The entire quantity of liquidations on the crypto market over the previous 24 hours exceeded $250 million.

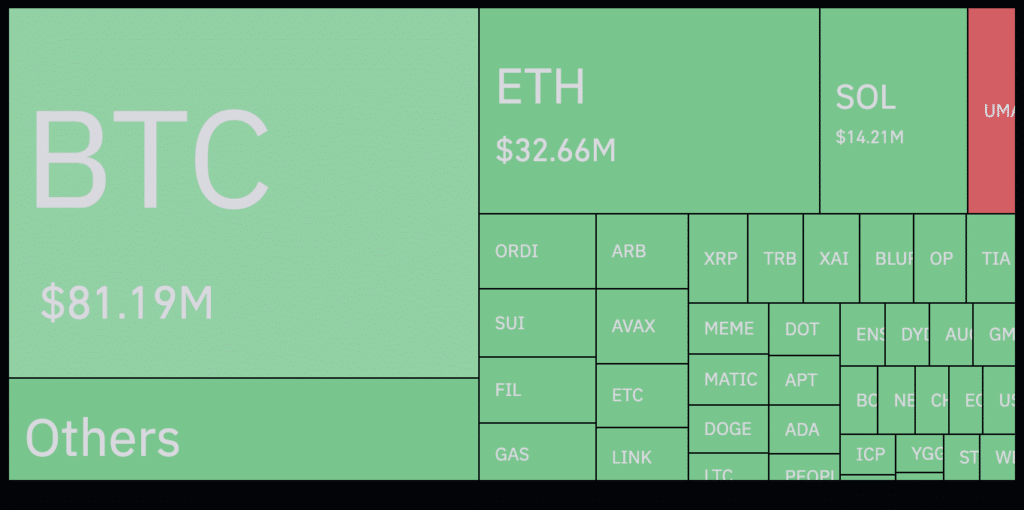

In accordance with Coinglass, the amount of liquidations at present stands at $252.5 million. Most compelled closed positions had been in Bitcoin (BTC) and Ethereum (ETH).

Earlier, the worth of Bitcoin dropped under $41,000, costing merchants $81.1 million. Market contributors who opened lengthy positions in Ethereum additionally suffered vital losses – the worth of the second largest cryptocurrency by capitalization to $2,400, costing merchants $32 million.

Over 90% of liquidations had been distributed between OKX, Bybit, Huobi and Binance. Binance executed essentially the most vital order – the alternate closed an extended BTCUSDT for $7.31 million.

On the time of writing, the speed of the most important cryptocurrency was $41,200. In accordance with Coinglass information, in the previous few hours, merchants have opened extra lengthy positions than quick ones, indicating market contributors’ confidence within the additional development of BTC.

Crypto fanatics and market specialists attribute the autumn to asset managers Grayscale‘s energetic sale of BTC. Grayscale’s Bitcoin Belief (GBTC) beforehand skilled vital outflows totaling $594 million in gentle of the present downturn within the cryptocurrency market. In parallel, Grayscale moved 9,840 BTC to Coinbase Prime value $418 million, bringing whole quantity to 41,478 BTC since Jan. 12.