There was an increase within the quantity of DeFi merchants lately which has resulted in additional decentralized exchanges (DEXs) being dropped at the market as effectively.

Web3 is growing its impression on main industries, and the buying and selling business is not any exception. We had seen the deficiencies in centralized exchanges like an absence of transparency, insecurity, monetary exclusiveness, and privateness, and this has supplied the necessity for DEXs.

DEX is a approach of exchanging cryptocurrencies with none middleman like brokers or third events. They comply with a unique strategy from centralized exchanges by counting on good contracts to deal with transactions peer-to-peer.

The enterprise mannequin focuses on privateness for its customers the place transactions are carried out anonymously, although the transaction particulars are saved on the blockchain.

We have now a number of DEX platforms in the marketplace, like Coinbase and Binance, however on this article, we’ll deal with Hashflow.

We’ll take a look at how merchants are related with pinpoints by way of a Hashflow token, the way it works in another way from others, how you can market make, and how you can commerce.

What’s Hashflow and what’s its purpose?

To begin with, Hashflow is understood for its bridge-less cross-chain swaps, which implies it’s extremely interoperable, has zero slippage, and has no MEV.

That is attainable as a result of Hashflow ensures market makers signal the worth quotes so it stays unchanged throughout the commerce.

Liquidity suppliers and merchants are related with skilled market makers on Hashflow and its core options supply higher flexibility for its market makers — no slippage, MEV-resistant, higher worth quotes, and a less expensive buying and selling charge are all benefits of it.

All of the above talked about are solely attainable due to the structure Hashflow makes use of, which is the Pool-based structure.

How Hashflow works

Beginning with a transaction, the consumer has to attach his pockets to Hashflow, enter a quantity they wish to commerce, after which a quote is exhibited to them.

If the consumer accepts, the order is submitted and that transaction is verified and added to the Hashflow community (or blockchain). On the opposite finish, there are maker markets that take care of the issuing of worth quotes that the consumer had already accepted.

The market maker then indicators the commerce and it’s executed with out slippage (no matter order was submitted by the consumer stands). In contrast to different DEXs, which do often have AMMs (Automated Market Maker) that handles market making and belongings pricing on-chain utilizing Lazy Liquidity Provision, Hashflow goes historically similar to the order-book mechanism.

The pricing is finished off-chain however the commerce is executed on-chain.

Hashflow was in 2021 and has grown considerably, providing one of the best costs due to its optimized fuel charge and 0 slippage. As of the time of this text being printed, Hashflow at the moment helps bridge-less cross-chain swaps which makes you provoke a swap on EVM-compatible chains, and it’s anticipated to incorporate Solana integration, good order Routing, gasless buying and selling, restrict orders, and Hashverse in future.

In abstract, Hashflow is a DeFi protocol that serves as a decentralized alternate working on the Ethereum blockchain.

Hashflow tokens

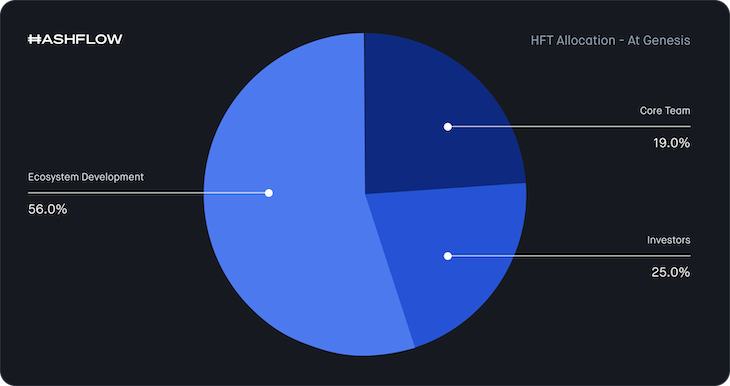

Hashflow supplies its token known as the HFT (Hashflow token), which is an ERC-20 on the Ethereum chain deployed on December 22, 2021. With one billion models of HFT in provide, Hashflow distributed this cryptocurrency on this method: 19% to the core staff; 25% to the early buyers; and 56% to the ecosystem. An extra 6.75% might be given to early customers as a reward.

The Hashflow NFT, which can also be known as the Hashbots, might be used within the Hashverse that might be launched sooner or later. NFT holders will obtain HFT that tallies to the worth of the NFT, as a result of every NFT may have an HFT worth. And Hashflow states that after 4 years, 5% of HFT might be issued to the neighborhood.

The best way to market make

Market markers are basically vital in Hashflow and available in the market as an entire. They’re the liquidity suppliers that make the market purposeful by shopping for and promoting belongings. This doesn’t imply that they’ll purchase and promote at any time instantly, however they’re all the time on standby, prepared to purchase and promote.

In most decentralized exchanges, the market makers are computerized and good contracts are deployed to seek out market pairs in AMMs (Automated Market Makers) however they’re vulnerable to assaults and likewise a bit laggy as a result of the worth quotes are dealt with on-chain.

Extra nice articles from LogRocket:

In Hashflow, the market makers are corporations, establishments, or people which can be given the privilege to make these market selections utilizing their professionalism, and that is accomplished off-chain, which in flip reduces fuel charges and slippage, as talked about earlier.

To market make on Hashflow, we’ll comply with the steps under. Integrating with Hashflow as a market maker is sort of easy.

Hook up with WebSocket

You have to to connect with the WebSocket from Hashflow API simply as you see on line 10 under, and chances are you’ll have to contact the staff on Telegram or Discord to be added to the “allowlist” makers.

const PING_PONG_INTERVAL_MS = 30000;

const PING_PONG_GRACE_PERIOD_MS = 1000;

operate getWebsocketConnection(

marketMakerName,

onMessageCallBack,

onCloseCallback,

onHeartbeatCallback,

) {

const ws = new WebSocket(`${course of.env.HASHFLOW_WS_API}/maker/v1`, {

headers: { marketmaker: marketMakerName, }

});

const heartbeat = () => {

if (ws.pingTimeout) {

clearTimeout(ws.pingTimeout);

}

ws.pingTimeout = setTimeout(() => {

ws.terminate();

}, PING_PONG_INTERVAL_MS + PING_PONG_GRACE_PERIOD_MS);

onHeartbeatCallback();

}

ws.on('open', heartbeat);

ws.on('ping', heartbeat);

ws.on('message', message => onMessageCallBack(message));

ws.on('shut', () => {

if (ws.pingTimeout) {

clearTimeout(ws.pingTimeout);

}

setTimeout(() => {

ws.removeAllListeners();

onCloseCallback();

}, 5000);

});

ws.on('error', err => {});

ws.on('unexpected-response', (_, res) => {

let message="";

res.on('information', (chunk) => {

message += chunk;

});

res.on('finish', () => {

if (res.statusCode === 401) {

logger.error(`WS entry not approved. ${message}`);

} else {

logger.error(`Unexpexted response from server: [${res.statusCode}] ${message}.`);

}

ws.shut()

});

});

return ws;

}

And Hashflow is related to you, as seen within the following:

// TODO: Substitute this together with your market maker title (as soon as added to the backend)

const MARKET_MAKER_NAME = 'TestMM';

// TODO: Set true if you wish to MM on 1inch, and so forth – and have signed authorized agreements

const SUPPORT_AGGREGATORS = false;

const levelsInterval = SUPPORT_AGGREGATORS

? setInterval(() => publishPriceLevels(mainSocket), 1000)

: undefined;

const onMessageCallback = message => processMessage(mainSocket, message);

const onHeartbeatCallback = () => {

for (const networkId of Object.keys(SUPPORTED_PAIRS)) {

sendMessage(mainSocket, 'subscribeToTrades', { networkId, pool: POOL });

}

};

const onCloseCallback = () => {

if (SUPPORT_AGGREGATORS) {

clearInterval(levelsInterval);

}

mainSocket = connectToHashflow();

};

const connectToHashflow = () => {

return getWebsocketConnection(

MARKET_MAKER_NAME,

onMessageCallback,

onCloseCallback,

onHeartbeatCallback,

);

}

let mainSocket = connectToHashflow();

The ‘TestMM’ is changed with yours after contacting the staff. You must also consult with this pattern codebase to see how to connect with the WebSocket from Hashflow.

Create a Pool

You have to to connect with your pockets after connecting to the WebServer to create a Pool that can supply quotes.

To do that, head over utilizing this hyperlink and fill in your Pool title, signer deal with, and eventually determine if you would like your Pool to be public or non-public. After finishing the method, you need to get a web page like this:

Obtain RFQ and reply with a quote

Now to the attention-grabbing half; Hashflow receives a request-for-quote from a consumer once they wish to commerce to our server which then provides the information to the desired market maker:

{

"messageType": "rfq",

"message": {

// This can be a distinctive RFQ ID -- you must use this when sending again a quote.

"rfqId": string,

// This might be one thing like: hashflow, 1inch. That is helpful

// since 1inch cost charges for his or her trades

"supply": string,

// 1 for ETH L1

"networkId": quantity,

// Base token (the token the dealer sells).

"baseToken": string, // contract deal with

"baseTokenName": string, // token title (e.g. USDC, ETH, ...)

"baseTokenNumDecimals": quantity, // token decimals (e.g. DAI: 18, USDC: 6)

// Quote token (the token the dealer buys).

"quoteToken": string, // contract deal with

"quoteTokenName": string, // token title (e.g. USDC, ETH, ...)

"quoteTokenNumDecimals": quantity, // token decimals (e.g. DAI: 18, USDC: 6)

// Precisely one of many following fields might be current within the RFQ.

// If baseTokenAmount is current, quoteTokenAmount must be stuffed by the quote.

// If quoteTokenAmount is current, baseTokenAmount must be stuffed by the quore.

// Quantities are in decimals, e.g. "1000000" for 1 USDT.

"baseTokenAmount": ?string,

"quoteTokenAmount": ?string,

// The dealer pockets deal with that can swap with the contract. This could be a proxy

// contract (e.g. 1inch)

"dealer": string,

// The pockets deal with of the particular dealer (e.g. finish consumer pockets for 1inch).

// That is useful so as to perceive consumer conduct.

// If effectiveTrader isn't current, you'll be able to assume that dealer == effectiveTrader.

"effectiveTrader": ?string,

}

}

And primarily based in your carried out logic in your codebase, a quote is returned to the consumer on this format as effectively:

{

"messageType": "quote",

"message": {

"rfqId": string, // This must be the identical rfqId that was despatched by the server

"pool": string, // This must be the contract deal with of the pool.

// That is elective. If utilizing an EOA (externally owned account), this could

// comprise the pockets deal with of the EOA.

// The EOA must have allowance set to the Pool.

"eoa": ?string,

// Similar as RFQ

"baseToken": string,

"quoteToken": string,

// Quantities are in decimals.

"baseTokenAmount": string,

"quoteTokenAmount": string,

// Set this to "0" for personal pool / EOA buying and selling.

"charges": string,

// The unix timestamp when the quote expires, in seconds.

"quoteExpiry": quantity,

}

}

Help signing quotes

This solely occurs if the consumer doesn’t provide a particular market maker, and in that context, Hashflow will make a request for a quote from all market makers and picks one of the best one.

When one of the best quote is picked, we ship a signQuote message kind again to the market maker for them to signal (get a signature from them). The request can also be on this format:

"messageType": "signQuote",

"message": {

// The RFQ ID that generated the quote.

"rfqId": string,

"networkId": quantity, // The chain ID (e.g. 1 for Ethereum mainnet)

"quoteData": {

"txid": string, // Distinctive identifier of the quote -- totally different from the RFQ ID.

"pool": string,

"eoa": string,

"baseToken": string,

"quoteToken": string,

"baseTokenAmount": string,

"quoteTokenAmount": string,

"charges": string,

"quoteExpiry": quantity,

// The account that might be executing the swap. For 1inch, that is the 1inch proxy.

"dealer": string,

// Dealer truly executing the swap, if totally different from 'dealer'.

"effectiveTrader": ?string,

// The next parameter is inside to hashflow contracts.

// It's leveraged to mitigate quote replay.

"nonce": quantity

}

}

}

Get the primary signed RFQ

You may take a look at your WebServer to see if you happen to get a signed RFQ from it by making a request to Hashflow’s staging API with the next physique params as a pattern:

POST https://api-staging.hashflow.com/taker/v1/quote/signedRfq

{

"networkId": 42, // 42 is Kovan, 1 is Mainnet

"supply": "hashflow",

"baseToken": "0x07de306ff27a2b630b1141956844eb1552b956b5", // USDT (Kovan)

"quoteToken": "0xa0a5ad2296b38bd3e3eb59aaeaf1589e8d9a29a9", // WBTC (Kovan)

"dealer": "0x2150DD462B496bd5e4A37b5411c13319427BE83E",

"baseTokenAmount": "1000000",

"marketMaker": "TestMM" // remember to vary this

}

When you get a response, then your market maker is ready. You must also consult with the documentation for extra edge instances.

Conclusion

On this article, we centered on demystifying the connection between Hashflow, its customers, and market makers and the important thing features of Hashflow — particularly, that it gives bridgeless cross-chain swaps and off-chain market selections; i.e., quotes are accomplished with out automated makers.

Hashflow is bringing the multichain world nearer to us simply as Vitalik of Ethereum had speculated. We hope to get extra Hashflow help for different chains as that is at the moment beneath mass adoption. To additionally view its metric, head over to this dashboard.

Be part of organizations like Bitso and Coinsquare who use LogRocket to proactively monitor their Web3 apps

Consumer-side points that impression customers’ potential to activate and transact in your apps can drastically have an effect on your backside line. When you’re considering monitoring UX points, robotically surfacing JavaScript errors, and monitoring sluggish community requests and part load time, attempt LogRocket.

LogRocket is sort of a DVR for internet and cell apps, recording all the pieces that occurs in your internet app or web site. As a substitute of guessing why issues occur, you’ll be able to combination and report on key frontend efficiency metrics, replay consumer periods together with utility state, log community requests, and robotically floor all errors.

Modernize the way you debug internet and cell apps — Begin monitoring at no cost.