Ethereum worth broke above $3,9500 barrier once more on Feb. 22, whereas Bitcoin worth rally struggles for momentum: 3 very important market metrics counsel ETH may additional lengthen its lead over BTC within the weeks forward.

Ethereum (ETH) and Bitcoin (BTC) are traditionally carefully correlated, however in 2024, ETH appears to have gained the higher hand. A deep dive into the on-chain knowledge tendencies and skilled evaluation offers key insights into which asset would come out on prime because the yr unfolds.

Is Ethereum higher than Bitcoin in 2024?

Up to now in 2024, Ethereum and Bitcoin, the 2 largest property within the crypto sector have attracted billions of {dollars} in capital inflows. As of March 2024, BTC is buying and selling at historic all-time highs of $71,200, whereas ETH worth makes an attempt to ascertain a gentle assist above the $4,000 milestone.

Nevertheless, a more in-depth take a look at the value charts reveals that ETH at the moment has the higher hand having outperformed BTC by 7% by way of year-to-date efficiency.

The chart above reveals that ETH worth has elevated 79% between Jan 1 and March 11 2024, which is considerably larger than Bitcoin’s 72% worth beneficial properties.

Nevertheless, whereas ETH at the moment has the upperhand, to find out which asset is a greater worth for cash in 2024, it is very important study the market catalyst driving each property.

First, it is very important word that each property are pushed by separate narratives and market catalysts in 2024.

For Ethereum, the continuing ETH ETF filings, liquidity staking derivatives, the Eigen-layer re-staking and Dencun improve have emerged main themes throughout the ecosystem in Q1 2024. In the meantime, the dominant themes for Bitcoin are the quickly rising demand from the ten newly-approved BTC ETFs and the upcoming halving occasion scheduled for April 19 2024.

These key occasions have triggered numerous adjustments in on-chain transaction tendencies and funding patterns throughout each ecosystems, resulting in Ethereum worth outpacing Bitcoin.

3 causes Ethereum worth may outperform Bitcoin in 2024

- Retail traders are rallying behind ETH as Establishments dominate BTC markets

The US Securities and Alternate Fee (SEC) permitted 10 new Bitcoin ETFs on Jan 11 2024 marking an actual milestone second for the cryptocurrency sector. Throughout the 2 months post-launch the ETFs have quickly acquired about 800,000 BTC, about 4.2% of the entire provide in circulation.

Evidently, Bitcoin worth has benefited immensely from record-breaking inflows made by the company institutional traders in 2024. However curiously, the ETF’s dominance has triggered a skittish response amongst BTC retail traders, a lot to the obvious development of the Ethereum ecosystem development.

Santiment’s whole holders metric estimates the entire variety of lively or funded pockets addresses that at the moment exist on a blockchain community. It serves a proxy for measuring the extent of adoption amongst retail traders and the mass markets.

Within the final 50-days courting again to Jan. 21, the Ethereum community has attracted 3.59 million new holder addresses, whereas 200,000 BTC addresses emptied their wallets and exited the community.

This uncommon on-chain development means that the retail mass markets are overwhelming behind Bitcoin. As Bitcoin turns into extra concentrated within the fingers of fewer whale traders and company entities, it places BTC worth liable to market manipulation and exterior shock from the macroeconomic fronts.

The numerous improve in new holder addresses on the Ethereum community in comparison with the variety of BTC addresses emptying their wallets suggests a divergence in retail investor sentiment between the 2 cryptocurrencies.

Firstly, this development signifies that retail traders are more and more favoring Ethereum over Bitcoin, doubtlessly as a result of Ethereum’s promise of profit-optimization and passive earnings from its low-risk staking yield to its retinue of decentralized finance functions (DApps).

Moreover, the rising dominance of institutional traders and company entities within the Bitcoin market introduces a brand new layer of uncertainty and potential threat. Whereas institutional adoption has been a key driver of Bitcoin’s latest worth rally, it additionally will increase the susceptibility of the market to large-scale sell-offs or coordinated buying and selling methods by these influential gamers.

Within the occasion of a tradfi market downturn or macroeconomic coverage adjustments, the concentrated possession of Bitcoin within the fingers of highly-sensitive Wall Avenue gamers may exacerbate BTC worth declines and result in heightened market volatility.

- Bitcoin Miners Buying and selling Bearish whereas Ethereum Node Validators stay bullish

The divergence within the present buying and selling disposition of Bitcoin miners and Ethereum node validators is one other very important market catalyst that would drive ETH worth additional forward of BTC. On the Bitcoin community, miners dedicate computing assets to validate transactions and safe the community in trade of BTC block rewards. Ethereum, since its transition to Proof of Stake (PoS), now depends on its node validators for that essential operate.

Bitcoin’s subsequent halving occasion slated for April 19, will see miners’ rewards slashed from 6.25 BTC to three.13 BTC. With the occasion now lower than 40-days away Bitcoin miners have entered a promoting frenzy in a bid to cash-in earlier than the halving date.

As of Dec. 29 2023, Bitcoin miners held a complete of 1.96 million BTC. However because the halving date drew nearer, the miners quickly offloaded 300,000 BTC, reducing down their balances to simply 1.93 million BTC at press time on March 11 2024.

Valued on the present costs of $71,200, the miners have bought $21.5 billion price of BTC in Q1 2024 forward of the halving.

If the Bitcoin miner’s promoting development persists, it may decelerate the BTC worth rally, particularly compared to Ethereum whose node validators have been accumulating extra cash in latest months.

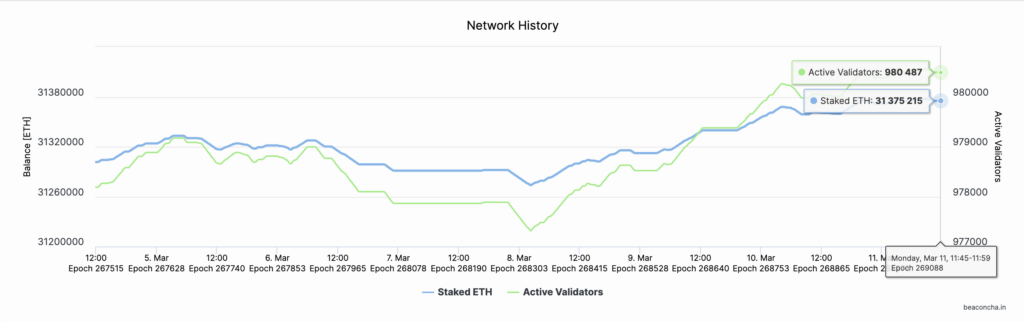

Ethereum node validators have doubled down on their bullish positions, depositing 2.4 million ETH price $9.7 billion into the beacon chain staking contracts since Jan. 2024, in the meantime Bitcoin miners entered a $21.5 billion promoting spree.

At press time on March 11, the entire staking deposits on the ETH 2.0 beacon chain stood at $1.4 million ETH, representing a 2.4 million ($9.7 billion) improve in 2024.

In contrast to Bitcoin miners, Ethereum node validators proceed to double-down on their long-term bullish positions as ETH worth edges additional above the $4,000 mark. Optimistic speculations surrounding the Dencun improve, and progress of ETH ETF filings are key catalysts incentivizing ETH stakeholders’ bullish disposition.

With these catalysts nonetheless in play, ETH may witness much more cash taken out of circulation, whereas BTC circulation provide will increase as miners improve promoting stress because the halving approaches.

VanEck’s Head of Digital Belongings to Cryptoquant additionally echoed this stance in a latest interview with Cryptoquant.

“Over the medium time period, ETH tends to outperform BTC within the halving yr, proper? So I don’t need to lose the forest for the bushes. I don’t suppose there shall be flippening, however I do suppose when the yr (2024) is alleged and completed, ETH may have outperformed BTC.

If these eventualities play out as predicted, ETH worth will possible lengthen its lead over BTC within the weeks forward.

- Technical Indicators Spotlight Ethereum’s Path to $5,000

In abstract, Ethereum is predicted to drag better retail market demand than Bitcoin and likewise expertise a short lived decline in circulation provide amid rising staking deposits. These key components put ETH worth on a path to a brand new all time highs above $5,000.

ETH is at the moment buying and selling above the $4,030 vary on the time of writing on March 11. IntoTheBlock’s in/out of the cash chart reveals that Ethereum has a comparatively clear path to reaching a brand new all time-high.

As seen beneath, the chart highlights the $4,500 territory as the biggest resistance cluster above the present costs. At that vary, 617,760 addresses had acquired 1.6 million ETH on the common worth of $4,557.

Contemplating that they’ve been holding at a loss for 3-years, lots of these holders may transfer to shut their positions as soon as Ethereum costs strategy their break-even level.

If ETH worth can set up a gentle assist degree above that $4,500 space, it may doubtlessly propel ETH worth to a brand new all-time excessive above $5,000.