A Bitcoin ETF will seemingly be authorised within the U.S. by the tip of 2023. Most of the people has no concept that is about to occur. Even crypto natives, dismayed by depressed markets and a decade of rejections by the Securities and Alternate Fee, are someway disregarding the present state of affairs.

Bitcoin exchange-traded funds have been extremely wanted since 2013 when the primary utility was submitted to the SEC and subsequently rejected. Over the previous 10 years, the SEC has denied every of the a number of dozen ensuing proposals, together with over 30 simply since 2021. There are at the moment 10 energetic purposes from main establishments. An uninformed observer might count on extra of the identical rejection, however this is able to be naive.

Two substantial developments previously three months have drastically improved the prospects of an approval. Let’s check out these developments and think about whether or not or not a spot ETF might revitalize Bitcoin and carry crypto out of its bear market.

Growth 1: BlackRock‘s ETF bid

Momentum kicked off on June 15 this yr when BlackRock made waves by unexpectedly submitting a Bitcoin ETF utility.

BlackRock CEO Larry Fink has spoken favorably about Bitcoin since then. Bitcoin “has a differentiating worth versus different asset courses, however extra importantly, as a result of it’s so worldwide it’s going to transcend anyone foreign money,” Fink stated. His change of tune is outstanding as he beforehand denounced Bitcoin as an “index of cash laundering” again in 2017.

BlackRock’s observe document of ETF utility approvals is nothing wanting excellent. The asset administration big has submitted 576 purposes and all however one have been authorised. Have the Bitcoin ETF tea leaves adjusted, and BlackRock taken word? BlackRock’s 99.8% approval fee suggests so.

A number of different high-profile establishments together with Constancy and Ark Make investments have adopted go well with with pending purposes underneath evaluate. Their submitting dates and choice deadlines are largely similar. There are 4 deadlines throughout the evaluate course of by which the fee might, and sometimes does, go for delay and additional evaluate.

Whether or not the SEC choice arrives early or not till remaining deadlines, the caliber of the establishments at the moment making use of and their optimism are signaling one outcome: approval.

Growth 2: Grayscale‘s court docket win

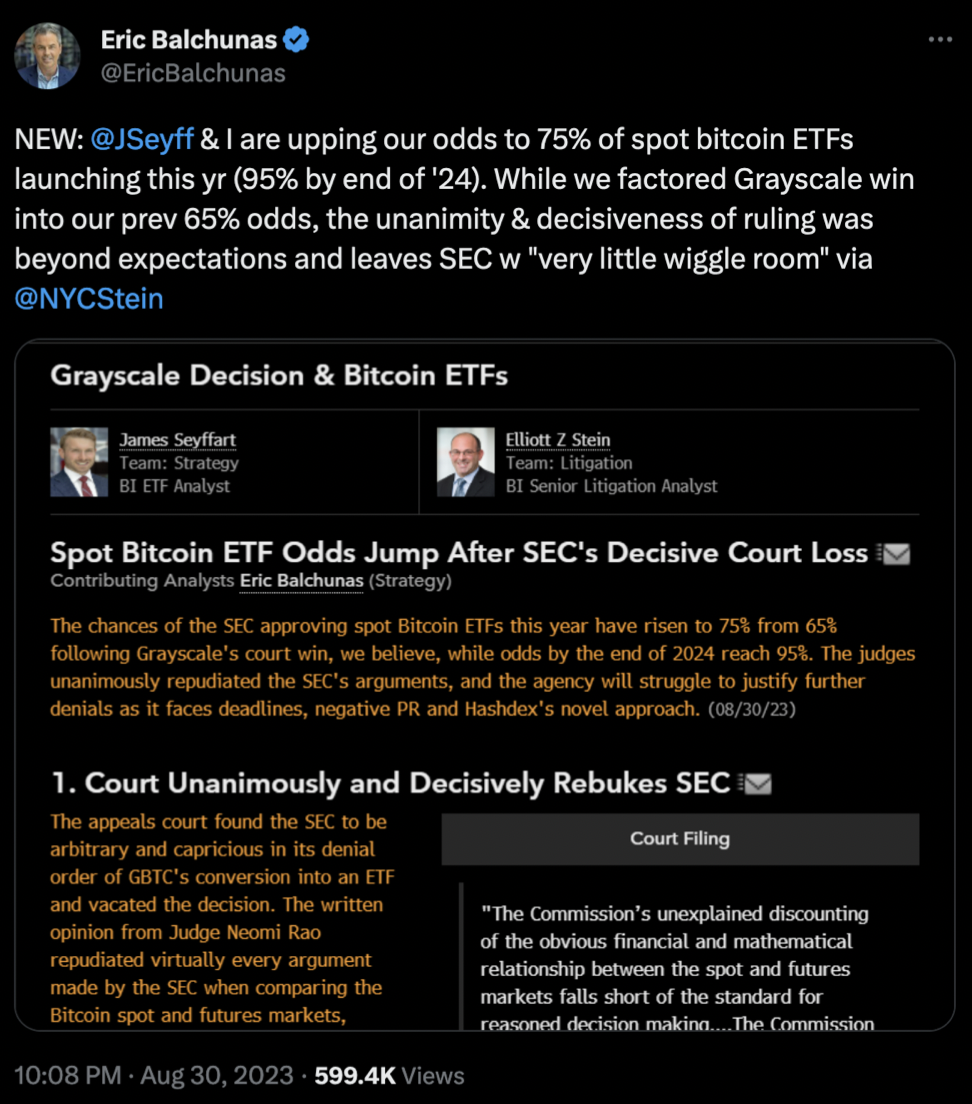

A separate however equally important growth within the route of ETF approval is the Aug. 29 federal court docket ruling that the SEC was fallacious to disclaim Grayscale Investments’ submitting for a spot Bitcoin ETF. Grayscale beforehand utilized to transform their Grayscale Bitcoin Belief (GBTC) to an ETF. The SEC denied this utility, and Grayscale responded with a lawsuit arguing that the choice was incorrect. The U.S. Courtroom of Appeals for the District of Columbia sided with Grayscale in its choice stating “Within the absence of a coherent clarification, this not like regulatory therapy of like merchandise is illegal.” The court docket additionally dominated that the SEC’s “denial of Grayscale’s proposal was arbitrary and capricious.”

The court docket ordered the SEC to as soon as once more evaluate Grayscale’s utility, successfully reversing the earlier rejection.

Whereas the ruling doesn’t equate to computerized approval, it strengthens the percentages that approval is on the horizon. The SEC would wish to offer robust help for additional rejection. This begs the query: If such help exists, wouldn’t it not have been included of their authentic rejection?

Odds of approval

Whereas the SEC not too long ago delayed all ETF purposes on Sept. 1, as most candidates’ first deadline for evaluate was on Sept. 2, the delays had been largely anticipated. The market responded accordingly with Bitcoin dropping about 5% from the delay announcement to round US$25,700 on the time of this writing. Regardless of the delays, the trail to a spot ETF approval is far clearer after Grayscale’s win in court docket. JPMorgan analysts consider this, in addition to former SEC Chair Jay Clayton who says approval is “inevitable.”

It’s affordable to count on the SEC to approve a number of and even all the filings without delay. The purposes are structured very equally, and it could be thought of unfair to grant any of the candidates a head begin. Cathie Wooden, the CEO of Ark Make investments, informed Bloomberg: “I believe the SEC, if it’s going to approve a Bitcoin ETF, will approve multiple without delay.” Ark Make investments has the earliest “remaining deadline” for its submitting, which is slated for Jan. 10, 2024.

Eric Balchunas, a senior ETF analyst for Bloomberg Intelligence, believes there’s a 75% probability of a spot Bitcoin ETF getting SEC approval this yr. He ups the percentages to 95% by the tip of 2024.

If SEC approval is inevitable, how may we count on markets to reply?

What crypto markets will do, post-ETF

Bitcoin ETFs exist already within the European Union, Canada, Brazil and Dubai. However because the U.S. is the middle of world monetary markets, together with crypto markets, approval by its authorities would undeniably be a serious occasion.

An ETF would shuttle new cash into Bitcoin. Whereas crypto exchanges similar to Coinbase are the first avenue for getting into crypto right this moment, the common American understandably has belief points with them. KYC (know-your-customer) procedures and having to switch funds to buy crypto are additionally onerous versus merely shopping for an ETF share. Crypto wallets, non-public keys and self-custody complicate issues additional.

The establishments making use of for a Bitcoin ETF deeply perceive these hurdles. They know an ETF is a chance for a big phase of the inhabitants, who’ve so far remained sidelined, to comfortably start including crypto publicity to their portfolio.

Bitcoin spot ETFs, in distinction to futures ETFs — which have traded within the U.S. since 2021 — could also be significantly constructive to crypto markets. Spot ETFs, the sort that each one present candidates are making use of for, would require the providing establishments to again the ETF with actual Bitcoin. This differs from futures ETFs, which merely allow buyers to commerce an listed by-product. Within the case of futures ETFs, Bitcoin doesn’t really change palms. A brand new purchaser of a spot ETF has a real constructive impression on the value of the underlying asset.

One other mind-set a few futures-based ETF is like two folks betting on how the value of one thing will change. It’s extra akin to a facet guess on what’s going to occur. Their guess has no direct impact on the value of the asset they’re betting on.

A Bitcoin spot ETF issuer similar to BlackRock or Constancy should purchase bona fide Bitcoin to again the shares of the fund that their clients maintain. A Bitcoin spot ETF purchase or promote will really change the value of BTC.

The brand new supply of fund flows into the house might present the spark the trade must get well from a collection of blows in 2022. The information itself will virtually definitely trigger a rush of shopping for within the brief time period. The volatility will breathe new life into the markets which have largely been subdued all through this summer season. The Grayscale choice on Aug. 29 produced a close to instant 6% Bitcoin worth enhance from US$26,100 to US$27,700. This enhance absolutely re-traced on information of the SEC’s option to delay all the excellent purposes on Aug. 31 as the primary choice deadline for many filings approached.

If the ETF is authorised, it’s doable that market positive factors will prolong longer than solely within the brief time period.

Within the brief to medium time period, a reflexivity loop could also be created whereby:

Bitcoin worth will increase on ETF approval information.

⬇

Buyers need Bitcoin allocation on account of worth will increase.

⤹ ⤴

Buyers buy shares in a spot ETF, which drives Bitcoin costs up additional.

In the long run, we are going to see BlackRock et al shepherding purchasers to diversify a part of their portfolio into Bitcoin. Passive buyers will purchase and maintain for the long run. As Bitcoin’s provide is finite, the value is certain to be pushed upward.

Gold appreciated eight years in a row after the preliminary spot Gold ETF was authorised again in 2004. For all proclamations of Bitcoin as “digital gold,” it will be becoming for Bitcoin’s subsequent upward cycle to equally start following ETF approval.

The world shouldn’t be taking note of Bitcoin in the mean time. That may change earlier than the yr ends.