The video games market is prospering. Uncover the potential rewards and alternatives in crypto with play-to-earn (P2E) video games.

The worldwide video game market is experiencing speedy progress, with projections indicating a considerable improvement in revenues to $282.30 billion by 2024.

Areas like China are anticipated to considerably contribute to this surge, with a projected income era of $94.4 billion this 12 months.

Moreover, the market is predicted to maintain this momentum with an annual progress fee of 8.76%, reaching a staggering $363.20 billion by 2027.

On this altering panorama, play-to-earn (P2E) video games are gaining consideration. These video games supply the normal gaming expertise but in addition, provide you with an opportunity to earn precise cryptocurrency rewards.

Nonetheless, the entry-level into these video games varies depending on the title. For example, Axie Infinity (AXS), a distinguished participant within the play-to-earn area, requires gamers to put money into at least three Axies, priced between $2 to several thousand {dollars} every.

Conversely, video games like Decentraland (MANA) supply an extra accessible start line. Gamers can provoke their journey with MetaMask pockets, though extra investments in digital property just like the MANA coin could also be essential to entry options.

When contemplating your potential earnings, it’s essential to know that they’ll change. This transformation is affected by components like the price of the tokens and the engagement of the gamers.

For instance, neighborhood studies counsel a mean each-day income potential of around $1 inside Axie Infinity.

Moreover, the secondary marketplace for in-game property, notably non-fungible tokens (NFTs), presents gamers with a possibility for added income streams, as evidenced by Decentraland’s success in NFT gross sales.

Video games main the P2E race

Let’s analyze high performers within the P2E market primarily based on the final 30 days of knowledge:

- motoDEX: Ranked first amongst P2E video games, motoDEX operates on a multi-chain mannequin. During the last 30 days, it has witnessed a rise of 35.6% in distinctive lively wallets (UAW) and a surge of 512.91% in transaction quantity, taking its complete transactions to eight.31 million.

- Sweat Economic system: Sweat Economic system operates on each Ethereum and Close to chains. The Ethereum (ETH) hosted model skilled a modest uptick of two.56% in UAW, whereas the close-to-hosted counterpart noticed a rise of 4.42% with complete transactions of 6.49 million.

- Trickshot Blitz: Holding the third spot, Trickshot Blitz runs on the Circulate blockchain. Nonetheless, it faces challenges with a 17.93% lower in UAW and declining transaction volumes over the previous 30 days.

- PlayEmber: Ranked fourth, PlayEmber is current on each Ethereum and Close to chains. Ethereum-based exercise declined by 20.87% in UAW, whereas Close to witnessed a lower of 35.38% over the past month.

- Pixels: Securing the fifth place, Pixels operates on Ethereum and Ronin chains. Ethereum-based exercise surged by 137.35% in UAW, whereas Ronin witnessed a 31.94% improvement in consumer engagement. Moreover, transaction volumes on Ronin skyrocketed by over 3,000%.

Find out how to earn a living from P2E video games in 2024

The P2E market is unstable, with earnings potential fluctuating as a result of components like token worth, recreation recognition, and in-game asset demand.

Profitable monetization methods in 2024 will hinge on staying knowledgeable about market tendencies, selecting the best video games, and managing property properly. Here’s what you can do:

Choosing the proper video games

Decentraland, The Sandbox (SAND), and Axie Infinity are highlighted as distinguished examples of P2E video games that have yielded excessive returns for early buyers and, by far, are nonetheless probably the most valued video games primarily based on market cap.

In the meantime, as of Mar. 7, motoDEX, Sweat Economic system, and Pixels stand out as a result of their distinctive lively wallets (UAW) progress and transaction volumes as per DappRadar.

Give attention to video games with excessive repute, recognition, UAW and transaction quantity as they point out an engaged neighborhood, a key issue for potential earnings.

Don’t put all of your assets right into a single recreation. Unfold your investments throughout completely different blockchains and recreation genres to mitigate dangers related to token volatility and recreation recognition modifications.

Incomes methods

- Lively participation: Interact each day to maximize earnings by way of gameplay, challenges, and neighborhood occasions. For example, the Sweat Economic system rewards customers for bodily exercise, selling constant interplay.

- Asset flipping: Asset flipping on secondary markets for video games like Decentraland and The Sandbox will be profitable, particularly for early buyers or those with an eager eye for invaluable in-game property. Timing is essential; buy property when costs are low and promote throughout peak demand. Analyzing historic worth knowledge and neighborhood sentiment can inform shopping for/promoting selections.

- Staking and funding: Some P2E video games supply staking mechanisms the place where you’ll be able to earn dividends or curiosity in your in-game property or tokens. This will present a passive earnings stream alongside lively gameplay earnings.

- Guild membership: Becoming a member of a guild can present entry to premium recreation property without upfront funding, sharing income from collective earnings. It’s additionally a good way to be taught methods from skilled gamers.

Calculations and profitability evaluation

- Return on funding (ROI): Calculate preliminary prices (shopping for recreation property, transaction charges) in opposition to each day/weekly earnings to know the break-even level. For instance, in case your preliminary funding is $100 and also you earn $5 each day, your break-even level is 20 days.

- Market evaluation: Regulate token and asset costs inside every recreation. Use instruments like DappRadar and NonFungible.com to research market tendencies and determine worthwhile properties.

- Group engagement: Lively neighborhood participation can supply insights into upcoming updates, market tendencies, and hidden alternatives for income. Reddit, Discord, and Twitter are important platforms for P2E recreation communities.

The present state of the P2E market

In 2023, the blockchain gaming sector witnessed vital shifts and challenges alongside notable successes.

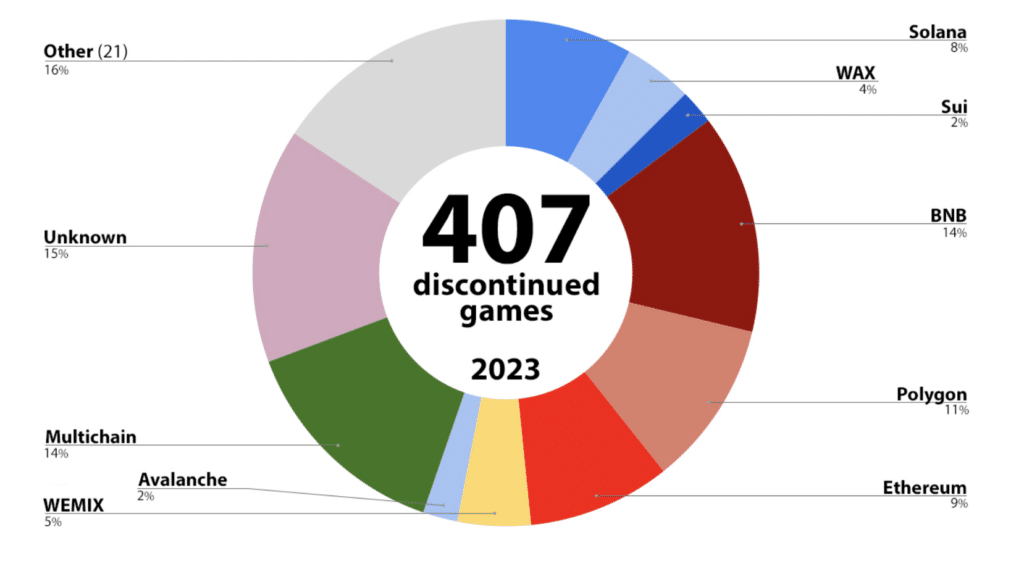

In response to the knowledge supplied by the Huge Blockchain Sports Listing, 2023 noticed over 30% of introduced blockchain-based video games being canceled or discontinued.

This pattern was notably evident throughout platforms similar to Binance Chain (BNB), Polygon (MATIC), and Ethereum, highlighting an excessive stage of challenge attrition throughout the business.

In response to DappRadar’s newest report, blockchain gaming attracted vital capital in 2023, with investments totaling $2.9 billion throughout 163 offers in web3 gaming and metaverse initiatives.

This marked a notable 62% drop in funding and a 19% lower within the variety of offers in comparison with 2022 when blockchain video games acquired $7.6 billion in funding.

The market composition remained largely dominated by indie or mid-size initiatives, with solely a small fraction (6%) securing larger AA and AAA funding ranges. However, Asia emerged as a distinguished hub for brand-spanking new recreation growth, with half of all new video games originating from the area.

In the meantime, blockchain video games accounted for the best share (34%) of dapps actions in 2023, attracting each day lively consumer base of 1.1 million.

WAX emerged as a standout gaming blockchain in 2023 drew in over 3 million new wallets and processed 4.7 billion gaming transactions, cementing its place as a key participant within the blockchain gaming area.

Moreover, in-game NFT markets witnessed vital exercise all year long. Notable platforms like Gods Unchained and Ethereum led the pack in buying and selling volumes, with Gods Unchained reaching an exceptional $209 million in buying and selling quantity and Ethereum sustaining its dominance with $347 million in in-game NFT trades.

Conclusion

Prioritize video games with established recognition and engaged communities, as they usually supply extra steady earnings potential.

Moreover, keep knowledgeable about market tendencies and monitor token and asset costs. Keep in mind to method P2E gaming as a long-term funding, exercising warning and diligence in your selections.

Disclosure: This text doesn’t characterize funding recommendations. The content material and supplies featured on this web page are for academic functions solely.