U.S.-based cryptocurrency change Coinbase has revealed it acquired over 13,000 requests from regulation enforcement businesses.

In line with Coinbase‘s newest “Transparency Report” printed on Nov. 29, 2023 the crypto change says it acquired a complete of 13,079 requests from regulation enforcement businesses from Oct. 2022 by way of Sept. 30, 2023, representing a 6% enhance from final 12 months.

The U.S. gave the impression to be essentially the most energetic nation with 5,868 requests, a 57% share of the entire quantity of inquiries the change acquired in the course of the reporting interval. Coinbase highlighted within the report the info mirror the requests acquired and “not essentially requests responded to.” It’s unclear how a lot knowledge Coinbase offered to regulation enforcement businesses, however famous that it goals handy out “anonymized or aggregated knowledge.”

“We additionally goal to supply anonymized or aggregated knowledge that aids regulation enforcement and authorities businesses with their work, the place it’s doable to take action, as a substitute of offering particular person buyer data.”

Coinbase Chief Authorized Officer, Paul Grewal

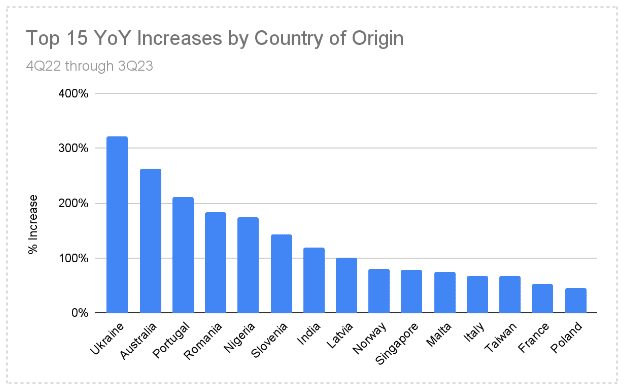

Along with the U.S., different nations similar to Germany, U.Okay. and Spain additionally despatched requests, with Armenia sending its requests to the San Francisco-based change for the primary time in 2023.

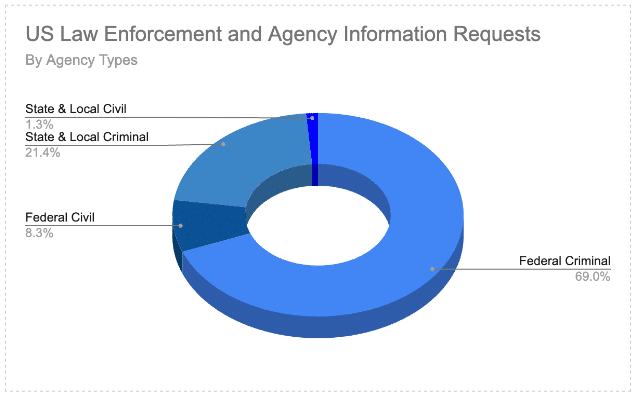

Ukraine gave the impression to be essentially the most energetic nation by way of year-over-year enhance, surging the quantity of its requests to Coinbase by over 300% in 2023, the info present. In 95.6% of requests, regulation enforcement businesses world wide have been looking for data as a part of a prison case, with solely 4.4% have been associated to civil or administrative authorized actions.

Coinbase mentioned it might produce sure buyer data, similar to identify, latest login/logout IP deal with, and cost data “relying on the character and scope of the request,” however identified it doesn’t give any authorities in any jurisdiction “direct entry to buyer data on our or any third-party’s programs.”

In late November 2023, crypto.information reported that the Biden administration is urging Congress to contemplate essentially the most vital updates to the Treasury’s sanctions authority since 2001. As per U.S. overseas commerce consultant Wally Adeyemo, there’s a must introduce a “secondary sanctions regime” because the Treasury has already offered Congress a set of “common sense suggestions to broaden our authorities and broaden our instruments and sources to go after illicit actors within the digital asset area.