Ripple’s worth peaked at $0.63 on Feb. 29, capping its February 2024 positive factors at 30%, however, declining BTC Dominance might see main altcoins rating extra important positive factors in March.

Ripple-backed XRP stands to make important positive factors in March 2024 as buyers start to redirect capital in the Altcoin direction of the altcoin markets.

Bitcoin dominance is in decline as altcoins achieve traction

Bitcoin dominated crypto headlines in February with several worth milestones and record-breaking ETF inflows. Nonetheless, because the month ended, market tendencies confirmed that buyers were more and more targeted in different crypto sectors.

TradingView’s Bitcoin Dominance (BTC.D) chart expresses Bitcoin’s market capitalization as a proportion of the general cryptocurrency market, offering real-time insights into stakeholders’ dangerous urge for food and funding preferences.

Since Bitcoin’s worth grazed $64,000 on Feb. 28, BTC.D has been downgraded, dropping from 55.2% to 54.3% at press time on Mar. 1.

Whereas the BTC worth retreated towards $60,000, altcoin markets pumped throughout this three-day frenetic interval. As seen within the chart, the decline in BTC.D has coincided with a $175 billion influx into the altcoin market, leading to an 8.5% enhancement within the general crypto market capitalization.

When Bitcoin’s dominant decline coincides with growth within the crypto market, it’s a prime indicator that altcoins are actually on the entrance burner. This uncommon market dynamic illustrates that buyers because the crypto bull market intensifies, buyers are rising in confidence and shifting extra capital toward the altcoin market.

Bullish XRP merchants increase leverage by 120% in 3 days

Bar XRP, every altcoin within the crypto high 10 rankings, together with Ethereum (ETH), BNB, Solana (SOL), and Cardano (ADA), have all reached new yearly peaks up to now month.

XRP is at the moment buying and selling across the $0.60 territory. To realize the identical feat, costs should surge by one other 9% to reclaim the $0.65 peak final seen on Jan. 2.

The latest tendencies within the derivatives markets present that speculative merchants have elevated bullish bets on XRP since Bitcoin dominance started to wane on Feb. 28.

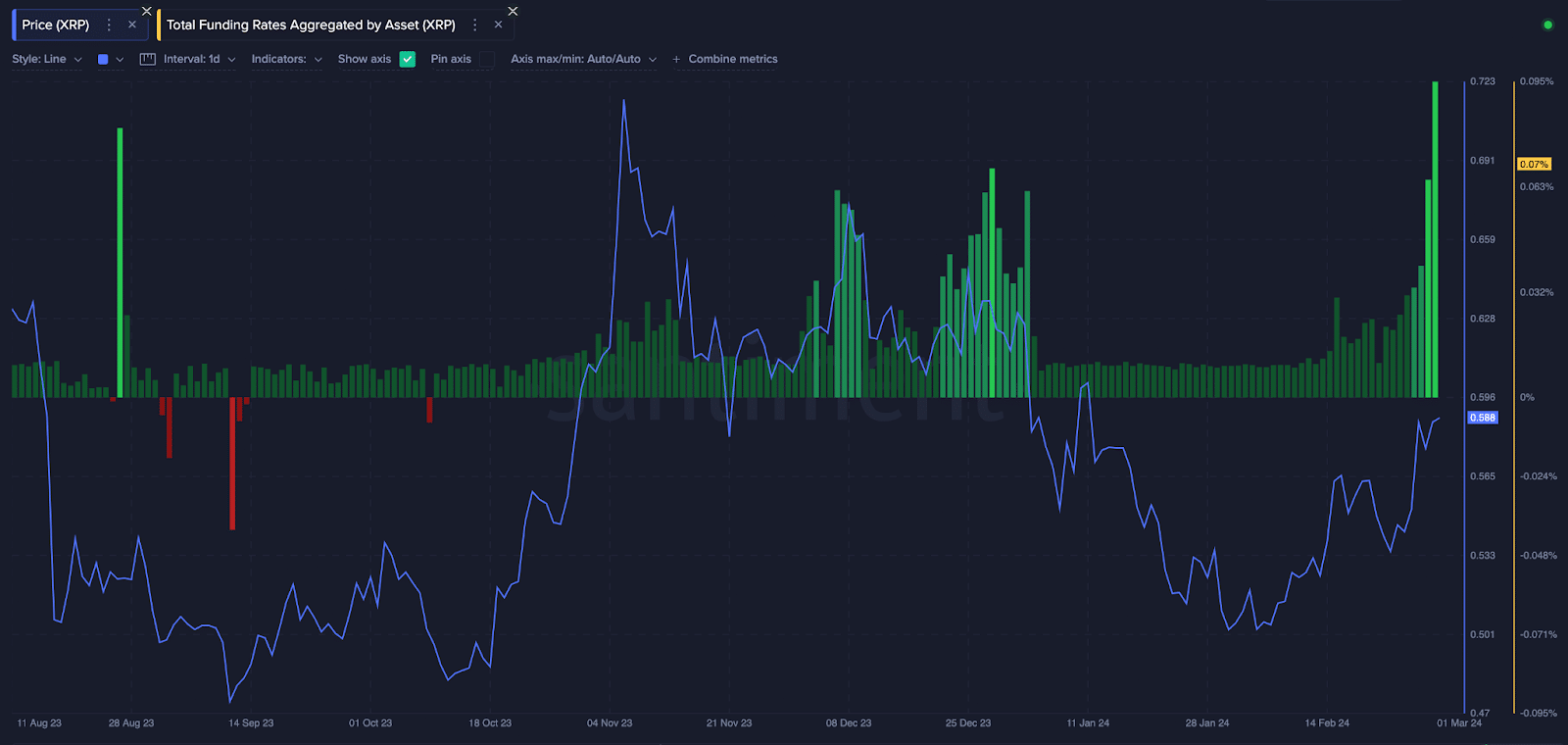

Santiment’s funding charge development aggregates the overall charges paid between futures contract placeholders throughout varied buying and selling platforms and exchanges. The funding charge spiked from 0.04% to 0.10% between Feb. 27 and Mar. 1.

Sometimes, elevated values of favorable funding charges imply that XRP lengthy placeholders are paying file charges to brief merchants to keep their positions open.

August 2023 was the final time XRP’s funding charge soared above 0.08%. Such constant and extended funding charge spikes happen when leveraged lengthy merchants are assured that spot costs will rise within the brief period and yield outsized income.

If this bullish state of affairs performs out, XRP’s worth might be on the verge of hovering to a brand new 2024 peak above $0.65, in step with the remainder of the altcoin within the high 10 market valuation rankings.