Amidst the rollercoaster of cryptocurrency costs, stablecoins promise stability. But, with various ranges of resilience and up to date depegging occasions inflicting concern, the query arises: Are all stablecoins actually that steady?

Within the ever-changing world of digital belongings, cryptocurrencies like Bitcoin (BTC) have been pioneering, bringing decentralization into the highlight. Nevertheless, the potential of those preliminary cryptocurrencies has usually been clouded by their stark volatility.

That is the place stablecoins are available. They purpose to bridge the hole by pegging their worth to extra steady belongings just like the U.S. greenback or gold, promising a mix of stability and reliability in a turbulent market.

Not all stablecoins are equally steady. Some are higher at dealing with the ups and downs of the crypto market, whereas others could be dangerous. Crypto.information talked to consultants to know how such crypto belongings behave and tips on how to put money into stablecoins extra successfully.

Stablecoin varieties and volatility developments

By analyzing the 4 major kinds of stablecoins, we are able to higher perceive their function and significance within the digital monetary panorama.

Fiat-backed stablecoins

Fiat-backed stablecoins, true to their title, have their worth tethered to conventional fiat currencies just like the US greenback, euro, or the yen.

The core attribute of fiat-backed stablecoins lies of their backing: for each coin issued, there may be an equal quantity of fiat foreign money held in reserve, purportedly cementing a basis of belief for his or her worth.

Whereas that is the declare laid out by their creators, it has often been met with scrutiny and requires extra clear regulatory oversight to make sure ongoing stability and belief in these digital belongings. Fashionable cash on this class are Tether (USDT), USD Coin (USDC), and Binance USD (BUSD).

Though designed to keep up a 1:1 peg with the fiat foreign money, they’ll typically expertise minor fluctuations as a consequence of market dynamics. Furthermore, geopolitical occasions or important coverage adjustments by governments can not directly affect their stability.

In totality, their volatility is significantly decrease than different stablecoin belongings however isn’t completely negligible.

Commodity-backed stablecoins

Commodity-backed stablecoins are primarily tied to the worth of tangible commodities, predominantly gold.

Commodities like gold have traditionally been steady, making these stablecoins a doubtlessly safer harbor throughout turbulent market situations.

These stablecoins can witness volatility correlating to the worth fluctuations within the commodity market. Elements corresponding to adjustments in financial situations, provide and demand shifts within the commodity markets, and geopolitical occasions can considerably affect their volatility.

Cash corresponding to Paxos Gold (PAXG) and Tether Gold (XAUT) present a chance to not directly put money into commodities, doubtlessly safeguarding buyers from the erratic nature of the crypto market to an extent.

Crypto-backed stablecoins

Crypto-backed stablecoins function with cryptocurrencies as their collateral. Cash like DAI or sUSD operate by way of good contracts primarily on platforms like Ethereum (ETH), using numerous cryptocurrencies to again their worth.

Nevertheless, since they’re backed by belongings with increased volatility (cryptocurrencies), their stability can typically be compromised, notably throughout a market downturn. Therefore, these stablecoins doubtlessly are extra risky in comparison with fiat and commodity-backed stablecoins.

Algorithmic stablecoins

Navigating into the futuristic sphere of stablecoins, algorithmic variants function with out tangible backing. They’re orchestrated by way of algorithms and good contracts that fine-tune the coin’s provide in accordance with the demand dynamics, carving a path of decentralization in its truest type.

These cash, although modern, are nonetheless of their experimental phases. Because the collapse of TerraUSD (UST) in Could 2022 showcased, they’re prone to excessive volatility, navigating by way of dramatic highs and lows based mostly on market reactions, making them a dangerous enterprise for many who should not attuned to excessive volatility in investments.

Therefore, they’re thought of to be the least steady among the many stablecoin classes as a result of experimental nature of their underlying expertise.

Stablecoins market shifts

Within the consistently altering world of cryptocurrency, the previous 12 months and a half noticed huge adjustments within the stablecoin space, with notable declines in market cap.

From March 2022 to September 2023, the stablecoin enviornment noticed a big shrinkage of about 22.8% in its whole market capitalization, plunging from a sturdy $162 billion to a extra restrained determine of roughly $125 billion.

The explanations for this decline is likely to be multifaceted. It might be influenced by a mix of regulatory crackdowns, financial fluctuations, or shifts in investor sentiment.

Particular person stablecoins mirrored this descending trajectory, albeit at completely different magnitudes. For example, USDC’s market cap took a big blow, witnessing a lower of 53.3% from June 2022 to September 2023. This decline noticed the cap shrinking from $56 billion to $26.13 billion.

BUSD, then again, confronted a fair steeper descent, plummeting by 87.2% inside lower than a 12 months. This precipitous fall, which introduced the cap down from $23.5 billion in November 2022 to only below $3 billion by September 2023, indicators a possible lack of investor confidence.

Opposite to the downward development evidenced by its counterparts, USDT managed to climate the storm, carving out a considerable area of interest for itself available in the market.

By September 2023, it constituted a dominant share of over 66% of the overall stablecoin market cap, a testomony to its perceived resilience amidst the broader market downturn.

The query that arises right here is why? One believable rationalization might be Tether’s established repute and widespread acceptance as a medium of change within the cryptocurrency market. Its perceived stability might need attracted buyers in search of refuge from the volatility engulfing different cryptocurrencies, thereby cementing its place as a steady funding haven throughout turbulent occasions.

Taking a look at these latest patterns, it appears that evidently the stablecoin market is changing into extra streamlined and mature. Traders are gravitating in direction of well-established and steady cash corresponding to USDT, avoiding others that seem like riskier.

These adjustments are pushed by a mix of regulatory updates, financial components, and shifts in investor sentiment, highlighting the necessity for ongoing cautious evaluation.

Depegging of stablecoins

In recent times, the cryptocurrency sector has undergone notable shifts regarding the stability of stablecoins, which promise a security internet amidst the extremely risky crypto market.

The standard viewpoint posited stablecoins like USDT and USDC as dependable, given their peg to established fiat currencies just like the US greenback. Nevertheless, latest occasions have showcased the vulnerability of this strategy.

On Aug. 7, Kaiko knowledge recorded a big de-pegging occasion with USDT, the place it skilled a 98% depeg severity, buying and selling at a notable low cost throughout numerous platforms.

Spurred by a speedy internet sale of USDT amounting to $500 million throughout important exchanges, this phenomenon didn’t garner substantial consideration as a consequence of its lesser magnitude than previous occasions.

Though recurrent USDT de-pegging will not be unusual, primarily attributed to components carried out by Tether Holdings, Kaiko warns that the continuation of such incidents would possibly progressively erode belief within the globally dominant stablecoin.

In the meantime, USDC’s dip following the Silicon Valley Financial institution crash has raised important doubts concerning the inherent stability of fiat-backed stablecoins.

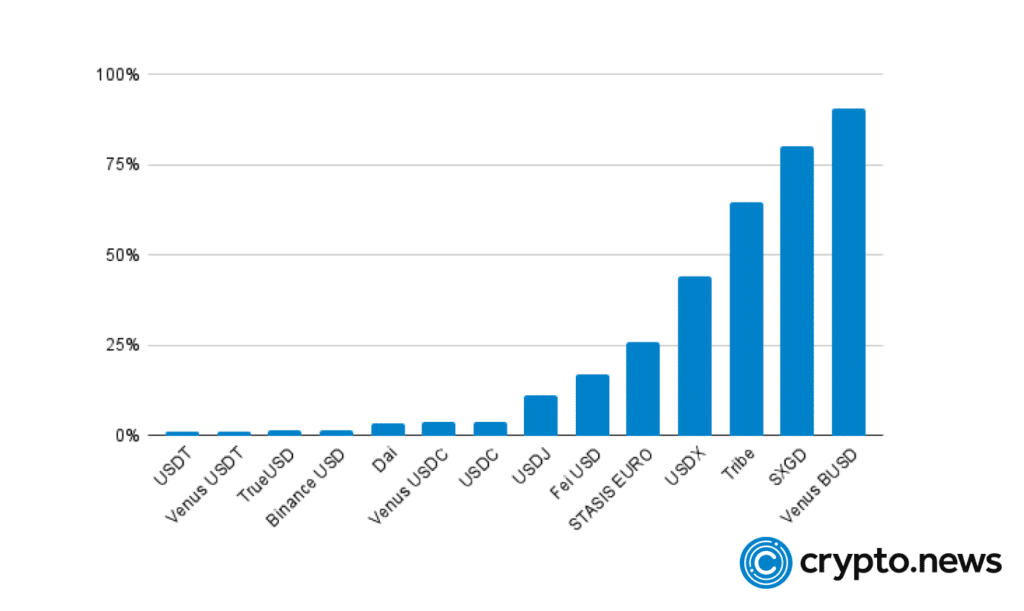

In a latest research commissioned by Coin Kickoff and produced by NeoMam Studios, the volatility rankings of assorted stablecoins have been assessed to current a transparent image for potential buyers.

At one finish of the spectrum, we’ve got USDT, showcasing a minimal annualized volatility of 0.88%, making it a significantly steady funding possibility.

Nevertheless, even essentially the most steady stablecoins can expertise intervals of fluctuation, as evidenced by Tether’s temporary deviation from its greenback peg in August 2023.

On the different finish of the spectrum lies Venus BUSD, with a placing annualized volatility of 90.7%, surpassing even Bitcoin’s 61.1% volatility price.

This state of affairs illuminates that not all stablecoins provide the identical stability, urging buyers to tread fastidiously and make well-informed selections.

Can metal-backed stablecoins be an answer?

The uncertainty surrounding conventional stablecoin has elevated curiosity in exploring different extra tangible choices for stablecoin backing. One such strategy that’s gaining traction is linking the worth of stablecoins to treasured metals corresponding to gold and silver.

Finance Professor Alam Asadov from Prince Sultan College and Dr. Ramazan Yildirim from Upsite Consulting instructed Crypto.information that sure stablecoins don’t keep 100% fiat backing, which will increase the danger of instability and vulnerability to inflation. Their analysis paper printed in Borsa Istanbul Evaluate suggests {that a} mixture of gold and silver, in a ratio of 88:12, can type the spine of a extra resilient and steady foreign money system.

The thought is that these metals have traditionally demonstrated a gradual improve in worth and safety in opposition to the diminishing price of normal currencies as a consequence of components like inflation and financial downturns. They additional talked about that “the worth of gold elevated by over 47 occasions in opposition to the US greenback in actual phrases from April 1968 to December 2022”, indicating a big resistance to inflation over the long run, mitigating financial institution default threat and inflation vulnerability.

Nevertheless, transitioning to a metal-backed stablecoin system is extra difficult. There are important questions to handle, together with devising protected storage options for these metals and creating mechanisms to confirm their authenticity. The consultants additional highlighted that “respected gold-backed stablecoins usually have licensed and audited reserves which are 100% equal to the cryptocurrency’s whole worth”, and these reserves are saved in safe vaults, considerably lowering the chance of default.

Nevertheless, implementing clear laws is crucial to keep away from potential misuse and foster system transparency. Thus, detailed planning and sturdy regulatory frameworks are indispensable earlier than this idea turns into a actuality, providing a promising different for these involved with the vulnerabilities of fiat-backed choices.

Navigating stablecoin investments

Investing in stablecoins comes with its personal set of execs and cons. They’re typically much less risky than conventional cryptocurrencies, making them a sensible choice for many who choose stability. Additionally they provide numerous makes use of, from shopping for items to incomes curiosity on sure platforms.

Nevertheless, this stability usually interprets to decrease returns. Whereas some buyers attempt to enhance returns by way of yield farming—incomes rewards or curiosity through the use of stablecoins—it additionally comes with added dangers corresponding to market volatility or good contract vulnerabilities.

Safety is one other concern. Stablecoins aren’t federally insured, so if the issuing firm faces issues, you might lose your funding. Asadov and Yildrim underscore the significance of conducting thorough due diligence earlier than getting into the stablecoin market.

They counsel understanding the kind of stablecoin you’re coping with, verifying the backing of the coin, and avoiding belongings that may’t produce credible proof of being 100% backed, that are methods that may “higher handle dangers and make knowledgeable selections within the risky stablecoin market.”

In abstract, stablecoins provide a mixture of stability and utility however include decrease return potential and particular dangers. A well-researched and balanced funding technique, fortified with insights from market analysts, will help you navigate these waters extra successfully.