CORE, the native token of the layer-1 Core ecosystem, emerged as the highest gainer among the many main 100 cryptocurrencies whereas a key indicator exhibits indicators of overbought.

CORE is up 70% prior to now 24 hours and is buying and selling at $2.8 on the time of writing — a degree not seen since March 2023. The asset’s market cap surged to $2.45 billion, making it the 54th-largest cryptocurrency.

Notably, CORE remains to be down by 58% from its all-time excessive of $6.47 on Feb. 8, 2023.

Furthermore, CORE’s each day buying and selling quantity rallied by 145%, reaching $433 million. In accordance with knowledge from CoinMarketCap, 40% of CORE’s buying and selling quantity comes from OKX, with buyers having excessive confidence of their buying and selling positions.

Alternatively, the token is at present hovering within the overheated zone which might finally put it within the bearish zone.

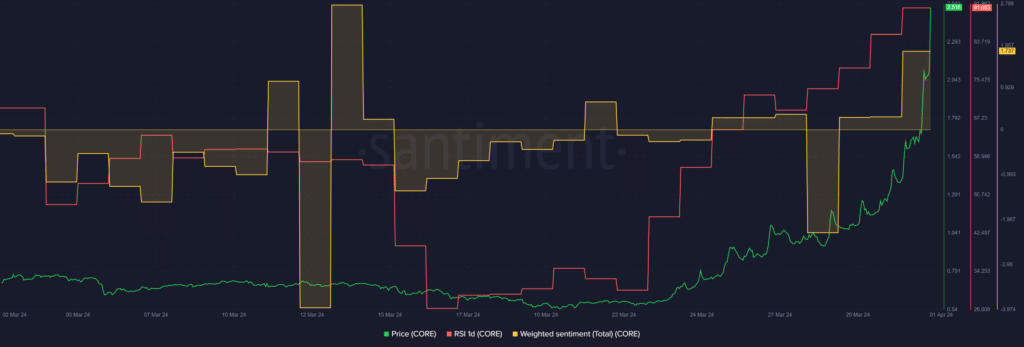

In accordance with knowledge offered by Santiment, the CORE Relative Energy Index (RSI) surged from 30 on March 22 — when the asset’s bullish momentum began — to 91 on the reporting time.

The indicator exhibits that CORE is roaming within the overbought zone or would possibly even witness whale manipulation. In these circumstances, excessive value volatility can be anticipated since buyers would possibly take short-term earnings on account of unsure market circumstances.

Regardless of the excessive RSI, the ratio of buyers with optimistic sentiment about CORE is barely increased than the damaging sentiment. Per Santiment, the asset’s weighted sentiment is standing at 1.71.