Bitcoin Money’s worth hit a yearly peak of $527 on March 3 however, it has since decoupled from the market pattern, bringing the upcoming halving occasion to the forefront.

Regardless of the crypto market uptrend, Bitcoin Money’s (BCH) worth has struggled to keep up its bullish momentum in the previous week. Historic market information offers vital insights into how the subsequent Bitcoin Money halving occasion may influence BTC worth motion.

Miners enter $1.1 billion promoting spree forward of halving

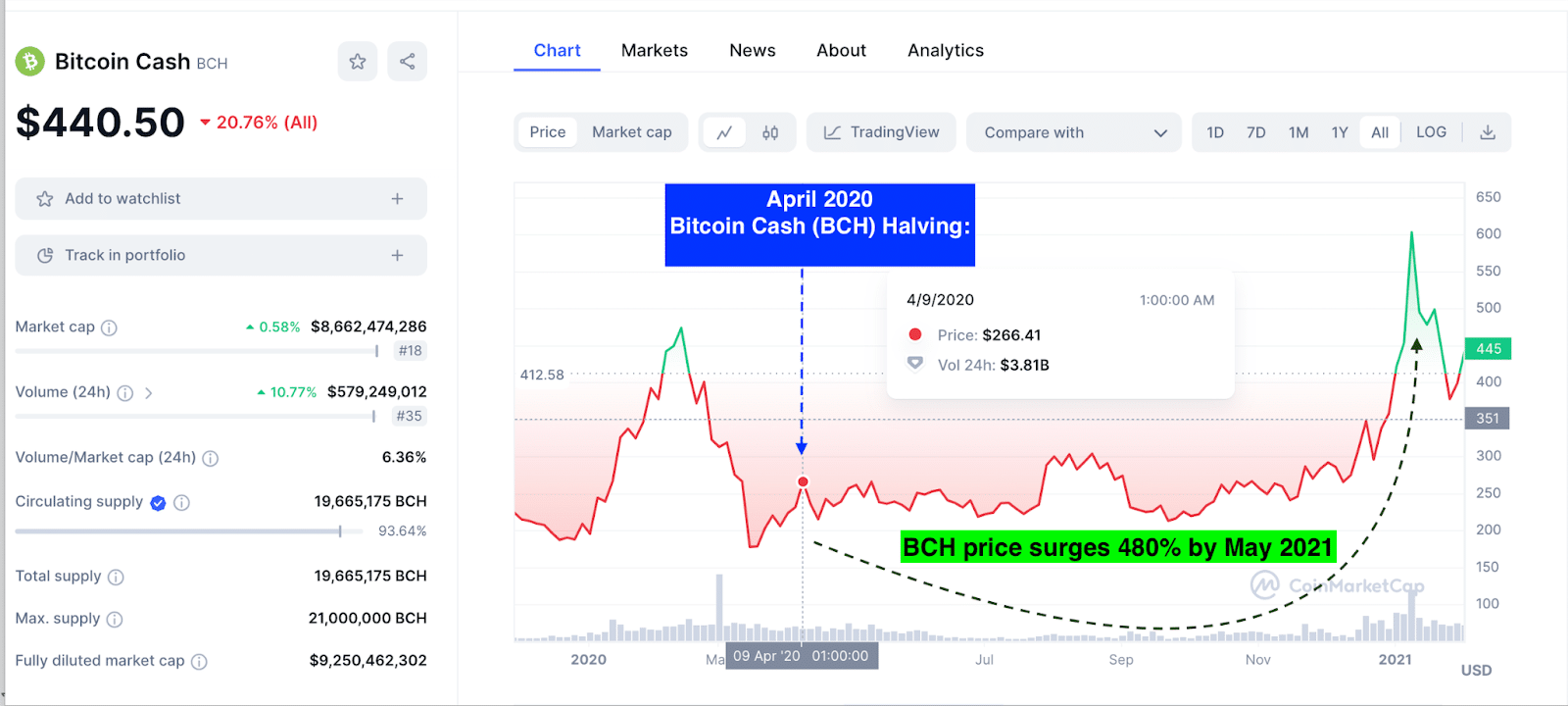

Bitcoin Money has a four-year or 200,000-block halving cycle. The primary occurred on April 8, 2020, whereas the anticipated date for the subsequent BCH halving occasion at block 840,000 is April 4, 2024.

The present block reward is 6.25 BCH and might be slashed to three.13 BCH in about 25 days and this vital community occasion has triggered intense reactions amongst miners.

IntoTheBlock’s miner reserves information and presents the cash held in wallets managed by acknowledged miners and mining swimming pools. It reveals that as of April 26, 2023, the BCH miners held a complete steadiness of 9.2 million BCH. However, as of March 2024, these balances have dwindled to only 6.65 million BCH

Miners have bought 2.51 million BCH price roughly $1.1 billion and almost 30% of holdings previously 12 months. This pattern is anticipated to exacerbate as extra miners look to money in on excessive costs forward of the rewards remission.

Nonetheless, historical information means that this pattern may reverse after the halving. In April 2020, the miners started to build up their reserves once more shortly after the halving.

As rewards are lower, unprofitable miners could unplug from the Bitcoin Money community. This might lower mining issues and dynamically enhance the mining income for many who can afford to stay in the sport.

This pattern was noticed in the Bitcoin Money community in 2020. As unprofitable miners bought out and exited the community, the remaining miners grew their reserve balances from 10.8 million on the April 8 halving date to a yearly peak of 13.5 million in November 2020.

Unsurprisingly, the BCH worth additionally skilled important worth good points throughout that interval.

Bitcoin Money’s 20% worth dip presents shopping for alternative

Bitcoin Money had a stable beginning to the month, hovering at a three-year peak of $527 on March 2. Nonetheless, because the BCH halving countdown rolled previous the 30-day mark, the BCH worth has decoupled from the broader crypto market uptrends and entered a steep 20% downtrend towards $440 at press time on March 11.

Nonetheless, given the historical market information analyzed above, this downtrend may currently a worthwhile shopping alternative for strategic bullish merchants.

The chart above reveals that the BCH worth exhibited an analogous downtrend sample forward of the final halving occasion on April 8, 2020. Nonetheless, curiously, shortly after the halving, BCH entered a bullish cycle that noticed costs soar 480% over the subsequent 12 months.

Current on-chain information tendencies recommend that long-term holders have positioned for one more bullish Bitcoin money post-halving cycle.

Bitcoin Money long-term holders positioned for post-halving rally

Bitcoin Money miners halting their sell-off and stacking up their reserves contributed immensely to BCH’s worth delivering an optimistic post-halving efficiency in 2020. The on-chain information metric has revealed that BCH long-term holders at the moment are positioned for a bullish post-halving rally.

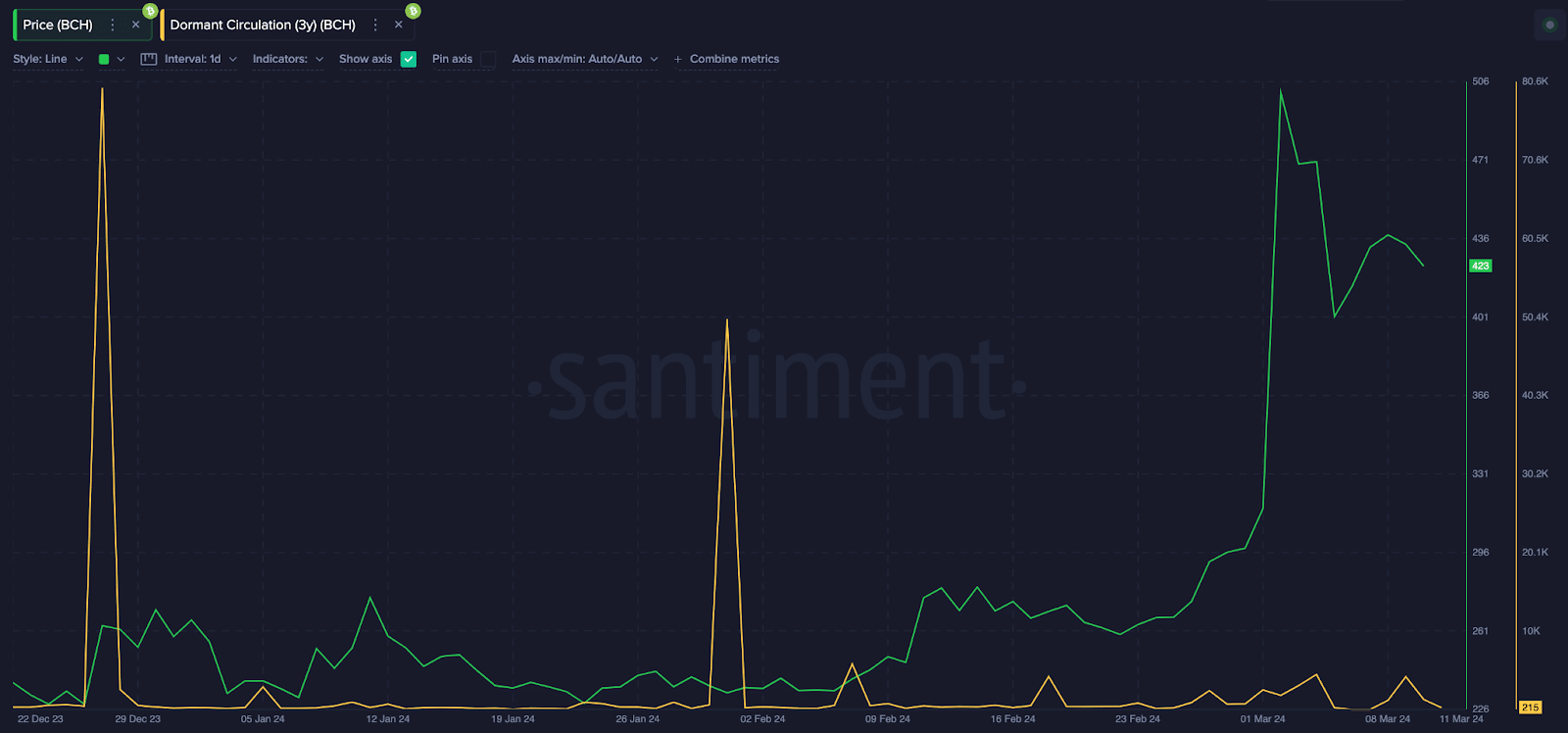

Santiment’s dormant circulation metric displays the variety of cash traded on a given day that had been beforehand held unmoved for 3 years or more.

As seen under, BCH’s three-year dormant cash in circulation has been in a comparatively flat pattern, forming decrease peaks within the final three months. The most recent spike on March 9 noticed long-term buyers commerce 4,208 BCH cash beforehand held for 3 years or extra at a 28% decrease from the earlier month’s peak.

Primarily, BCH’s three-year dormant provide in circulation for March is trending to decrease than the earlier month’s peaks, signaling that long-term buyers are rising more and more reluctant to promote because of the April 4 halving date.

If this pattern persists, different strategic buyers may additionally take a cue from the long-term holders’ optimism and begin to tackle a bullish disposition.

BCH worth prediction: extra correction earlier than the $750 breakout?

Based mostly on the information tendencies analyzed above, the Bitcoin Money miners promoting frenzy may put downward strain on BCH worth, doubtlessly forcing a downswing under $400 forward of the halving.

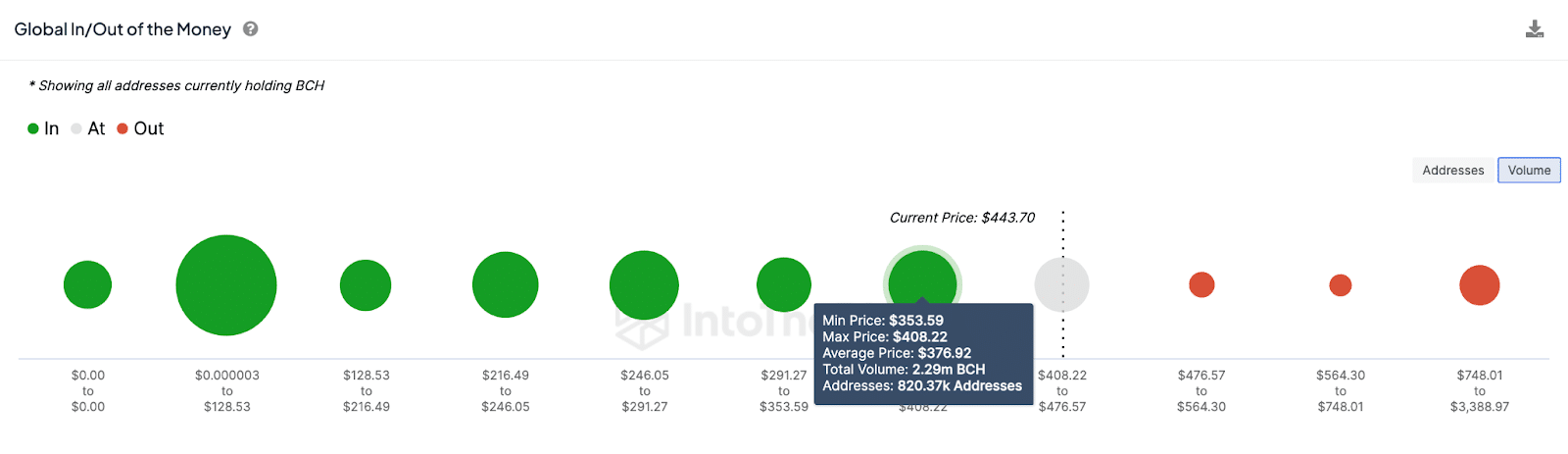

Nonetheless, within the brief time, the bull can depend on the looming buy-wall at $410 for preliminary assistance.

IntoTheBlock’s international in/out of the cash chart reveals that 820,370 addresses had acquired 2.3 million BCH on the most worth of $408.

Given the curtailed promoting strain from long-term holders. BCH can put up a stable entrance to defend the vital assist degree.

Conversely, the bears may mount important resistance at $750 in a post-halving bullish cycle. But when the bulls can smash through that key resistance degree, a transfer above $1,000 might be on the playing cards.