Worldcoin’s value soared to an all-time excessive of $9 on Feb. 22, up by a staggering 336% within the final 10 days as OpenAI’s SORA launch and NVIDIA earnings emerge as key drivers.

On Feb. 22, Worldcoin (WLD) achieved unicorn standing, crossing the $1 billion market capitalization milestone.

WLD’s emergence on the crypto top-gainers chart is essentially attributed to bullish headwinds from NVIDIA’s inventory efficiency and OpenAI’s just lately shipped SORA generative AI video rendition mannequin.

It stays to be seen if Worldcoin’s underlying ecosystem’s development can maintain the momentum or if the rally will peter out because the media hype cools.

Worldcoin provides $840 million market cap in 10 days

On Feb. 22, Worldcoin’s native WLD token stretched its exceptional value rally in February 2024 to a staggering 320%, including $840 million to its market capitalization inside a frenetic 10-day interval.

After a tepid begin to the month, Worldcoin’s value pattern flipped bullish on Feb. 15 when OpenAI soft-launched its newest text-to-video AI mannequin, Sora.

Between Feb. 15 and Feb. 19, WDL value soared 160%, rising from $3 to a world peak of $8.

On the $8 territory, a speedy profit-taking wave noticed WLD value retrace towards $6 on Feb. 21, as buyers grew hawkish on NVIDIA’s This fall earnings.

Nevertheless, the main chip producer posted record-breaking earnings on Feb. 21, sending its share value to all-time highs. Together with different AI-related danger property, WDL value additionally rocketed additional, hitting an all-time excessive of $9, including one other 50% to its February positive factors.

Past the media hype, the Worldcoin undertaking has witnessed elevated international adoption for the reason that flip of the yr.

Worldcoin-funded addresses had been on the rise earlier than the rally

WLD’s over 300% value breakout within the final 10 days has been credited to the developments surrounding NVIDIA and OpenAI and for an excellent cause.

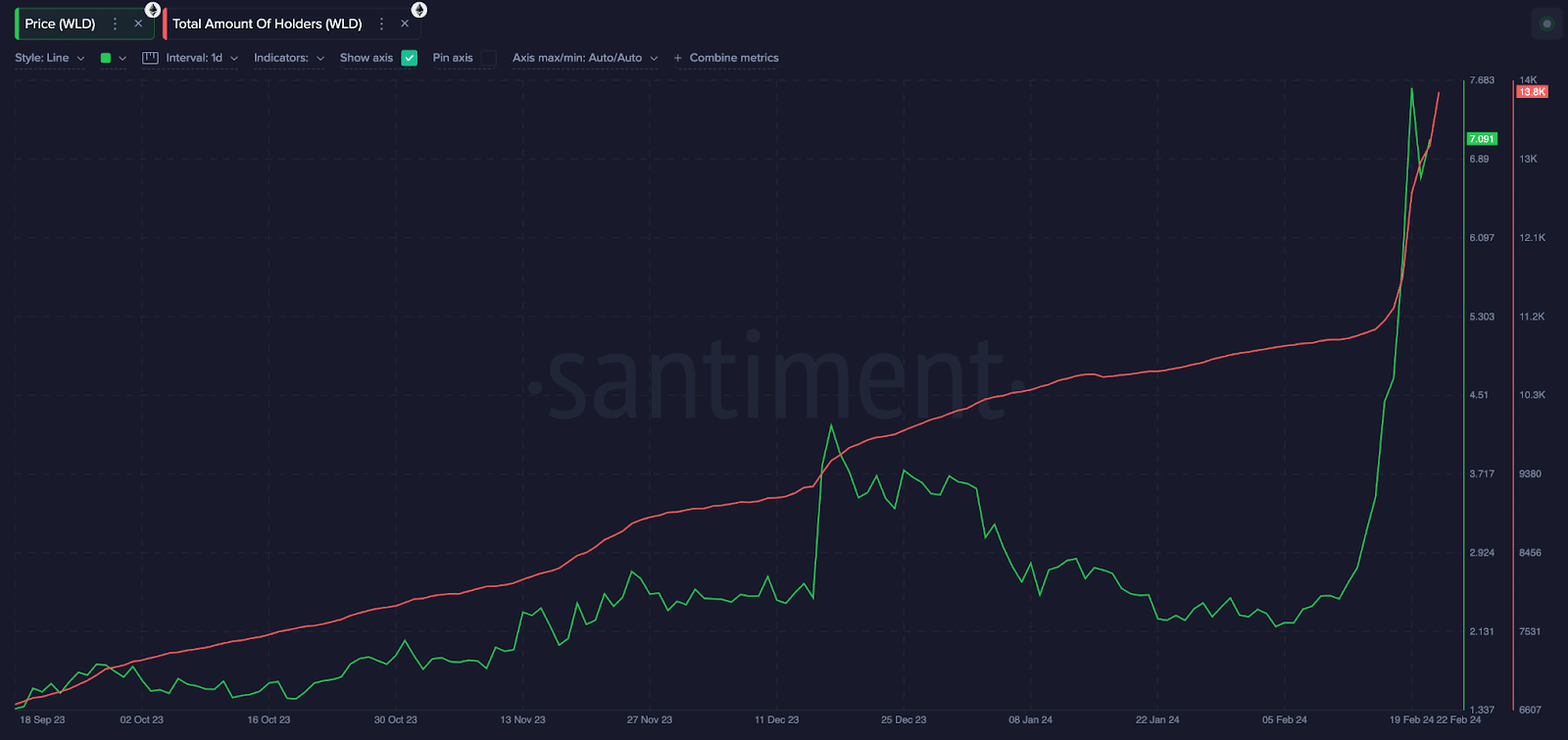

Nevertheless, trying previous constructive headlines, on-chain knowledge traits present that Worldcoin has attracted a gentle development in person base, even earlier than the newest frenzy.

The Santiment chart tracks the variety of distinctive addresses holding models of a selected cryptocurrency. It exhibits that Worldcoin has attracted 3,608 new funded addresses for the reason that flip of the yr, bringing the overall to 13,800 at press time on Feb. 23.

A better have a look at the crimson trendline exhibits that whereas WDL value dipped 50% from $4.21 to $2.20 between Dec. 17 and Feb. 5, it continued to draw regular development in new investor addresses.

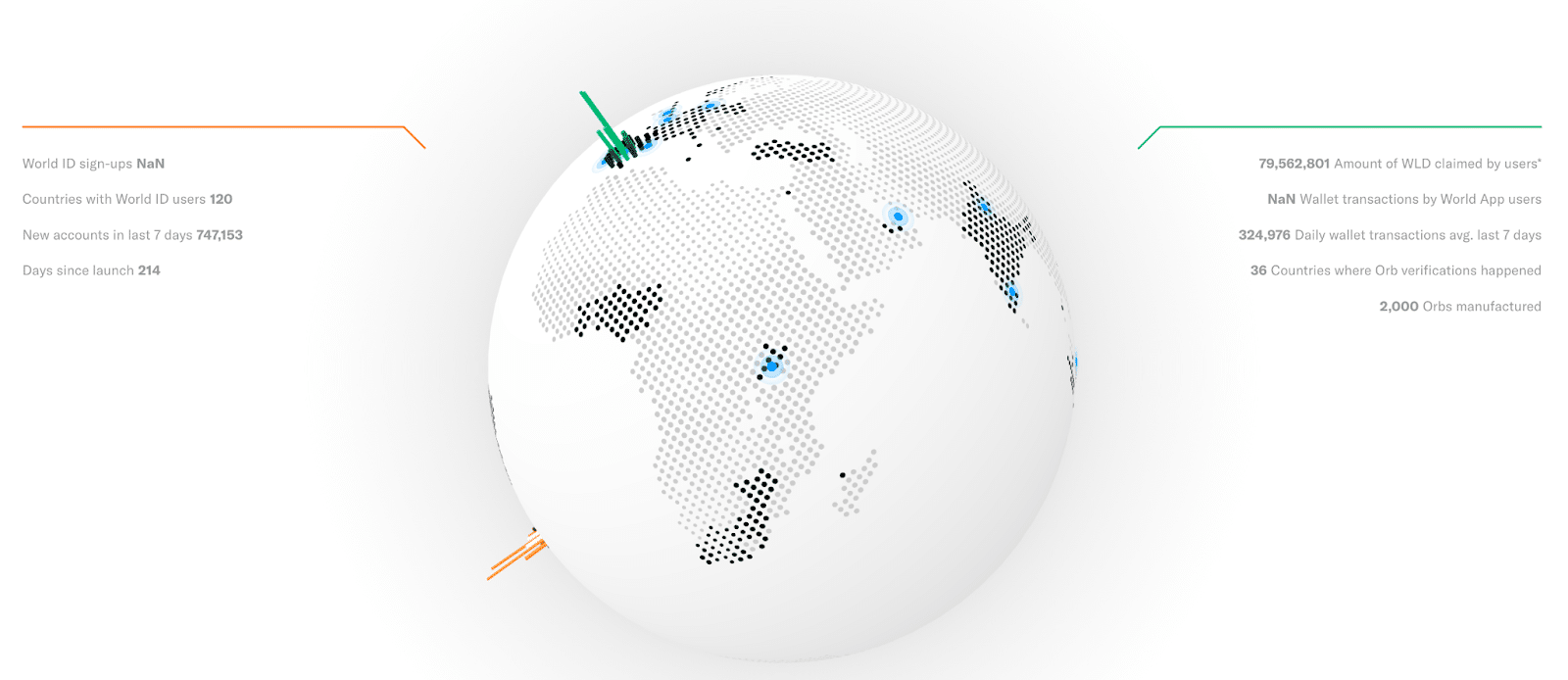

Extra knowledge from the Worldcoin official web site exhibits that 3.5 million folks from 120 international locations have now signed up for distinctive World IDs.

This exceptional development throughout the on-chain WLD ecosystem got here after preliminary pushback surrounding its IRIS scanning and knowledge harvesting issues from critics.

It, nevertheless, stays to be seen if this development interprets into regular on-chain transactions and community exercise ample to maintain WLD on its present upward trajectory.

Worldcoin value prediction: $10 is the subsequent main resistance

When it comes to short-term value motion, with out one other comparable bullish catalyst, Worldcoin’s value will seemingly enter a pullback under $8 within the coming days.

With costs trending at all-time highs, nearly each present holder sits on unrealized earnings. As media fanfare surrounding SORA and NVIDIA wanes, some strategic buyers might look to take some earnings.

The higher and decrease Bollinger bands are stretched to extremes, pointing in reverse instructions. This uncommon market alignment occurs when an asset has reached overbought situations and is primed for a pullback.

If this situation performs out as predicted, shedding the $8 assist might set off a free fall towards the 20-day SMA value at $4.20, the earlier peak recorded earlier than the blistering rally set in 10 days in the past.

Then again, there’s an opportunity bullish buyers might maintain out for extra positive factors, particularly with the official launch of SORA nonetheless to return. On this case, the bulls should first scale the $10 psychological resistance.

This week’s value traits present that WLD witnessed a momentary pullback every time the value approached nominal milestones at $8 and $9, respectively. A repeat of this sample might see the WLD value rejected from $10 through the subsequent rally.