Key Takeaways

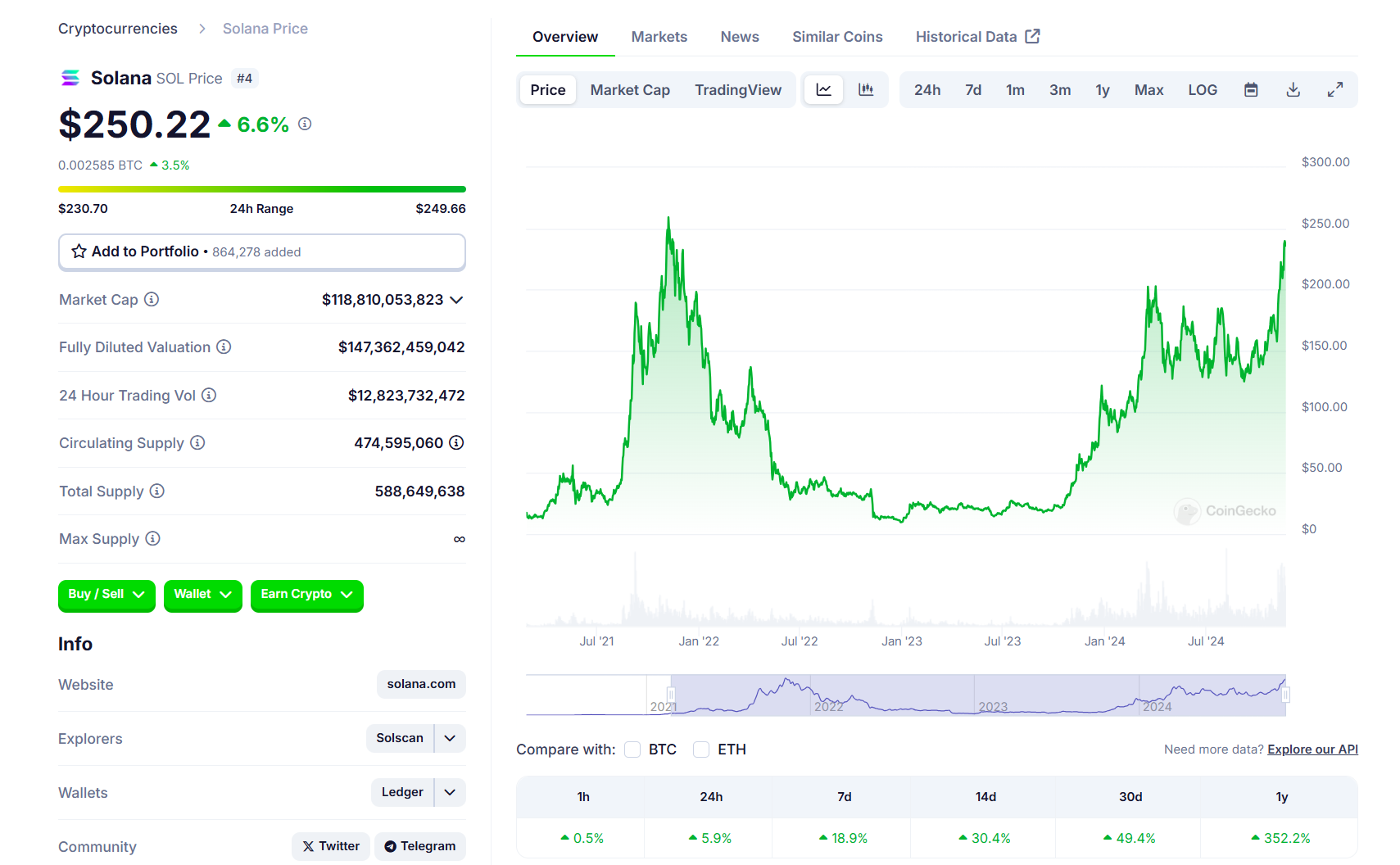

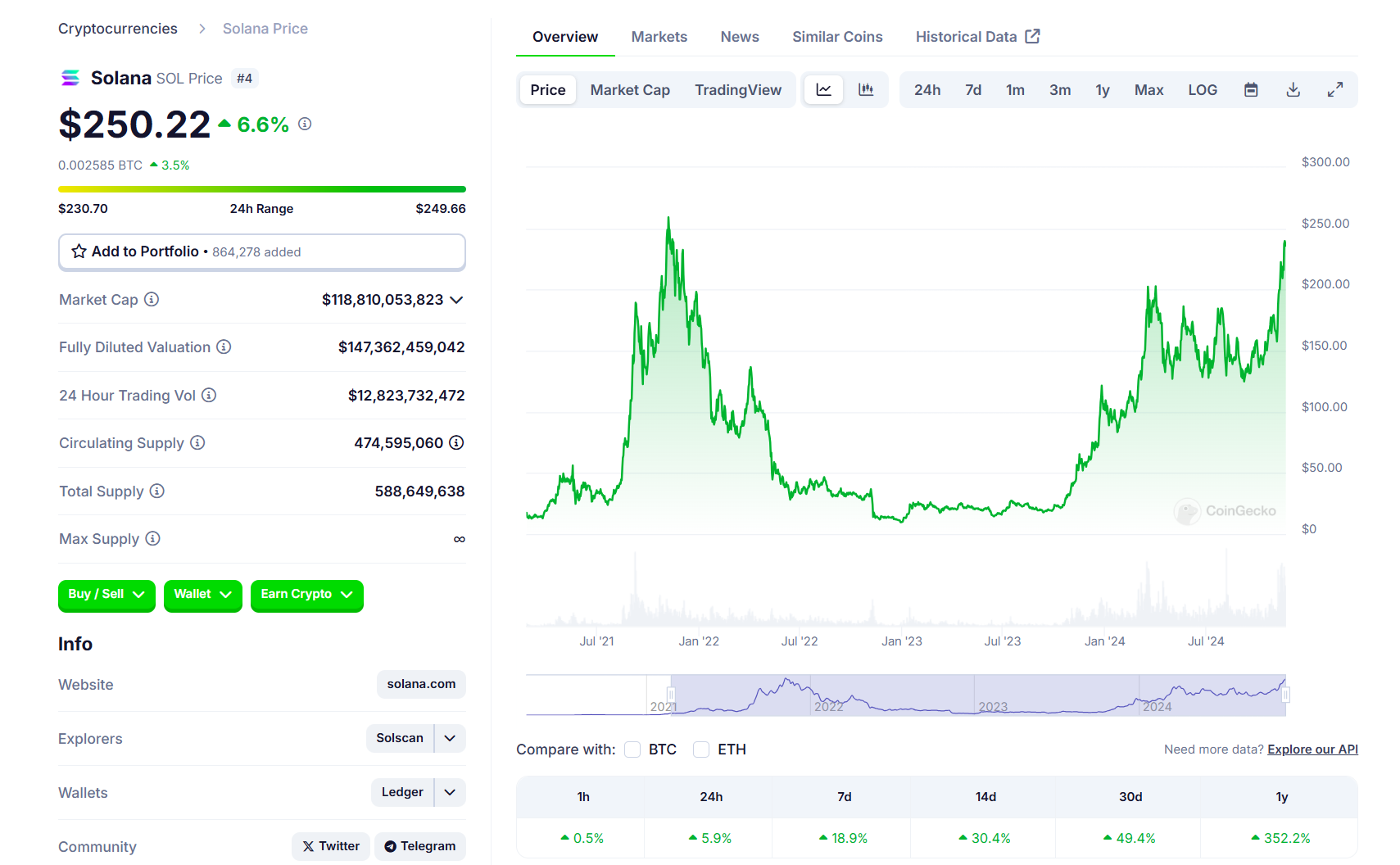

- Solana’s SOL token price surged to $250, nearing its all-time high amid SEC discussions with ETF issuers.

- The SEC has initiated talks with Solana ETF issuers like VanEck and 21Shares on S-1 forms.

Share this article

Solana’s SOL token surged to $250, its highest level since November 2021, on Thursday morning. The rally comes as discussions between SEC staff and Solana ETF issuers are making progress.

The fourth-largest crypto asset is now just 4% away from its all-time high of $260 set in November 2021, based on data from CoinGecko. If the current bullish momentum continues, Solana will soon surpass its record high before Ethereum does.

The SEC has initiated talks with Solana ETF issuers regarding their S-1 registration forms, according to FOX Business journalist Eleanor Terrett, citing “two people familiar with the matter.”

VanEck, 21Shares, and Canary Capital submitted S-1 applications for Solana ETFs earlier this year. Both VanEck and 21Shares plan to list their products on the Cboe exchange if approved.

“There’s a ‘good chance’ we’ll see some 19b4 filings from exchanges on behalf of prospective issuers — the next step in the ETF approval process — in the coming days,” Terrett said. These filings would initiate a 240-day SEC review period.

Previous 19b-4 filings from VanEck and 21Shares were removed from the Cboe’s website in August, though issuers now report increased engagement from SEC staff. Combined with an incoming pro-crypto administration, this has led to optimism about potential Solana ETF approval in 2025.

The potential for Solana ETF approval is linked to shifts in the American political landscape. A Donald Trump re-election could lead to new SEC leadership that may be more receptive to new financial products.

“We would expect the SEC to approve more crypto products than they have in the past four years,” said Matthew Sigel, head of crypto research at VanEck. “I think the odds are overwhelmingly high that there will be a Solana ETF trading by the end of next year.”

Following VanEck and 21Shares, Bitwise filed to establish a trust entity for its proposed Solana ETF in Delaware on November 20.

Apart from Solana ETFs, asset managers have also filed for similar funds that invest directly in other crypto assets, like XRP and Litecoin.

Moreover, the recent launch of options trading on spot Bitcoin ETFs signals a growing trend among fund managers to diversify investment options tailored to clients’ specific needs and risk tolerances.

Share this article