The next is an essay initially revealed on Unchained.com by Dhruv Bansal, CSO and Co-founder of Unchained, the Official US Collaborative Custody Companion of Bitcoin Journal. For extra data on providers provided, custody merchandise, and the connection between Unchained and Bitcoin Journal, please go to our web site.

Click on right here to obtain a PDF of this 7,000 phrase essay on the origins of Bitcoin.

Bitcoin is commonly in comparison with the web within the Nineteen Nineties, however I imagine the higher analogy is to the telegraph within the 1840s.[1]

The telegraph was the primary know-how to transmit encoded information at near-light velocity over lengthy distances. It marked the start of the telecommunications trade. The web, although it’s larger in scale, richer in content material, and manyto-many as a substitute of one-to-one, is basically nonetheless a telecommunications know-how.

Each the telegraph and the web rely on enterprise fashions through which firms deploy capital to construct a bodily community after which cost customers to ship messages by this community. AT&T’s community has traditionally transmitted telegrams, phone calls, TCP/IP packets, textual content messages, and now TikToks.

The transformation of society by telecom has led to higher freedoms but in addition higher centralization. The web has elevated the attain of tens of millions of content material creators and small companies, however has additionally strengthened the grasp of firms, governments and different establishments well-positioned sufficient to watch and manipulate on-line exercise.

However bitcoin is just not the top of any transformation— it’s the start of 1. Like telecommunications, bitcoin will change each human society and day by day life. Predicting the complete scope of this alteration right now is akin to imagining the web whereas residing within the period of the telegraph.

This sequence makes an attempt to think about this future by beginning with the previous. This preliminary article traces the historical past of digital currencies earlier than bitcoin. Solely by understanding the place prior tasks fell quick can we understand what makes bitcoin succeed—and the way it suggests a strategy for constructing the decentralized programs of the long run.

Define

I. Decentralized programs are markets

II. Decentralized markets require decentralized items

III. How can decentralized programs worth computations?

IV. Satoshi’s financial coverage targets led to bitcoin

V. Conclusion

How did Satoshi consider bitcoin?

Satoshi was sensible, however bitcoin didn’t come out of nowhere.

Bitcoin iterated on current work in cryptography, distributed programs, economics, and political philosophy. The idea of proof-of-work existed lengthy earlier than its use in cash and prior cypherpunks equivalent to Nick Szabo, Wei Dai, & Hal Finney anticipated and influenced the design of bitcoin with tasks equivalent to bit gold, b-money, and RPOW. Contemplate that, by 2008, when Satoshi wrote the bitcoin white paper,[2] most of the concepts essential to bitcoin had already been proposed and/or carried out:

- Digital currencies ought to be P2P networks

- Proof-of-work is the idea of cash creation

- Cash is created by an public sale

- Public key cryptography is used to outline possession & switch of cash

- Transactions are batched into blocks

- Blocks are chained collectively by proof-of-work

- All blocks are saved by all members

Bitcoin leverages all these ideas, however Satoshi didn’t originate any of them. To raised perceive Satoshi’s contribution, we must always decide which ideas of bitcoin are lacking from the checklist.

Some apparent candidates are the finite provide of bitcoin, Nakamoto consensus, and the problem adjustment algorithm. However what led Satoshi to those concepts within the first place?

This text explores the historical past of digital currencies and makes the case that Satoshi’s deal with sound financial coverage is what led bitcoin to surmount challenges that defeated prior tasks equivalent to bit gold and b-money.

I. Decentralized programs are markets

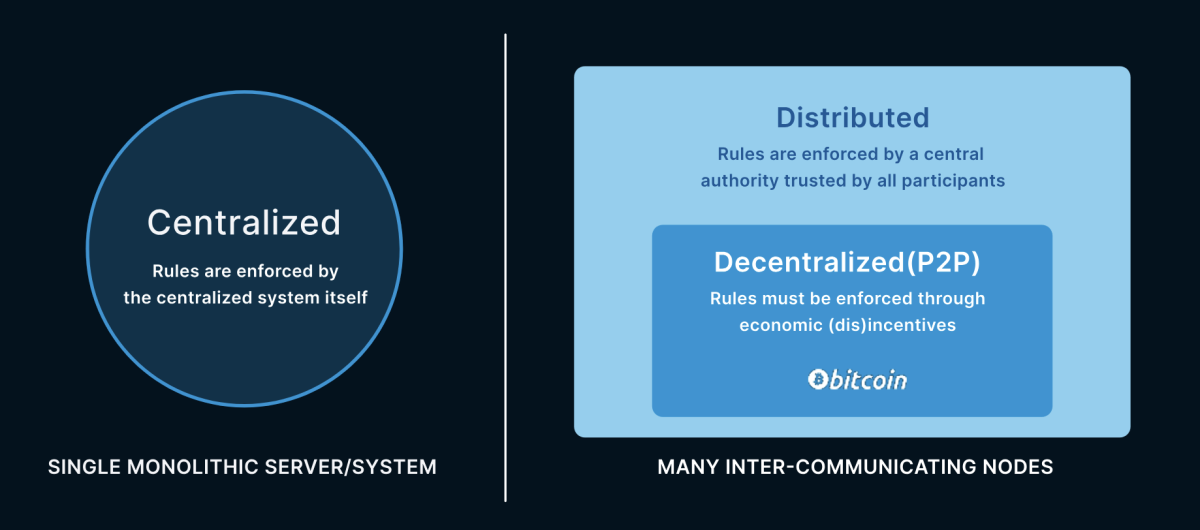

Bitcoin is commonly described as a decentralized or distributed system. Sadly, the phrases “decentralized” and “distributed” are continuously confused. When utilized to digital programs, each phrases check with methods a monolithic software may be decomposed right into a community of speaking items.

For our functions, the main distinction between decentralized and distributed programs is just not the topology of their community diagrams, however the way in which they implement guidelines. We take a while within the following part to check distributed and decentralized programs and encourage the concept that sturdy decentralized programs are markets.

Distributed programs rely on central authorities

On this work, we take “distributed” to imply any system that has been damaged up into many elements (sometimes called “nodes”) which should talk, sometimes over a community.

Software program engineers have grown adept at constructing globally distributed programs. The web consists of distributed programs collectively containing billions of nodes. We every have a node in our pocket that each participates in and depends upon these programs.

However nearly all of the distributed programs we use right now are ruled by some central authority, sometimes a system administrator, firm, or authorities that’s mutually trusted by all nodes within the system.

Central authorities guarantee all nodes adhere to the system s guidelines and take away, restore, or punish nodes that fail to take action. They’re trusted to offer coordination, resolve conflicts, and allocate shared assets. Over time, central authorities handle adjustments to the system, upgrading it or including options, and making certain that taking part nodes adjust to the adjustments.

The advantages a distributed system beneficial properties from relying upon a government include prices. Whereas the system is strong in opposition to failures of its nodes, a failure of its central authority might trigger it to cease functioning general. The power for the central authority to unilaterally make selections signifies that subverting or eliminating the central authority is adequate to manage or destroy all the system.

Regardless of these trade-offs, if there’s a requirement {that a} single celebration or coalition should retain central authority, or if the members inside the system are content material with relying upon a government, then a conventional distributed system is the perfect resolution. No blockchain, token, or comparable decentralized dressing is required.

Specifically, the case of a VC- or government-backed cryptocurrency, with necessities {that a} single celebration can monitor or prohibit funds and freeze accounts, is the proper use case for a conventional distributed system.

Decentralized programs don’t have any central authorities

We take “decentralized” to have a stronger which means than “distributed”: decentralized programs are a subset of distributed programs that lack any central authority. An in depth synonym for “decentralized” is “peer-to-peer” (P2P).

Eradicating central authority confers a number of benefits. Decentralized programs:

- Develop rapidly as a result of they lack boundaries to entry—anybody can develop the system by merely operating a brand new node, and there’s no requirement for registration or approval from the central authority.

- Are sturdy as a result of there is no such thing as a central authority whose failure can compromise the functioning of the system. All nodes are the identical, so failures are native and the community routes round injury.

- Are troublesome to seize, regulate, tax, or surveil as a result of they lack centralized factors of management for governments to subvert.

These strengths are why Satoshi selected a decentralized, peer-to-peer design for bitcoin:

“Governments are good at reducing off the heads of… centrally managed networks like Napster, however pure P2P networks like Gnutella and Tor appear to be holding their very own.” – Nakamoto, 2008

However these strengths include corresponding weaknesses. Decentralized programs may be much less environment friendly as every node should moreover bear duties for coordination beforehand assumed by the central authority.

Decentralized programs are additionally stricken by scammy, adversarial habits. Regardless of Satoshi’s nod to Gnutella, anybody who’s used a P2P file sharing program to obtain a file that turned out to be one thing gross or malicious understands the explanations that P2P file sharing by no means turned the mainstream mannequin for information switch on-line.

Satoshi didn’t title it explicitly, however electronic mail is one other decentralized system that has evaded authorities controls. And electronic mail is equally infamous for spam.

Decentralized programs are ruled by incentives

The basis drawback, in all of those instances, is that adversarial habits (seeding dangerous information, sending spam emails) is just not punished, and cooperative habits (seeding good information, solely sending helpful emails) is just not rewarded. Decentralized programs that rely on their members to be good actors fail to scale as a result of they can not forestall dangerous actors from additionally taking part.

With out imposing a government, the one method to clear up this drawback is to make use of financial incentives. Good actors, by definition, play by the foundations as a result of they’re inherently motivated to take action. Dangerous actors are, by definition, egocentric and adversarial, however correct financial incentives can redirect their dangerous habits in direction of the frequent good. Decentralized programs that scale achieve this by making certain that cooperative habits is worthwhile and adversarial habits is dear.

The easiest way to implement sturdy decentralized providers is to create markets the place all actors, each good and dangerous, are paid to offer that service. The dearth of boundaries to entry for patrons and sellers in a decentralized market encourages scale and effectivity. If the market’s protocols can defend members from fraud, theft, and abuse, then dangerous actors will discover it extra worthwhile to both play by the foundations or go assault a distinct system.

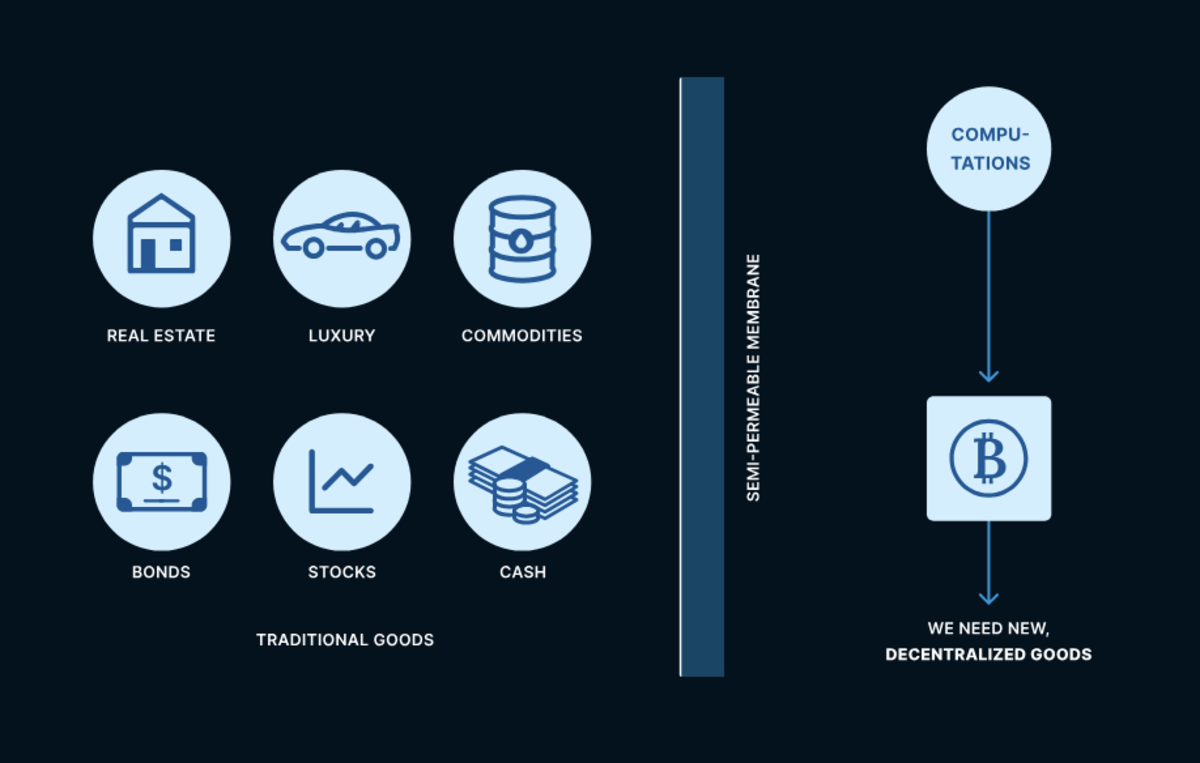

II. Decentralized markets require decentralized items

However markets are complicated. They need to present patrons and sellers the flexibility to submit bids & asks in addition to uncover, match and settle orders. They should be truthful, present robust consistency, and keep availability regardless of durations of volatility.

International markets right now are extraordinarily succesful and complicated, however utilizing conventional items and cost networks to implement incentives in a decentralized market is a nonstarter. Any coupling between a decentralized system and fiat cash, conventional belongings, or bodily commodities would reintroduce dependencies on the central authorities that management cost processors, banks, & exchanges.

Because of this decentralized programs can not execute funds denominated in any conventional good. They can’t even decide the balances of fiat-dominated accounts or the possession of actual property or bodily items. Your complete conventional financial system is totally illegible from inside decentralized programs.

Creating decentralized markets requires buying and selling new sorts of decentralized items that are legible and transferable inside decentralized programs.

Computation is the primary decentralized good

The primary instance of a “decentralized good” is a particular class of computations first proposed in 1993 by Cynthia Dwork and Moni Naor.[3]

Due to deep connections between arithmetic, physics, and laptop science, these computations price real-world vitality and {hardware} assets—they can’t be faked. Since real-world assets are scarce, these computations are additionally scarce.

The enter for these computations may be any sort of information. The ensuing output is a digital “proof” that the computations had been carried out on the given enter information. Proofs comprise a given “problem” which is (statistical) proof of a given quantity of computational work. Most significantly, the connection between the enter information, the proof, and the unique computational work carried out may be independently verified with out enchantment to any central authority.

The thought of passing round some enter information together with a digital proof as proof of real-world computational work carried out on that enter is now known as “proof-of-work”.[4] Proofs-of-work are, to make use of Nick Szabo’s phrase, “unforgeable costliness”. As a result of proofs-of-work are verifiable by anybody, they’re financial assets which can be legible to all members in a decentralized system. Proofs-of-work flip computations on information into decentralized items. Dwork & Naor proposed utilizing computations to restrict the abuse of a shared useful resource by forcing members to offer proofsof-work with a sure minimal problem earlier than they will entry the useful resource:

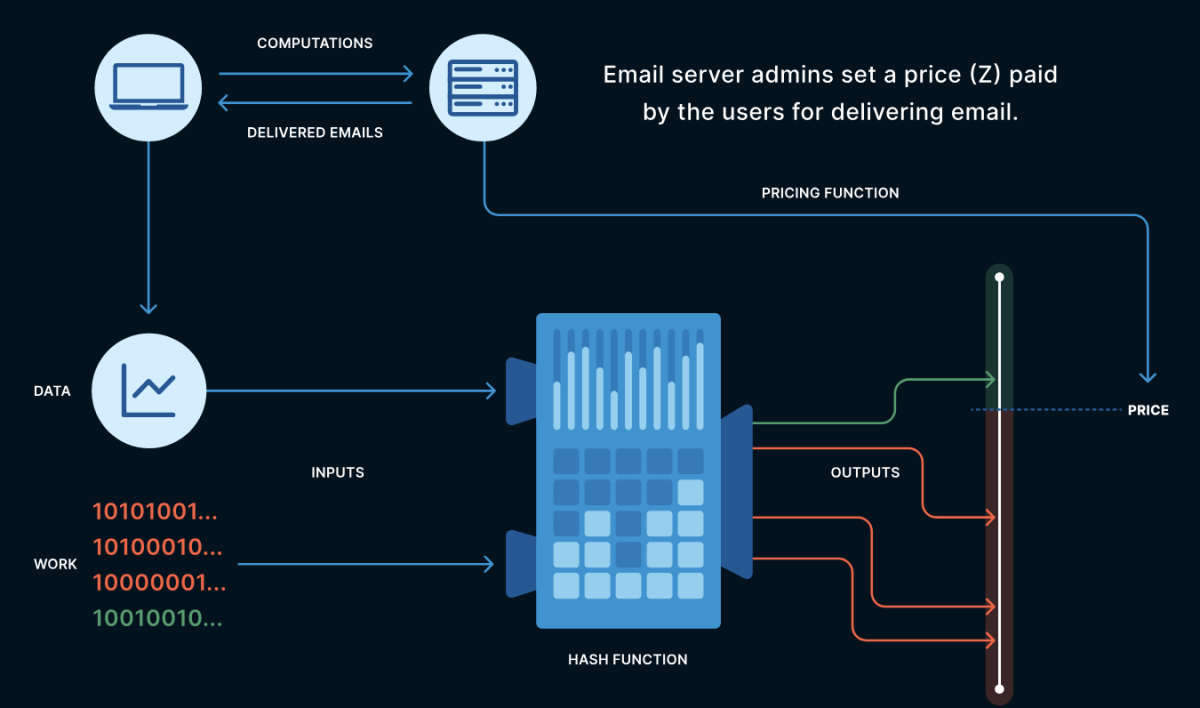

“On this paper we recommend a computational strategy to combatting the proliferation of email correspondence. Extra usually, we’ve designed an entry management mechanism that can be utilized each time it’s fascinating to restrain, however not prohibit, entry to a useful resource.” – Dwoak & Naor, 1993

In Dwork & Naor’s proposal, an electronic mail system administrator would set a minimal proof-of-work problem for delivering electronic mail. Customers eager to ship electronic mail would wish to carry out a corresponding variety of computations with that electronic mail because the enter information. The ensuing proof could be submitted to the server alongside any request to ship the e-mail.

Dwork & Naor referred to the problem of a proofof-work as a “pricing operate” as a result of, by adjusting the problem, a “pricing authority” may make sure that the shared useful resource remained low-cost to make use of for trustworthy, common customers however costly for customers searching for to use it. Within the electronic mail supply market, server directors are the pricing authorities; they need to select a “worth” for electronic mail supply which is low sufficient for regular utilization however too excessive for spam.

Although Dwork & Naor framed proofs-of-work as an financial disincentive to fight useful resource abuse, the nomenclature “pricing operate” and “pricing authority” helps a distinct, marketbased interpretation: customers are buying entry to a useful resource in trade for computations at a worth set by the useful resource’s controller.

On this interpretation, an electronic mail supply community is known as a decentralized market buying and selling electronic mail supply for computations. The minimal problem of a proof-of-work is the asking worth for electronic mail supply denominated within the foreign money of computations.

Foreign money is the second decentralized good

However computations aren’t a very good foreign money.

The proofs used to “commerce” computations are solely legitimate for the enter utilized in these computations. This unbreakable lilnk between a particular proof and a particular enter signifies that the proof-of-work for one enter can’t be reused for a distinct enter.

This constraint is beneficial – it may be used to stop the work achieved by one purchaser available in the market from being re-spent by one other. For instance, HashCash, the primary actual implementation of the marketplace for electronic mail supply, included metadata equivalent to the present timestamp and the sender’s electronic mail tackle within the enter information to its proof-of-work computations. Proofs produced by a given consumer for a given electronic mail can’t be respent for sending a distinct electronic mail.

However this additionally signifies that proof-of-work computations are bespoke items. They aren’t fungible, they will’t be re-spent,[5] and so they don’t clear up the coincidence-of-wants drawback. These lacking financial properties forestall computations from being foreign money. Regardless of the title, there is no such thing as a incentive for an electronic mail supply supplier to wish to accumulate HashCash, as there could be for precise money.

Adam Again, inventor of HashCash, understood these issues:

“hashcash is just not immediately transferable as a result of to make it distributed, every service supplier accepts cost solely in money created for them. You possibly can maybe setup a digicash model mint (with chaumian ecash) and have the financial institution solely mint money on receipt of hash collisions addressed to it. Nonetheless this implies you have to belief the financial institution to not mint limitless quantities of cash for it is personal use.” – Adam Again, 1997

We don’t wish to trade bespoke computations for each particular person good or service offered in a decentralized financial system. We would like a basic function digital foreign money that may immediately be used to coordinate exchanges of worth in any market.

Constructing a functioning digital foreign money whereas remaining decentralized is a big problem. A foreign money requires fungible items of equal worth that may be transferred amongst customers. This requires issuance fashions, cryptographic definitions of possession and switch, a discovery and settlement course of for transactions, and a historic ledger. None of this infrastructure is required when proof-of-work is considered a mere “entry management mechanism”.

Furthermore, decentralized programs are markets, so all these primary capabilities of a foreign money should someway be supplied by paying service suppliers…within the items of the foreign money that’s being created!

Like compiling the primary compiler, a black begin of {the electrical} grid, or the evolution of life itself, the creators of digital currencies had been confronted with a bootstrapping drawback: how you can outline the financial incentives that underlie a functioning foreign money with out having a functioning foreign money through which to denominate or pay these incentives.

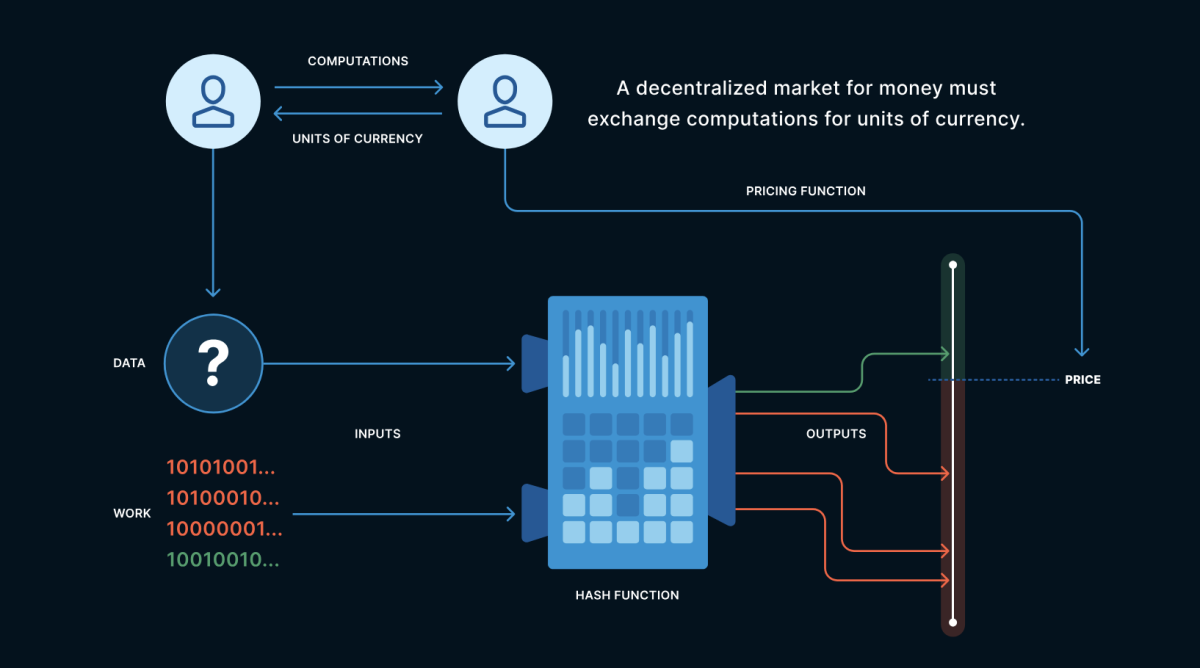

The primary decentralized market should commerce computations for foreign money

Progress on this bootstrapping drawback comes from correctly framing its constraints.

Decentralized programs should be markets. Markets include patrons and sellers exchanging items. The decentralized marketplace for a digital foreign money solely has two items which can be legible inside it:

- Computations by proof-of-work

- Models of the foreign money we’re attempting to construct

The one market commerce attainable should due to this fact be between these two items. Computations should be offered for items of foreign money orF equivalentlyF items of foreign money should be offered for computations. Stating that is simple—the exhausting half is structuring this market in order that merely exchanging foreign money for computation bootstraps all of the capabilities of the foreign money itself!

Your complete historical past of digital currencies culminating in Satoshi’s 2008 white paperF was a sequence of more and more subtle makes an attempt at structuring this market. The next part opinions tasks equivalent to Nick Szabo’s bit gold and Wei Dai’s b-money. Understanding how these tasks structured their marketsF and why they failed will assist us body why Satoshi and bitcoin succeeded.

III. How can decentralized programs worth computations?

A serious operate of markets is worth discovery. A market buying and selling computations for foreign money should due to this fact uncover the worth of computation itself, as denominated in items of that foreign money.

We don’t sometimes assign financial worth to computations. We sometimes worth the capability to carry out computations as a result of we worth the output of computations, not the computations themselves. If the identical output may be carried out extra effectively, with fewer computations, that’s normally known as “progress”.

Proofs-of-work symbolize particular computations whose solely output is proof that they had been carried out. Producing the identical proof by performing fewer computations and fewer work wouldn’t be progress—it will be a bug. The computations related to proofs-of-work are thus an odd and novel good to aim to worth.

When proofs-of-work are regarded as disincentives in opposition to useful resource abuse, it isn’t essential to worth them exactly or constantly. All that issues is that the e-mail service supplier units difficulties low sufficient to be unnoticeable for legit customers but excessive sufficient to be prohibitive for spammers. There’s thus a broad vary of acceptable “costs” and every participant acts as their very own pricing authority, making use of an area pricing operate.

However items of a foreign money are supposed to be fungible, every having the identical worth. Resulting from adjustments in know-how over time, two items of foreign money created with the identical proof-of-work problem— as measured by the variety of corresponding computations—might have radically totally different realworld prices of manufacturing, as measured by the point, vitality, and/or capital to carry out these computations . When computations are offered for foreign money, and the underlying price of manufacturing is variable, how can the market guarantee a constant worth?

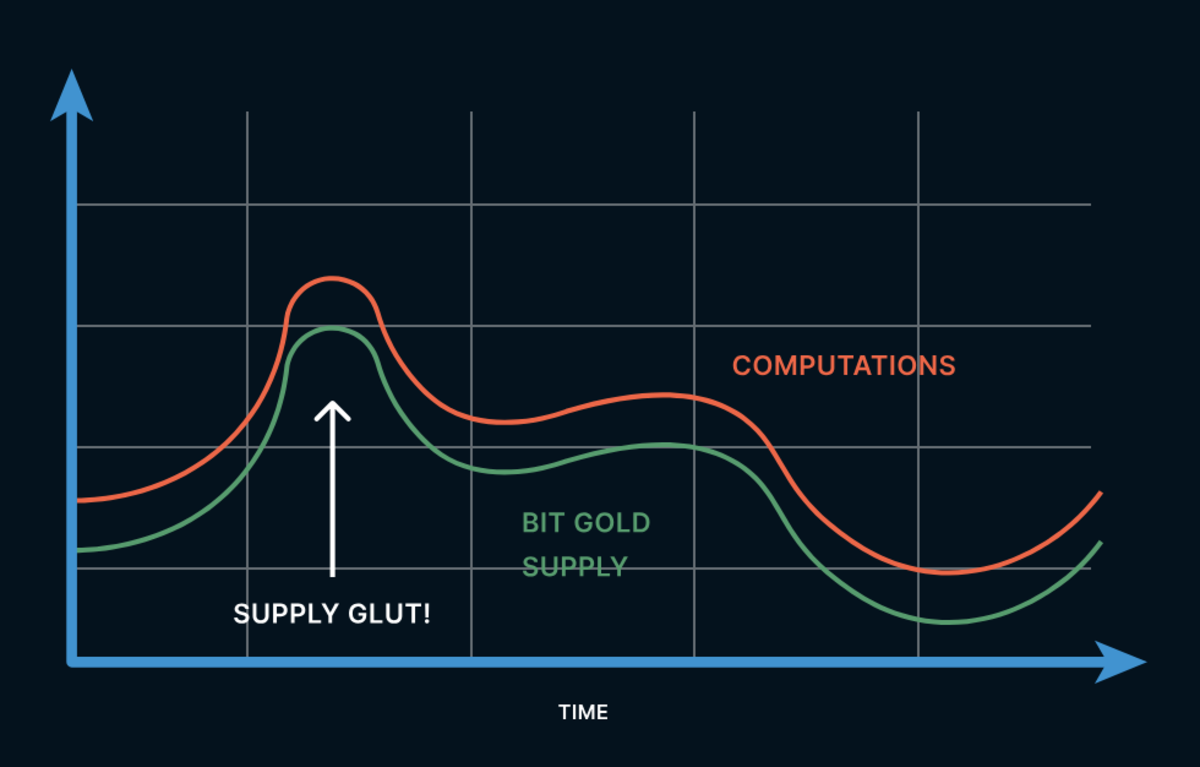

Nick Szabo clearly recognized this pricing drawback when describing bit gold:

“The primary drawback…is that proof of labor schemes rely on laptop structure, not simply an summary arithmetic primarily based on an summary “compute cycle.” …Thus, it is perhaps attainable to be a really low price producer (by a number of orders of magnitude) and swamp the market with bit gold.” – Szabo, 2005

Early digital currencies tried to cost computations by trying to collectively measure the “price of computing”. Wei Dai, for instance, proposes the next hand-wavy resolution in b-money:

‘The variety of financial items created is the same as the price of the computing effort by way of an ordinary basket of commodities. For instance if an issue takes 100 hours to resolve on the pc that solves it most economically, and it takes 3 normal baskets to buy 100 hours of computing time on that laptop on the open market, then upon the published of the answer to that drawback everybody credit the broadcaster’s account by 3 items.” – Dai, 1998

Sadly, Dai doesn’t clarify how customers in a supposedly decentralized system are presupposed to agree upon the definition of a “normal basket”, which pc solves a given drawback “most economically”, or the price of computation on the “open market”. Attaining consensus amongst all customers a few time-varying shared dataset is the important drawback of decentralized programs!

To be truthful to Dai, he realized this:

“One of many extra problematic elements within the b-money protocol is cash creation. This a part of the protocol requires that every one [users] determine and agree on the price of specific computations. Sadly as a result of computing know-how tends to advance quickly and never all the time publicly, this data could also be unavailable, inaccurate, or outdated, all of which might trigger critical issues for the protocol.” – Dai, 1998

Dai would go on to suggest a extra subtle auction-based pricing mechanism which Satoshi would later say was the place to begin for his concepts. We are going to return to this public sale scheme beneath, however first let’s flip to bit gold, and contemplate Szabo’s insights into the issue.

Use exterior markets

Szabo claims that proofs-of-work ought to be “securely timestamped”:

“The proof of labor is securely timestamped. This could work in a distributed vogue, with a number of totally different timestamp providers in order that no specific timestamp service want be considerably relied on.” – Szabo, 2005

Szabo hyperlinks to a web page of assets on safe timestamping protocols however doesn’t describe any particular algorithm for safe timestamping. The phrases “securely” and “distributed vogue” are carrying numerous weight right here, hand-waving by the complexities of relying upon one (or many) “exterior the system” providers for timestamping.[6]

No matter implementation fuzziness, Szabo was proper—the time a proof-of-work was created is a vital think about pricing it as a result of it’s associated to the price of computation:

“…Nonetheless, since bit gold is timestamped, the time created in addition to the mathematical problem of the work may be routinely confirmed. From this, it may well normally be inferred what the price of producing throughout that point interval was…” – Szabo, 2005

“Inferring” the price of manufacturing is essential as a result of bit gold has no mechanism to restrict the creation of cash. Anybody can create bit gold by performing the suitable computations. With out the flexibility to control issuance, bit gold is akin to a collectible:

“…Not like fungible atoms of gold, however as with collector s objects, a big provide throughout a given time interval will drive down the worth of these specific objects. On this respect bit gold acts extra like collector s objects than like gold…” – Szabo, 2005

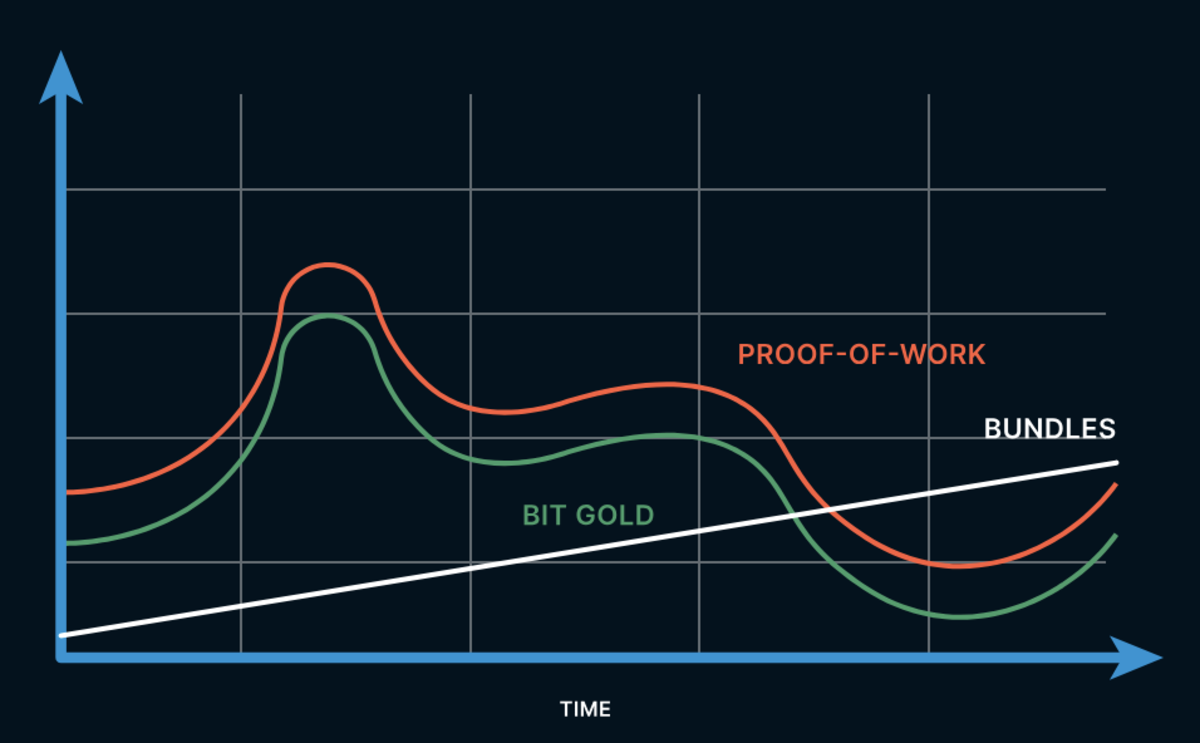

Bit gold requires an extra, exterior course of to create fungible items of foreign money:

“…[B]it gold is not going to be fungible primarily based on a easy operate of, for instance, the size of the string. As an alternative, to create fungible items sellers must mix different-valued items of bit gold into bigger items of roughly equal worth. That is analogous to what many commodity sellers do right now to make commodity markets attainable. Belief continues to be distributed as a result of the estimated values of such bundles may be independently verified by many different events in a largely or fully automated vogue.” – Szabo, 2005

To paraphrase Szabo, “to assay the worth of… bit gold, a supplier checks and verifies the problem, the enter, and the timestamp”. The sellers defining “bigger items of roughly equal worth” are offering an identical pricing operate as Dai’s “normal basket of commodities”. Fungible items will not be created in bit gold when proofs-ofwork are produced, solely later when these proofs are mixed into bigger “items of roughly equal worth” by sellers in markets exterior the community.

To his credit score, Szabo acknowledges this flaw:

“…The potential for initially hidden provide gluts attributable to hidden improvements in machine structure is a possible flaw in bit gold, or at the very least an imperfection which the preliminary auctions and ex submit exchanges of bit gold must tackle.” – Szabo, 2005

Once more, regardless of not having arrived at (what we now know as) the answer, Szabo was pointing us at it: as a result of the price of computation adjustments over time, the community should reply to adjustments within the provide of computation by adjusting the worth of cash.

Use inner markets

Szabo’s sellers would have been an exterior market that outlined the worth of (bundles of) bit gold after its creation. Is it attainable to implement this market inside the system as a substitute of out of doors it?

Let’s return to Wei Dai and b-money. As talked about earlier, Dai proposed an alternate auction-based mannequin for the creation of bmoney. Satoshi’s design for bitcoin improves immediately on bmoney’s public sale mannequin[7]:

“So I suggest an alternate cash creation subprotocol, through which [users]… as a substitute determine and agree on the quantity of b-money to be created every interval, with the price of creating that cash decided by an public sale. Every cash creation interval is split up into 4 phases, as follows:

Planning. The [users] compute and negotiate with one another to find out an optimum improve within the cash provide for the subsequent interval. Whether or not or not the [network] can attain a consensus, they every broadcast their cash creation quota and any macroeconomic calculations achieved to help the figures.

Bidding. Anybody who desires to create b-money broadcasts a bid within the type of the place x is the quantity of b-money he desires to create, and y is an unsolved drawback from a predetermined drawback class. Every drawback on this class ought to have a nominal price (in MIPS-years say) which is publicly agreed on.

Computation. After seeing the bids, those who positioned bids within the bidding section might now clear up the issues of their bids and broadcast the options. Cash creation.

Cash creation. Every [user] accepts the very best bids (amongst those that truly broadcasted options) by way of nominal price per unit of bmoney created and credit the bidders accounts accordingly.” Dai, 1998

B-money makes important strides in direction of the right market construction for a digital foreign money. It makes an attempt to eradicate Szabo’s exterior sellers and permit customers to have interaction in worth discovery by immediately bidding in opposition to one another.

However implementing Dai’s proposal as written could be difficult:

- Within the “Planning” section, customers bear the burden of negotiating the “optimum improve within the cash provide for the subsequent interval”. How “optimum” ought to be outlined, how customers ought to negotiate with one another, and the way the outcomes of such negotiations are shared is just not described.

- No matter what was deliberate, the “Bidding” section permits anybody to submit a “bid” to create b-money. The bids embrace each an quantity of b-money to be created in addition to a corresponding quantity of proofof-work so every bid is a worth, the variety of computations for which a given bidder is prepared to carry out with the intention to purchase a given quantity of b-money.

- As soon as bids are submitted, the “computation” section consists of bidders performing the proof-of-work they bid and broadcasting options. No mechanisms for matching bidders to options is supplied. Extra problematically, it’s not clear how customers ought to know that every one bids have been submitted – when does the “Bidding” section finish and the “computation” section start?

- These issues recur within the “Cash ]reation” section. Due to the character of proof-of-work, customers can confirm the proofs they obtain in options are actual. However how can customers collectively agree on the set of “highest bids”? What if totally different customers decide totally different such units, both attributable to desire or community latency?

Decentralized programs wrestle to trace information and make decisions constantly, but b-money requires monitoring bids from many customers and making consensus decisions amongst them. This complexity prevented b-money from ever being carried out.

The basis of this complexity is Dai’s perception that the “optimum” price at which b-money is created ought to fluctuate over time primarily based on the “macroeconomic calculations” of its customers. Like bit gold, b-money has no mechanism to restrict the creation of cash. Anybody can create items of b-money by broadcasting a bid after which doing the corresponding proof-of-work.

Each Szabo and Dai proposed utilizing a market exchanging digital foreign money for computations but neither bit gold nor b-money outlined a financial coverage to control the provision of foreign money inside this market.

IV. Satoshi’s financial coverage targets led to bitcoin

In distinction, a sound financial coverage was one in all Satoshi’s main targets for the bitcoin mission. Within the very first mailing checklist submit the place bitcoin was introduced, Satoshi wrote:

“The basis drawback with typical foreign money is all of the belief that is required to make it work. The central financial institution should be trusted to not debase the foreign money, however the historical past of fiat currencies is stuffed with breaches of that belief.” – Satoshi, 2009

Satoshi would go on to explain different issues with fiat currencies equivalent to dangerous fractional reserve banking, a scarcity of privateness, rampant theft & fraud, and the shortcoming to make micropayments. However Satoshi began with the problem of debasement by central banks—with a priority about financial coverage.

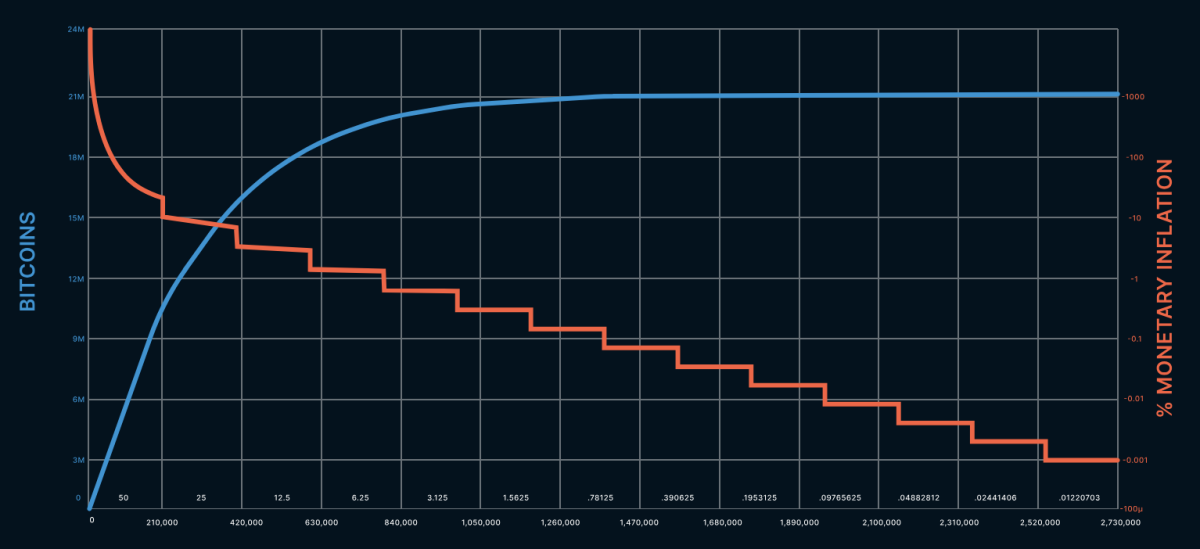

Satoshi wished bitcoin to in the end attain a finite circulating provide that can not be diluted over time. The “optimum” price of bitcoin creation, for Satoshi, ought to thus ultimately be zero.

This financial coverage purpose, greater than some other attribute they personally (or collectively!) possessed, was the rationale Satoshi “found” bitcoin, the blockchain, Nakamoto consensus, and so on. —and never another person. It’s the quick reply to the query posed within the title of this text: Satoshi considered bitcoin as a result of they had been centered on making a digital foreign money with a finite provide.

A finite provide of bitcoin is just not solely a financial coverage purpose or a meme for bitcoiners to rally round. It’s the important technical simplification that allowed Satoshi to construct a useful digital foreign money whereas Dai’s b-money remained simply an enchanting internet submit.

Bitcoin is b-money with an extra requirement of a predetermined financial coverage. Like many technical simplifications, constraining financial coverage permits progress by decreasing scope. Let’s see how every of the phases of b-money creation is simplified by imposing this constraint.

All 21M bitcoin exist already

In b-money, every “cash creation interval” included a “Planning” section, through which customers had been anticipated to share their “macroeconomic calculations” justifying the quantity of b-money they wished to create at the moment. Satoshi’s financial coverage targets of a finite provide and nil tail emission had been incompatible with the liberty granted by b-money to particular person customers to create cash. Step one on the journey from bmoney to bitcoin was due to this fact to eradicate this freedom. Particular person bitcoin customers can not create bitcoin. Solely the bitcoin community can create bitcoin, and it did so precisely as soon as, in 2009 when Satoshi launched the bitcoin mission.

Satoshi was capable of substitute the recurring “Planning” phases of b-money right into a single, predetermined schedule on which the 21M bitcoin created in 2009 could be launched into circulation. Customers voluntarily endorse Satoshi’s financial coverage by downloading and operating the Bitcoin Core software program through which this financial coverage is hard-coded.

This adjustments the semantics of bitcoin’s marketplace for computations. The bitcoin being paid to miners is just not newly issued; it’s newly launched into circulation from an current provide.

This framing is crucially totally different from the naive declare that “bitcoin miners create bitcoin”. Bitcoin miners will not be creating bitcoin, they’re shopping for it. Bitcoin isn’t precious as a result of “bitcoin are made out of vitality”—bitcoin’s worth is demonstrated by being offered for vitality.

Let’s repeat it another time: bitcoin isn’t created by proof-of-work, bitcoin is created by consensus.

Bitcoin is priced by consensus

This freedom granted to customers to create cash leads to a corresponding burden for the bmoney community. Through the “Bidding” section the b-money community should gather and share cash creation “bids” from many various customers.

Eliminating the liberty to create cash relieves the bitcoin community of this burden. Since all 21M bitcoin exist already, the community doesn’t want to gather bids from customers to create cash, it merely has to promote bitcoin on Satoshi’s predetermined schedule.

The bitcoin community thus gives a consensus asking worth for the bitcoin it’s promoting in every block. This single worth is calculated by every node independently utilizing its copy of the blockchain. If nodes have consensus on the identical blockchain (a degree we are going to return to later) they’ll all supply an equivalent asking worth at every block.[8]

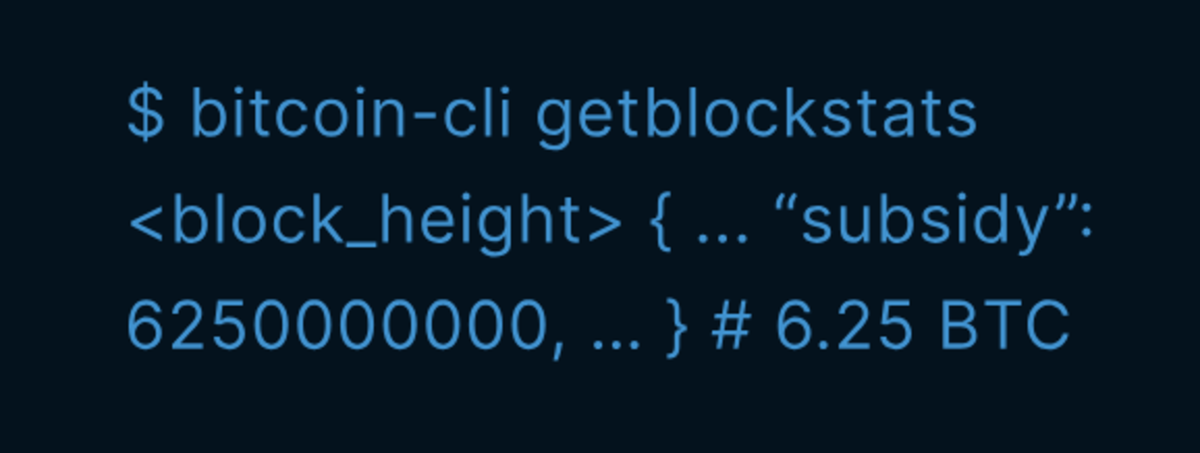

The primary half of the consensus worth calculation determines what number of bitcoin to promote. That is fastened by Satoshi’s predetermined launch schedule. All bitcoin nodes within the community calculate the identical quantity for a given block:

The second half of the consensus asking worth is the variety of computations the present subsidy is being offered for. Once more, all bitcoin nodes within the community calculate the identical worth (we are going to revisit this problem calculation within the subsequent part):

Collectively, the community subsidy and problem outline the present asking of bitcoin as denominated in computations. As a result of the blockchain is in consensus, this worth is a consensus worth.

Customers in b-money additionally had been presumed to have a consensus “blockchain” containing the historical past of all transactions. However Dai by no means considered the easy resolution of a single consensus asking worth for the creation of latest b-money, decided solely by the information in that blockchain.

As an alternative, Dai assumed that cash creation should go on eternally. Particular person customers would due to this fact have to be empowered to have an effect on financial coverage – simply as in fiat currencies. This perceived requirement led Dai to design a bidding system which prevented b-money from being carried out.

This added complexity was eliminated by Satoshi’s requirement of a predetermined financial coverage.

Time closes all spreads

Within the “Computation” section of b-money, particular person customers would carry out the computations they’d dedicated to of their prior bids. In bitcoin, all the community is the vendor – however who’s the customer?

Within the electronic mail supply market, the patrons had been people eager to ship emails. The pricing authority, the e-mail service supplier, would set a worth that was thought-about low-cost for people however costly for spammers. But when the variety of legit customers elevated, the worth may nonetheless stay the identical as a result of the computing energy of particular person customers would have remained the identical.

In b-money, every consumer who contributed a bid for cash creation was presupposed to subsequently carry out the corresponding variety of computations themselves. Every consumer was performing as their very own pricing authority primarily based on their data of their very own computing capabilities.

The bitcoin community gives a single asking worth in computations for the present bitcoin subsidy. However no particular person miner who finds a block has carried out this variety of computations.[9] The person miner’s successful block is proof that every one miners collectively carried out the required variety of computations. The client of bitcoin is thus the worldwide bitcoin mining trade.

Having arrived at a consensus asking worth, the bitcoin community is not going to change that worth till extra blocks are produced. These blocks should comprise proofs-of-work on the present asking worth. The mining trade due to this fact has no selection if it desires to “execute a commerce” however to pay the present asking worth in computations.

The one variable the mining trade can management is how lengthy it’ll take to provide the subsequent block. Simply because the bitcoin community gives a single asking worth, the mining trade thus gives a single bid—the time it takes to provide the subsequent block assembly the community’s present asking worth.

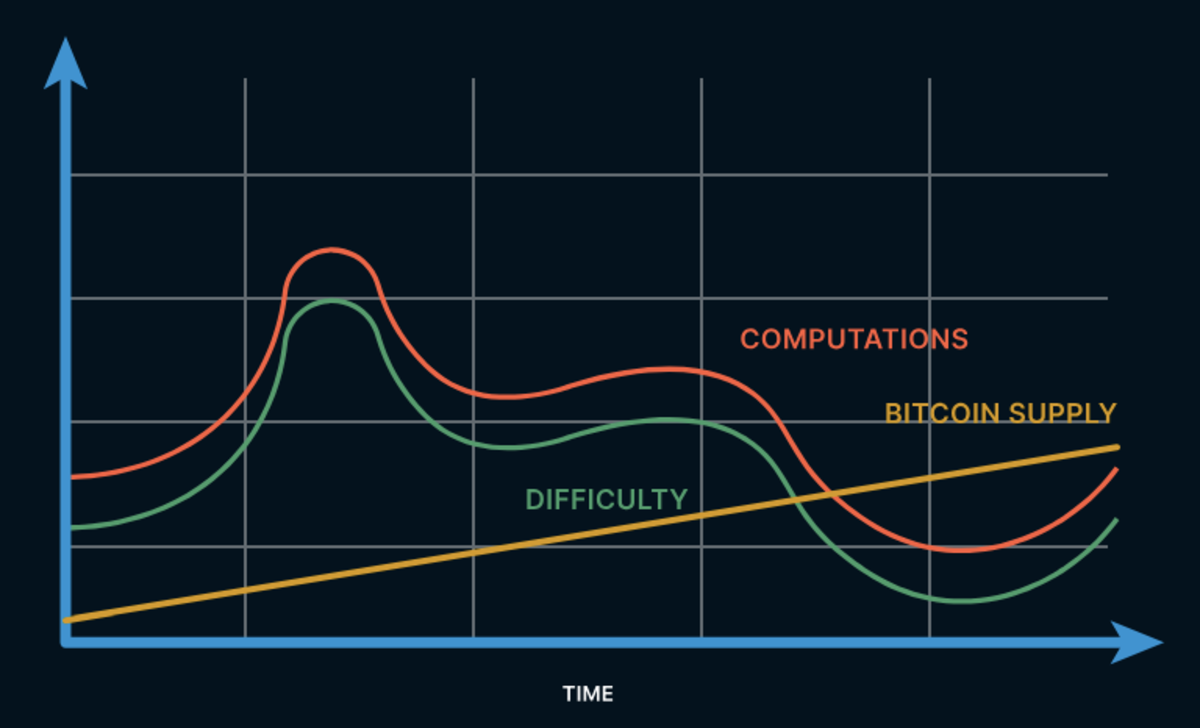

To compensate for rising {hardware} velocity and ranging curiosity in operating nodes over time, the proof-of-work problem is decided by a transferring common concentrating on a median variety of blocks per hour. In the event that they’re generated too quick, the problem will increase. – Nakamoto, 2008

Satoshi is modestly describing the problem adjustment algorithm, typically cited as one of the vital unique concepts in bitcoin’s implementation. That is true, however as a substitute of specializing in the inventiveness of the answer, let’s as a substitute deal with why fixing the issue was so essential to Satoshi within the first place.

Initiatives equivalent to bit gold and b-money didn’t have to constrain the speed in time of cash creation as a result of they didn’t have a set provide or a predetermined financial coverage. Durations of quicker or slower cash creation could possibly be compensated for by different means, e.g. exterior sellers placing bit gold tokens into bigger or smaller bundlers or b-money customers altering their bids.

However Satoshi’s financial coverage targets required bitcoin to have a predetermined price at which bitcoin was to be launched for circulation. Constraining the (statistical) price at which blocks are produced over time is pure in bitcoin as a result of the speed of block manufacturing is the speed at which the preliminary provide of bitcoin is being offered. Promoting 21M bitcoin over 140 years is a distinct proposition than permitting it to be offered in 3 months.

Furthermore, bitcoin can truly implement this constraint as a result of the blockchain is Szabo’s “safe timestamping protocol.” Satoshi describes bitcoin as at the start a “distributed timestamp server on a peer-to-peer foundation,” and early implementations of the bitcoin supply code use the world “timechain” quite than “blockchain” to explain the shared information construction that implements bitcoin’s proof-of-work market.[10]

Bitcoin’s problem readjustment algorithm leverages this functionality. The consensus blockchain is utilized by members to enumerate the historic bids made by the mining trade and readjust the problem with the intention to transfer nearer to the goal block time.

A standing order creates consensus

The chain of simplifications brought on by demanding robust financial coverage extends to the “Cash creation” section of b-money.

Person-submitted bids in b-money endure from “nothing at stake” drawback. There isn’t a mechanism to stop customers from submitting bids with an enormous quantity of b-money for little or no work. This requires the community to each monitor which bids have been accomplished and solely settle for the “highest bids…by way of nominal price per unit of b-money created” with the intention to keep away from such nuisance bids. Every b-money participant should monitor a complete order guide value of bids, match bids with their subsequent computations, and solely settle such accomplished orders with the very best costs.

This drawback is an occasion of the extra basic drawback of consensus in decentralized programs, also referred to as the “Byzantine generals” or typically the “double-spend” drawback within the context of digital currencies. Sharing an equivalent sequence of knowledge amongst all members is difficult inside an adversarial, decentralized community. Current options to this drawback – socalled “Byzantine-fault tolerant (BFT) consensus algorithms”—require earlier coordination amongst members or a supermajority (>67%) of members to not behave adversarially.

Bitcoin doesn’t should handle a big order guide of bids as a result of the bitcoin community gives a single consensus asking worth. This implies bitcoin nodes can settle for the primary (legitimate) block they see that meets the community’s present asking worth— nuisance bids can simply be ignored and are a waste of a miner’s assets.

Consensus pricing of computations permits the matching of purchase/promote orders in bitcoin to be achieved eagerly, on a first-come, first-served foundation. Not like b-money, this keen order matching signifies that bitcoin’s market has no phases—it operates constantly, with a brand new consensus worth being calculated after every particular person order is matched (block is discovered). To keep away from forks brought on by community latency or adversarial habits, nodes should additionally comply with the heaviest chain rule. This grasping order settling rule ensures that solely the very best bids are accepted by the community.

This mix eager-greedy algorithm, the place nodes settle for the primary legitimate block they see and in addition comply with the heaviest chain, is a novel BFT algorithm which quickly converges on consensus concerning the sequence of blocks. Satoshi spends 25% of the bitcoin white paper demonstrating this declare.[11]

We established in earlier sections that bitcoin’s consensus asking worth itself depends upon the blockchain being in consensus. Nevertheless it seems that the existence of a single consensus asking worth is what permits the marketplace for computations to eagerly match orders, which is what results in consensus within the first place!

Furthermore, this new “Nakamoto consensus” solely requires 50% of members to not be adversarial, a big enchancment on the prior state-of-the-art. A cypherpunk like Satoshi made this theoretical laptop science breakthrough, as a substitute of a conventional educational or trade researcher, due to their slender deal with implementing sound cash, quite than a generic consensus algorithm for distributed computing.

IV. Conclusion

B-money was a strong framework for constructing a digital foreign money however one which was incomplete as a result of it lacked a financial coverage. Constraining b-money with a predetermined launch schedule for bitcoins lowered scope and simplified implementation by eliminating the requirement to trace and select amongst user-submitted cash creation bids. Preserving the temporal tempo of Satoshi’s launch schedule led to the problem adjustment algorithm and enabled Nakamoto consensus, widely known as one of the vital revolutionary features of bitcoin’s implementation.

There’s much more to bitcoin’s design than the features mentioned thus far. We now have centered this text on the “main” market inside bitcoin, the market which distributes the preliminary bitcoin provide into circulation.

The subsequent article on this sequence will discover the marketplace for bitcoin transaction settlement and the way it pertains to the marketplace for distributing the bitcoin provide. This relationship will recommend a strategy for how you can construct future markets for decentralized providers on prime of bitcoin.

Acknowledgements

I’ve been ranting about bitcoin and markets for years now and should thank the many individuals who listened and helped me sharpen my considering. Specifically, Ryan Gentry, Will Cole and Stephen Hall met with me weekly to debate these concepts. I’d not have been capable of overcome numerous false begins with out their contributions and their help. Ryan additionally helped me start speaking about these concepts publicly in our Bitcoin 2021 discuss. Afsheen Bigdeli, Allen Farrington, Joe Kelly, Gigi, Tuur Demeester, and Marty Bent, have all inspired me through the years and supplied precious suggestions. I have to additionally apologize to Allen for turning out to be such a awful collaborator. Lastly, Michael Goldstein could also be higher identified for his writing & memes, however I’d prefer to thank him for the archival work he does on the Nakamoto Institute to maintain protected the historical past of digital currencies.

Footnotes

[1] The title of this sequence is taken from the primary telegraph message in historical past, despatched by Samuel Morse in 1844: “What hath God wrought?”.

[2] Bitcoin: A Peer-to-Peer Digital Money System, out there: https://bitcoin.org/bitcoin.pdf

[3] Pricing by way of Processing or Combatting Junk Mail by Dwork and Naor out there: https://www.knowledge.weizmann.ac.il/~naor/PAPERS/pvp.pdf

[4] Regardless of originating the concept, Dwork & Naor didn’t invent “proof-of-work”—that moniker was supplied later in 1999 by Markus Jakobsson and Ari Juels.

[5] Hal Finney’s RPOW mission was an try at creating transferable proofs-of-work however bitcoin doesn’t use this idea as a result of it would not deal with computations as foreign money. As we’ll see later after we look at bit gold and b-money, computations can’t be foreign money as a result of the worth of computations adjustments over time whereas items of foreign money will need to have equal worth. Bitcoin is just not computations, bitcoin is foreign money that’s offered for computations.

[6] At this juncture, some readers might imagine me dismissive of the contributions of Dai or Szabo as a result of they had been inarticulate or hand-wavy on some factors. My emotions are the precise reverse: Dai and Szabo had been primarily proper and the very fact that they didn’t articulate each element the way in which Satoshi subsequently did doesn’t detract from their contributions. Quite, it ought to heighten our appreciation of them, because it reveals how difficult the arrival of digital foreign money was, even for its greatest practitioners.

[7] Dai’s b-money submit is the very first reference in Satoshi’s white paper, out there: http://www.weidai.com/bmoney.txt

[8]There are two simplifications being made right here:

a. The variety of bitcoin being offered in every block can be affected by the transaction price market, which is out of scope for this text, although lookout for subsequent work.

b. The problem as reported by bitcoin is just not precisely the variety of anticipated computations; one should multiply by a proportionality issue.

[9] At the least not for the reason that dangerous previous days when Satoshi was the one miner on the community. [10] Gigi’s classicBitcoin is Timeis an excellent introduction to the deep connections between bitcoin and time, out there: https://dergigi.com/2021/01/14/bitcoin-is-time/

[11] Satoshi blundered each of their evaluation within the white paper and their subsequent preliminary implementation of bitcoin through the use of the“longest chain” rule as a substitute of the “heaviest chain” rule.