Cardano value has made a swift restoration to $0.54 after hitting a 50-day low of $0.43 on Jan. 23, speculative merchants are betting large on additional positive aspects.

After two weeks of energetic Bitcoin ETFs buying and selling, the dreaded sell-the-news cycle that noticed the worldwide crypto market capitalization shrink by greater than $270 billion between Jan. 11 and Jan. 23 seems to have cooled. The $180 billion uptick previously week has raised optimism throughout the altcoin markets.

Layer-1 altcoins lead the crypto market resurgence

Because the crypto market entered restoration mode this week, outstanding Layer-1 cash, together with Solana (SOL), Avalanche (AVAX), and Cardano (ADA), have been on the forefront of the rally.

With 24.1% and 20.2% positive aspects, respectively, Avalanche and Solana have collectively added $14.9 billion in market capitalization between Jan. 23 and Jan. 30.

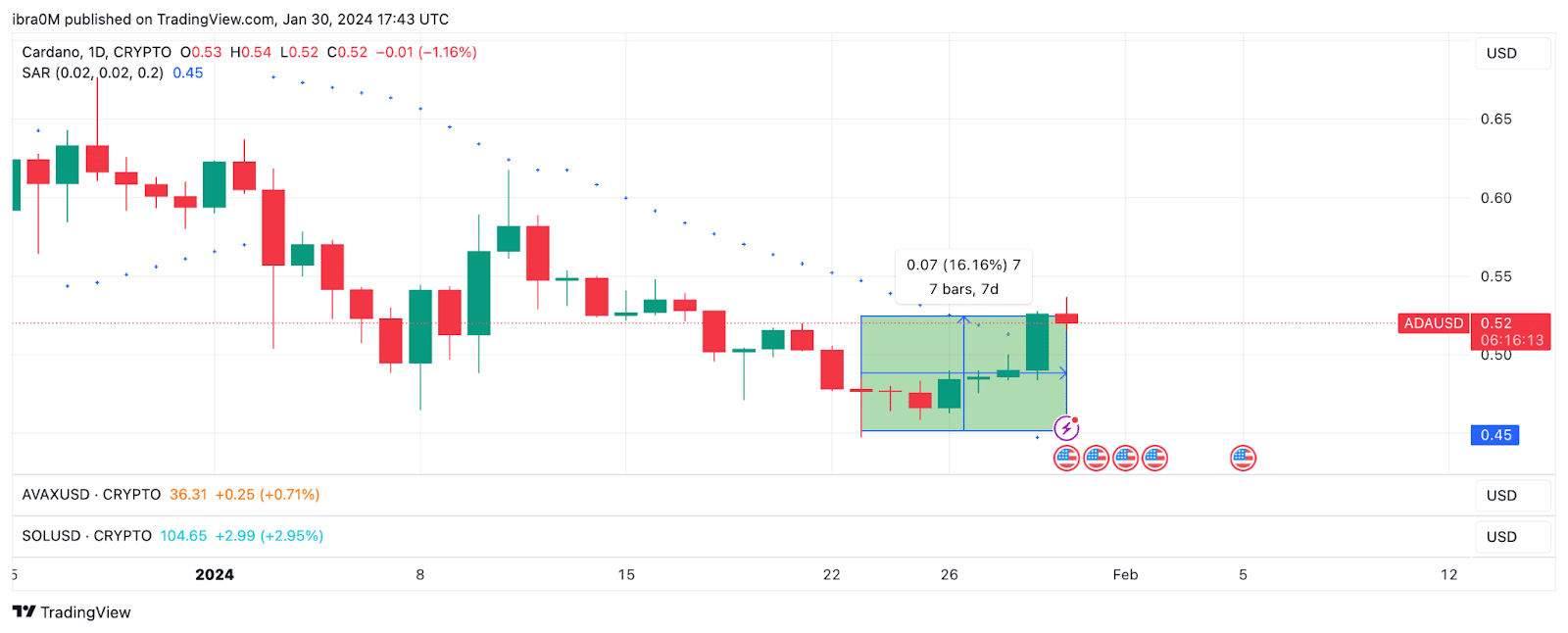

The chart beneath notably reveals that ADA value is trailing with a decrease 16% leap.

Whereas Cardano’s 16.2% improve to a $2.2 billion market cap over the previous week is nothing to scoff at, important spinoff market information tendencies noticed on Jan. 30 recommend that ADA value might be subsequent in line for a significant breakout.

Cardano data 800% spike in funding fee

Cardano and its rival mega-cap layer-1 cash have stolen the present within the crypto spot markets this week, including billions of {dollars} in market capitalization. However trying past the value charts, derivatives merchants seem like inserting unusually massive bullish bets on an imminent ADA value breakout.

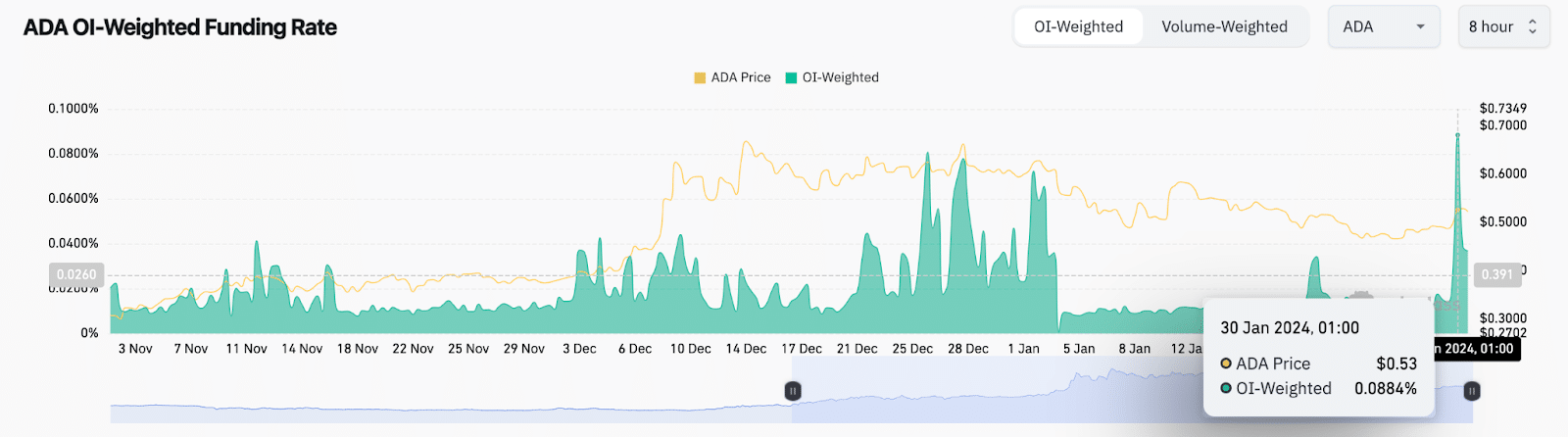

CoinGlass’s funding charges metric tracks adjustments in charges paid by futures contract holders to opposing events, offering insights into market dynamics and dominant sentiment amongst merchants.

Optimistic funding charges imply that LONG place holders pay quick merchants to maintain their positions open, anticipating that costs will improve and end in bigger earnings.

The chart beneath reveals that Cardano’s open-interest weighted funding fee rose 800% to hit 0.09% on Jan. 30 after sustaining a median of 0.01% since Jan. 2.

The chart above reveals bullish speculative merchants pay report charges to maintain their LONG ADA positions energetic. Such a speedy improve in constructive funding fee typically happens when speculative merchants quickly react to a bullish catalyst.

Given the dominant bullish momentum noticed in rival layer-1 altcoin markets this week, this might point out that merchants are betting large on ADA value, probably catching as much as AVAX and SOL, each of which have delivered superior efficiency.

The historic information pattern within the chart additionally affirms that ADA value has typically made a leg-up every time the Cardano funding fee has recorded comparable spikes.

Cardano value forecast: All eyes on $0.60 resistance

From an on-chain perspective, the present Cardano value uptrend could be attributed to bullish headwinds surrounding the altcoin markets, and the rising funding charges might propel it additional.

The Parabolic Cease and Reverse (SAR) technical indicator helps this Cardano value prediction. When the Parabolic SAR dot factors beneath an asset’s present value, it signifies a rising bullish momentum.

On this case, the ADA Parabolic SAR dot pointing to $0.45 whereas the present value is $0.52 aligns with the bullish on-chain prediction.

Merchants could interpret this as a shopping for alternative or a sign to go lengthy within the derivatives markets, anticipating additional Cardano value appreciation.

If this situation is predicted, the bears can mount preliminary resistance on the $0.55 milestone value. Nevertheless, a decisive breakout might set off margin name triggers and quick squeeze alerts, presumably sending ADA costs above $0.65 for the primary time in 2024.

Conversely, the bears might invalidate this optimistic value forecast if a downswing beneath $0.40 is pressured.

Nevertheless, as outlined by the SAR chart, the help at $0.45 might show daunting. Merchants taking extremely leveraged positions might make frantic purchases to avert main losses as soon as costs method the $0.45 space, probably triggering one other value bounce.