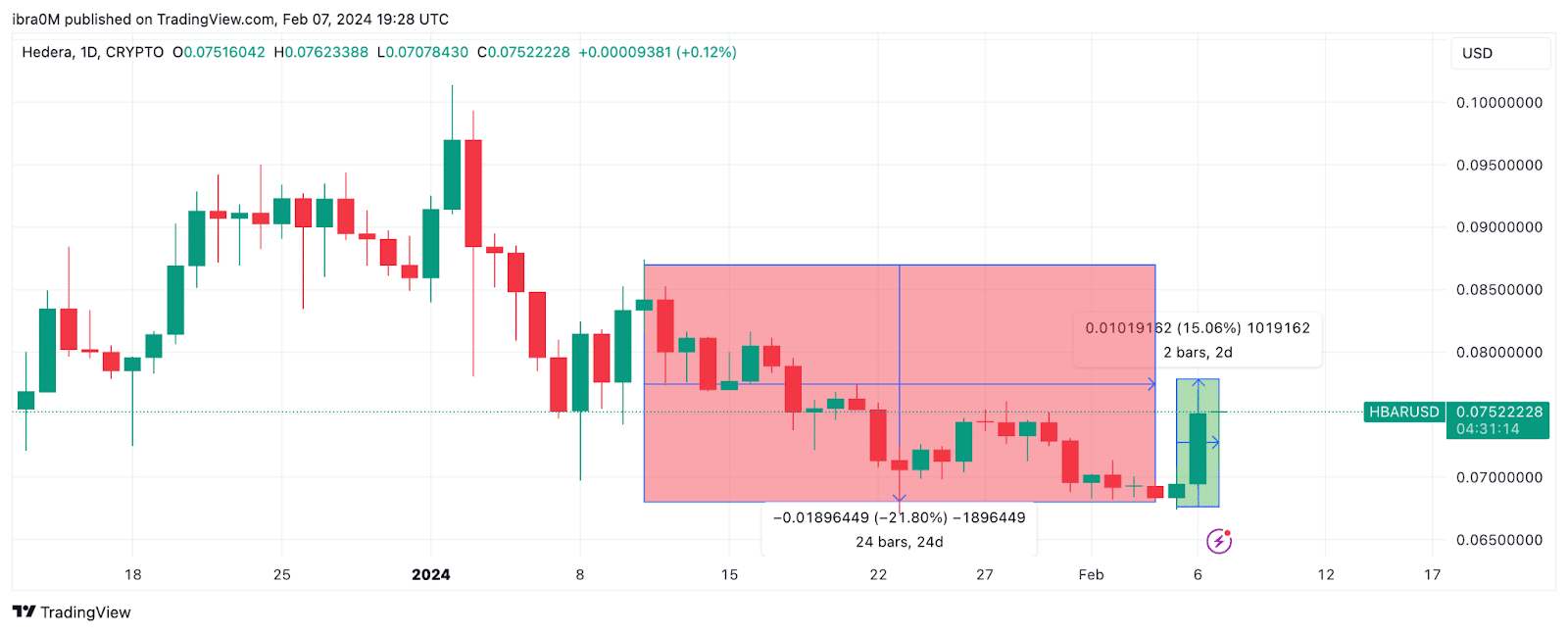

Hedera worth soared 15% as buyers reacted to Saudi partnership

HBAR worth has been trending down for the reason that crypto market correction that heralded the Bitcoin ETF approval in mid-January.

The Hedera blockchain native coin had tanked 22% between Jan. 11 and Feb. 5, However the momentum flipped bullish following the announcement of Hedera’s partnership with the Saudi Arabian authorities on Feb. 6.

Particulars of the partnership outlined an funding plan enabling firms to create superior technological options on the newly launched DeepTech Enterprise Studio in Riyadh.

In a dramatic flip of occasions, HBAR worth gained 15%, rising from $0.69 to $0.77 inside 24 hours of the announcement, as depicted within the chart above.

Speculative merchants inserting massive bets on retracement

The uncommon rally despatched Hedera to a 20-day peak after three consecutive weeks on the again foot. Nonetheless, an important market metric exhibits that speculative merchants might scuttle the restoration part.

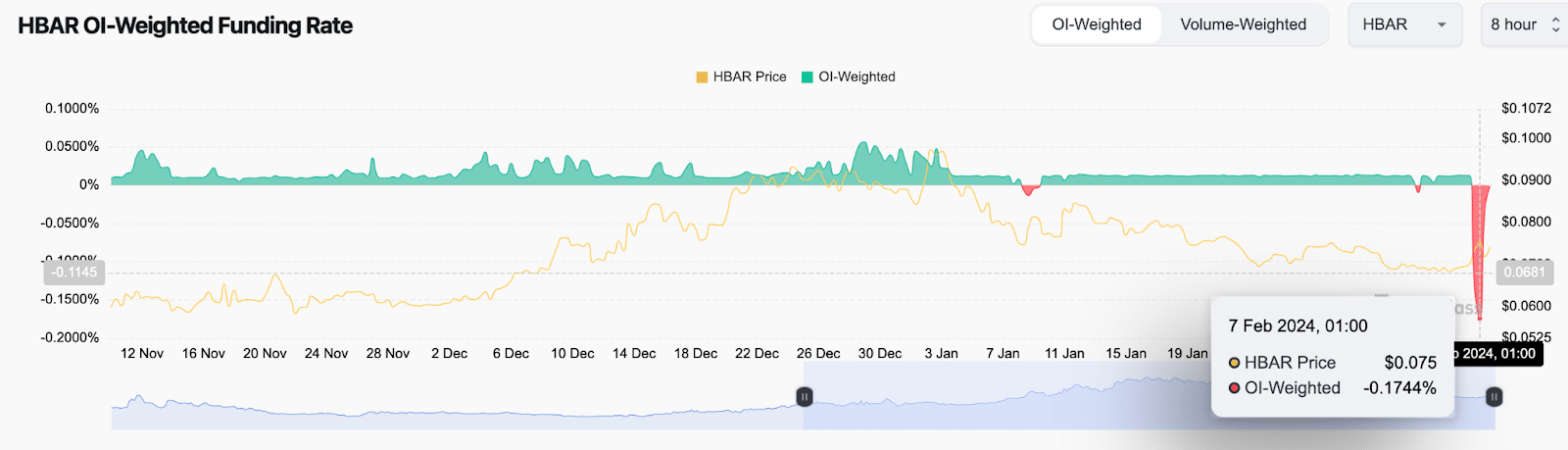

Coinglass’ funding fee metric tracks real-time swings in charges paid by lengthy and quick trades within the derivatives markets to maintain their contract positions open.

The HBAR funding fee has recorded a noticeable decline within the damaging zones as market actions swung bullishly within the spot markets. An in depth take a look at the chart beneath exhibits that the funding fee sank to a 90-day low of -0.02% on Feb. 7.

When the funding fee quickly swings damaging throughout a rally, most speculative quick merchants pay file charges to maintain their futures place open in hopes of reserving earnings when costs fall.

Basically, the damaging pattern in HBAR funding charges implies that the prevailing sentiment within the derivatives markets is skeptical concerning the sustainability of the value rally. If the bulls fail to counteract these positions and set up a stronger upward momentum, HBAR spot costs may quickly be prone to a pointy downturn.

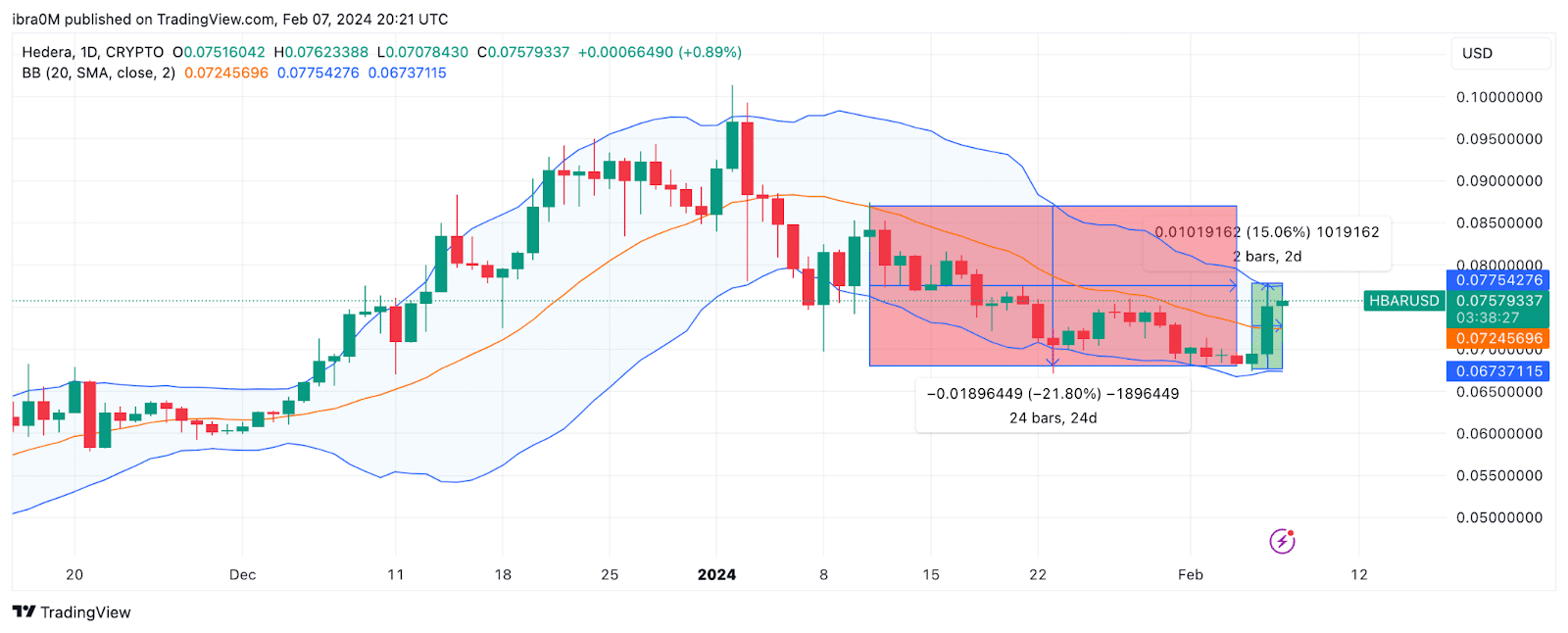

HBAR worth forecast: Bears may goal $0.65

Drawing inferences from the market knowledge pattern analyzed above, the bullish affect of the $250 million Saudi Arabia partnership on Hedera worth could possibly be shortlived.

And having not too long ago traded as little as $0.67 on Feb. 5, earlier than the current rally, the bears may set their sights on a extra audacious downswing beneath $0.65 in the course of the subsequent try.

Nonetheless, the Bollinger band’s technical indicator exhibits that the bulls may mount a formidable help line across the $0.67 space. But when that help stage can not maintain regular, a bearish reversal towards $0.60 could possibly be on the playing cards.

On the upside, if the bulls can construct on the momentum from the Saudi partnership, they may invalidate this damaging Hedera worth prediction by staging a $0.80 retest.

Nonetheless, as depicted by the higher Bollinger band within the chart, a looming sell-wall at $0.78 may scuttle the rally.