Whereas Individuals have seen the adoption of Bitcoin (BTC) spot and futures ETFs, the scenario in Europe is completely different.

Bitcoin ETFs have been a scorching subject for a lot of months, because the approval of ETFs primarily based on precise Bitcoin within the U.S. might doubtlessly result in an inflow of funds from Wall Avenue establishments, probably pushing the value of Bitcoin to new heights.

How do Bitcoin ETFs work?

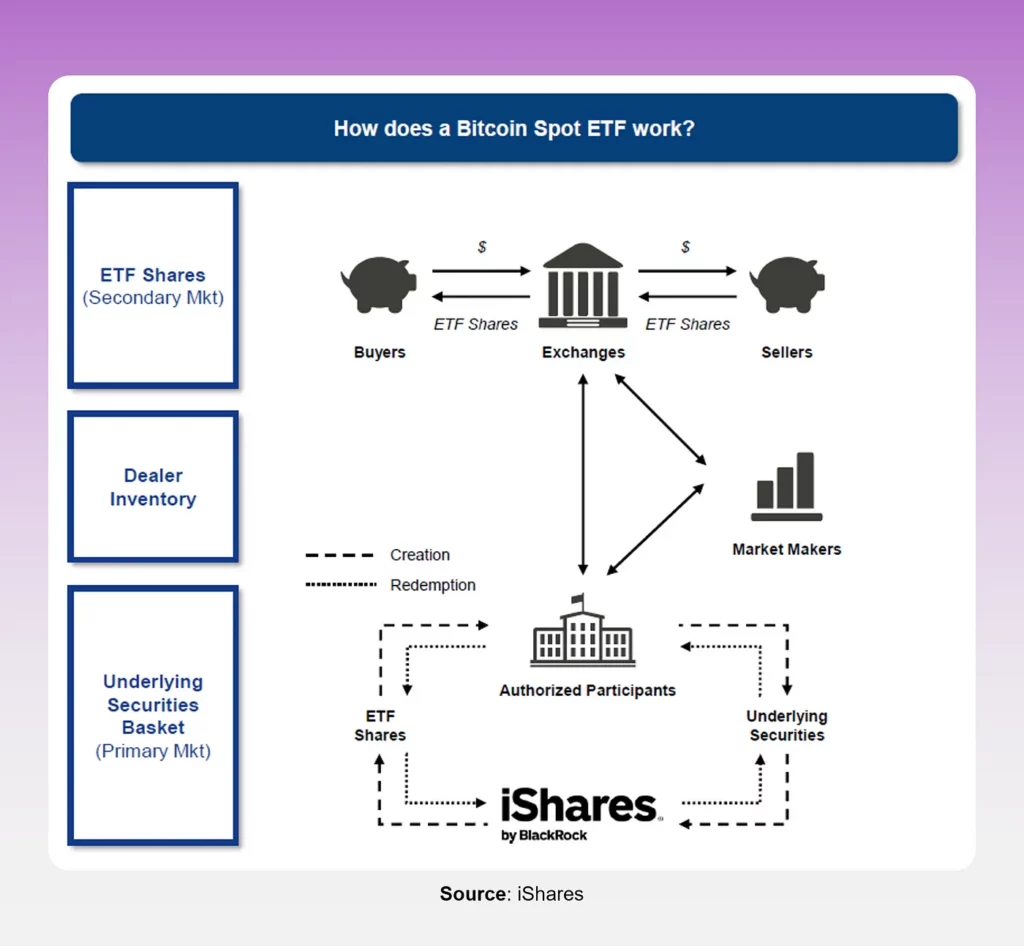

Like conventional ETFs, Bitcoin ETFs are issued by monetary establishments that put money into Bitcoin and handle the fund on behalf of traders. A Bitcoin ETF might be structured in numerous methods. For instance, it could maintain Bitcoin futures or “bodily” Bitcoin because the underlying asset, managed by the ETF issuer on behalf of the investor.

Within the case of funds with a Bitcoin base, the issuing establishment buys BTC and holds it. Subsequently, it points shares of the fund on a securities change, monitoring the asset’s value. Buyers immediately personal a portion of the underlying Bitcoin, and as the price of BTC fluctuates, the worth of the ETF adjustments accordingly.

One notable benefit of Bitcoin ETFs is their buying and selling on regulated securities exchanges, offering accessibility to numerous traders and eliminating the necessity for technical data in securely storing crypto property.

In consequence, traders new to cryptocurrencies can achieve publicity to Bitcoin with out requiring a crypto pockets or participating in buying and selling on a cryptocurrency change platform.

Bitcoin ETP: to not be confused with ETF

Along with ETFs, exchange-traded merchandise (ETPs) exist within the regulated funding markets. ETP stands for exchange-traded product, representing an funding product accessible on a inventory change.

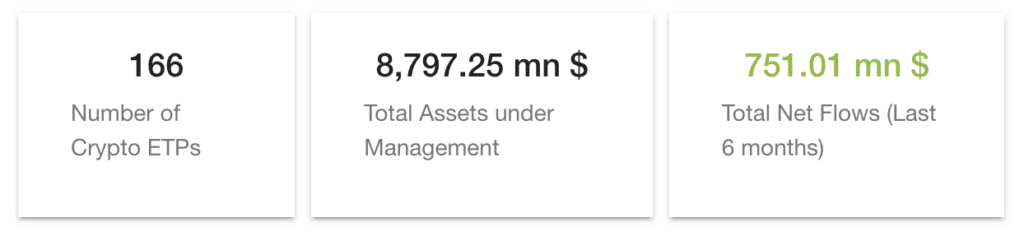

As the worth and alternative of the digital asset market grows, extra cryptocurrency ETPs are coming into circulation, together with ETPs for Bitcoin, Ethereum (ETH), and Litecoin (LTC).

What is thought about ETP in Europe

Spot Bitcoin ETPs have existed in Europe for a very long time, offering traders with entry to digital tokens. Europe is rather more progressive when it comes to cryptocurrency merchandise.

In Could 2015, Swedish vendor XBT AB introduced the authorization of Bitcoin Tracker One (a CoinShares product). It was the very first BTC-based safety accessible on a regulated change. In October 2015, the corporate launched the euro-denominated Bitcoin Tracker EUR safety system, accessible via Nasdaq Nordic.

About $9 billion is presently allotted to ETPs in Europe, in line with ETFbook, with a lot of the asset assortment and earnings over the previous 12 months pushed by a flood of stories associated to anticipated ETF approvals within the U.S.

Bitcoin ETF in Europe

The primary Bitcoin ETF in Europe, the Jacobi FT Wilshire Bitcoin ETF, was launched in August 2023 on the Euronext Amsterdam change underneath the ticker BCOIN.

Jacobi FT Wilshire Bitcoin ETF, a inexperienced ETF from Jacobi Asset Administration, aligns its targets with the European Union’s aspirations for sustainable blockchain innovation. This can be a vital first step in the direction of introducing ETFs in Europe as different asset administration companies look to put money into the area’s blockchain trade. The software has a built-in answer for renewable vitality certification. In line with the corporate, it permits “institutional traders to entry the advantages of Bitcoin whereas attaining ESG targets.”

The agency obtained the Guernsey Monetary Companies Fee’s approval to launch the product in October 2021. In line with Jacobi’s plans, the Bitcoin fund was supposed to seem in July 2022, but it surely was postponed as a result of collapse of Terra.

Nevertheless, the fund’s approval didn’t trigger a lot pleasure. The main cryptocurrency entered an upward pattern solely in the direction of the top of the 12 months in anticipation of the acceptance of spot Bitcoin ETFs in the USA.

There are some obstacles to growing cryptocurrency ETFs, primarily the Undertakings for Collective Funding in Transferable Securities Directive 2009 or UCITS. Crypto, like gold and different commodities, will not be included within the European Fee’s Eligible Asset Directive for UCITS funds.

Will there be analogs of spot Bitcoin ETFs in Europe?

Regardless of the cryptocurrency scenario in Europe turning into extra progressive with the launch of the Market in Crypto Property (MiCA) regulation, it’s unlikely that the European Union will observe the trail of the USA quickly.

Firstly, cultural variations between Individuals and Europeans needs to be thought-about. Whereas Individuals are sometimes seen as brilliant representatives of capitalism, unafraid to speculate and take a look at new monetary devices, Europe has a considerably completely different method.

Notably, as a result of extra conservative funding method of Europeans, it’s unlikely that spot Bitcoin ETFs in Europe will replicate the success seen in the USA. Furthermore, exchange-traded merchandise (ETPs) are already acquainted on the continent, with asset managers like CoinShares, 21shares, WisdomTree, and VanEck providing ETPs that behave like ETFs.

Nevertheless, the emergence of spot Bitcoin ETFs in Europe can’t be totally dominated out. If the American market units a optimistic instance, maybe Europeans will observe swimsuit.