Transferring ahead, we’ll clarify what the Protecc crypto challenge is all about, and also you’ll have an opportunity to study the gist of Protecc Labs. Subsequent, will concentrate on guaranteeing the fundamentals of Protectorate Protocol. After all, we can even dive a bit deeper into varied facets of this new Protecc Labs enterprise. Then, we’ll commit our consideration to the Protectorate coin. As such, you’ll have the ability to get acquainted with this new token, its tokenomics, use circumstances, and extra.

So, you may consider the primary a part of as we speak’s article as a form of primary elementary evaluation (FA) of the Protectorate crypto challenge. As for the second half, we’ll shift our focus to the PRTC token’s value motion. That half will likely be a form of technical evaluation (TA), the place we’ll additionally share some PRTC crypto value predictions.

With our FA and TA of the Protectorate crypto asset, you’ll have the ability to resolve if the PRTC token deserves your consideration or not. If sure, you’ll wish to use the ability of Moralis Cash to analysis the asset additional.

So, that can assist you reply whether or not you can purchase $PRTC, we’ll clarify how one can entry Moralis Cash’s web page for that token to DYOR. Nonetheless, you’ll study that there’s much more to this final on-chain evaluation device than simply altcoin researching!

What’s the Protecc Crypto? Exploring Protecc Labs

The Protecc crypto refers to Protecc Labs. The latter presents itself because the simplification layer and ecosystem accomplice for NFTs. Whereas the challenge does not have an in depth web site, it does have a pleasant and energetic X (previously Twitter) account since June 2022:

Plus, as outlined within the screenshot simply above this part’s title, Protecc Labs does have an energetic profile on Mirror. That is the place you may learn extra in regards to the ins and outs of this NFT-focused enterprise.

As an illustration, the “Asserting Protecc” put up offers some core particulars. That is the place you may study that the challenge is particularly centered on bolstering NFT liquidity. Plus, it goals to facilitate progress operations by a wide range of NFT financialization (NFTfi) protocols.

All in all, in response to that put up, Protecc’s principal purpose is to develop into the go-to market maker for the NFT panorama. As per the phrases of Protecc’s core crew, the NFT area actually wants to enhance its liquidity if it had been to develop into an integral a part of the rising DeFi area.

Additionally, in that Mirror put up, Protecc Labs additionally introduced a partnership with Abacus and Blur.

What’s Protectorate Protocol?

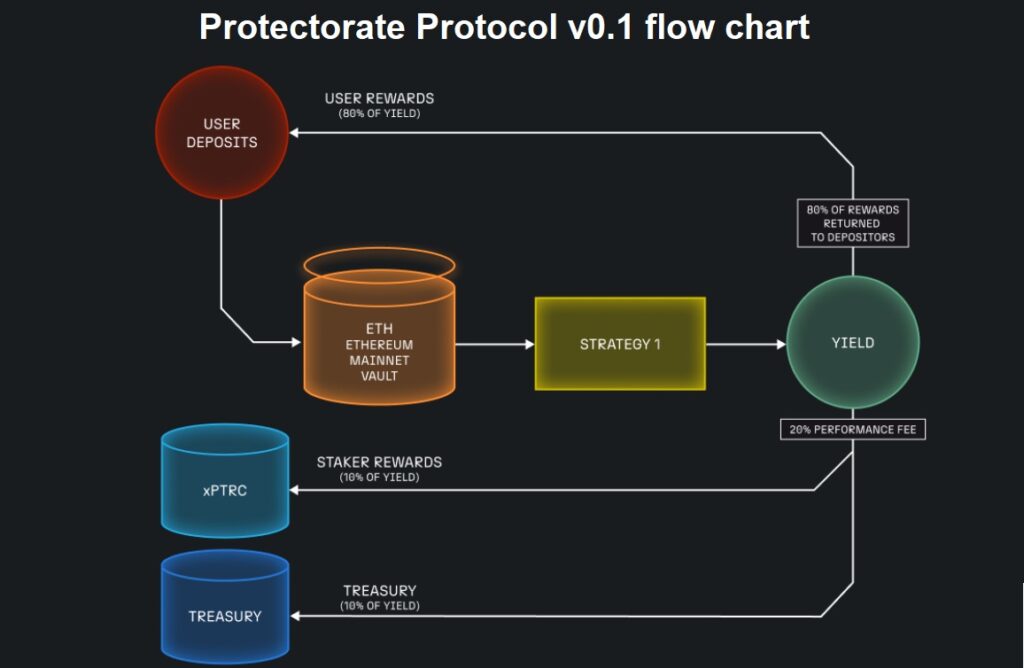

Protectorate Protocol is Protecc Labs’ initiative to create the definitive liquidity layer for NFTfi. This protocol is basically a yield aggregation and liquidity routing platform. The latter goals to soundly deploy customers’ property into a wide range of methods throughout accomplice NFTfi protocols and ship the very best doable yield.

As well as, in response to the protocol’s documentation, the Protectorate crypto challenge is designed to generate deep and sustainable liquidity for NFT collections. It is capable of obtain that by NFTfi protocols.

Nonetheless, it’s essential to level out that (on the time of writing) the protocol is in its early stage (v0.1). At this level, it gives just one core product – ETH Capsule.

Exploring the Protectorate Crypto Venture

As we proceed, we’ll take a more in-depth have a look at a number of the most essential facets of the Protectorate crypto challenge. Nonetheless, be happy to dive deeper your self. You are able to do so by exploring the articles on Protectorate Protocol’s Mirror profile (use the “Mirror” hyperlink on the challenge’s homepage).

That stated, the challenge’s litepaper could also be an excellent higher start line. This doc explains what Protectorate is, what NFT liquidity is like as we speak, offers you a high-level protocol overview, and extra. In actual fact, a lot of the data shared herein comes from that litepaper.

At its core, Protectorate permits customers to supply liquidity by the protocol’s dapp. Anybody can entry that dapp by way of the “Launch App” button on the challenge’s official web site. The challenge goals to ultimately provide many “capsules” (t.i. liquidity channels) that can settle for NFTs, Ethereum, stablecoins, and different crypto property. Nonetheless, on the time of writing, solely ETH Capsule exists.

As soon as customers submit their property, the platform determines the place to deploy this liquidity. It does so by aiming for the highest-yield methods throughout NFTfi. The challenge names the protocol liquidity suppliers “Envoys” and the protocol’s native foreign money stakers “Elders.”

Who’s the Protectorate Protocol For?

In response to the challenge’s litepaper, NFT merchants, collectors, DAOs, and completely different establishments can probably profit from utilizing Protectorate. In spite of everything, the protocol goals to simplify and optimize the method of offering liquidity.

Protectorate sees NFT collections benefiting from its protocol by accessing seamless liquidity provision by a various vary of accomplice NFTfi protocols. For particular person customers, the protocol guarantees to maximise yield and provide a easy and simple UI. So, each particular person ought to discover it simple to make the most of their idle NFT stock in a single place.

As for DAOs, the Protectorate crypto challenge factors out that utilizing its protocol, they’ll (similar to particular person customers) generate yield on idle stock.

Protectorate’s Staff, Governance, Roadmap, and Neighborhood

Apart from the truth that Protecc Labs is behind the Protectorate crypto challenge, there are not any obtainable particulars relating to the challenge’s core crew.

Nonetheless, the challenge’s documentation factors out that one of many high priorities is transitioning to the Protectorate DAO governance quickly after launch. Moreover, that part of the docs additionally factors out that within the early levels of this DAO, the principle management will likely be within the palms of Protectorate Elders who will type the Elder Council.

So far as the challenge’s roadmap goes, we weren’t capable of finding any detailed milestones or timeframes. Nonetheless, the crew behind the protocol makes use of the above picture for that function. You possibly can see that in an animated video if you happen to scroll down the challenge’s X account.

Talking of the @Protectoratexyz X profile, it is likely one of the channels you should utilize to become involved with the challenge’s neighborhood. One other path is to hitch the protocol’s Discord server, which you’ll entry by way of “linktr.ee/protectoratexyz”:

What’s the Protectorate Coin?

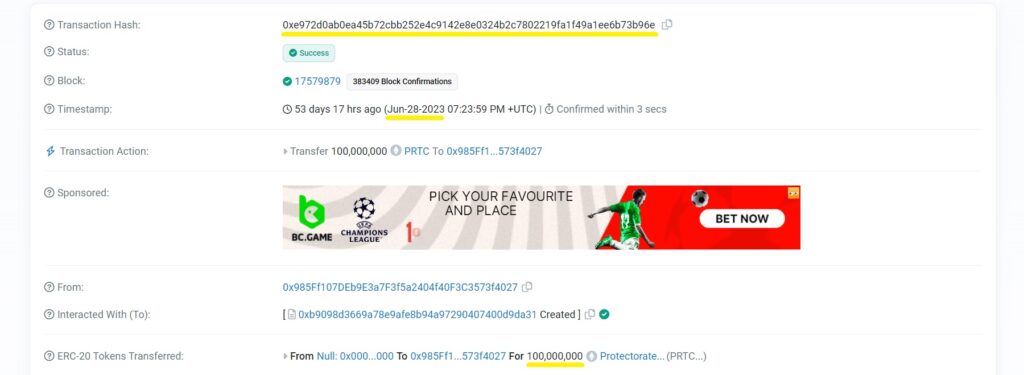

The Protectorate coin is the above-presented protocol’s native cryptocurrency. The PRTC crypto asset was born on June 28, 2023. That’s when 100,000,000 situations of the PRTC token had been minted on the Ethereum chain:

Tokenomics of the Protectorate Crypto Asset

- Token title: Protectorate

- Image/ticker: PRTC or $PRTC

- Community: Ethereum

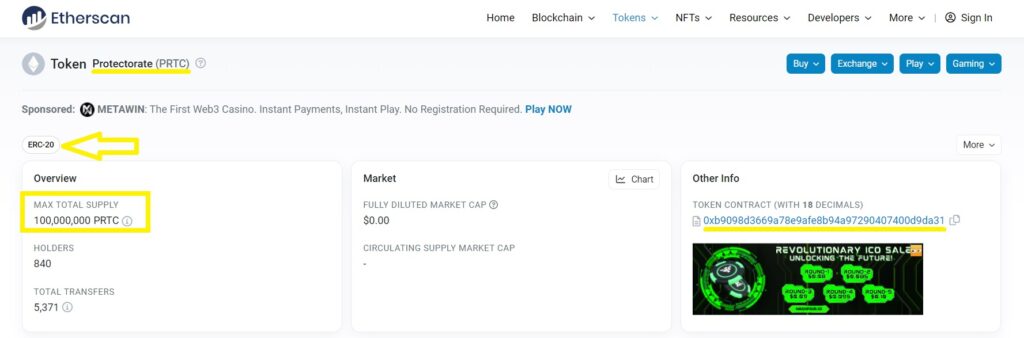

- Token customary: ERC-20

- Good contract handle: 0xb9098D3669A78e9AfE8b94a97290407400D9dA31

- Complete provide: 100,000,000 $PRTC

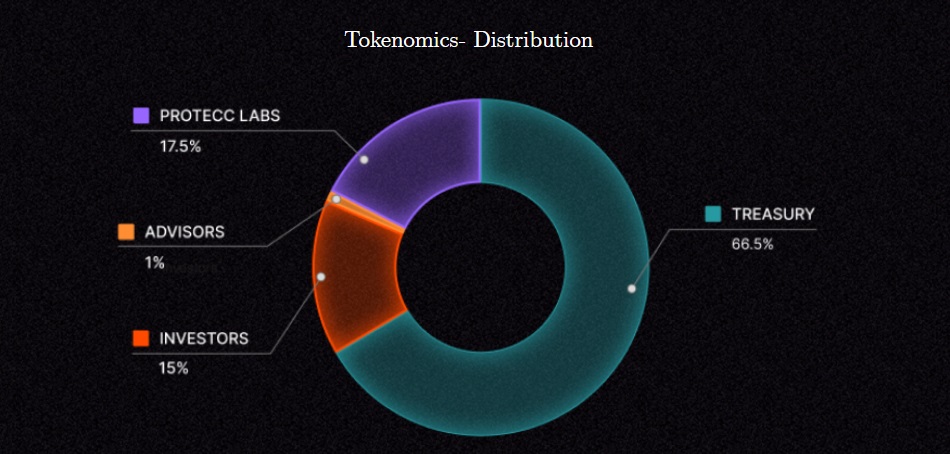

- Preliminary distribution (% of complete provide):

- 1% to advisors

- 15% to traders

- 17.5% to Protecc Labs

- 66.5% to the Protectorate DAO treasury

Protectorate Coin Use Instances

Apart from being a tradable asset, the Protectorate coin serves governance functions. So, the PRTC crypto is a ticket to the Protectorate DAO.

As such, anybody holding a adequate quantity (to be decided) of the Protectorate coin will have the ability to be part of the protocol’s DAO. To make this dedication, holders might want to stake their $PRTC. In return, they are going to obtain rewards in ETH.

What Sort of Token is the Protectorate ($PRTC) Coin?

The Protectorate coin is a fungible cryptocurrency that lives on the Ethereum blockchain, the place it follows the ERC-20 token customary. So, from the technical perspective, the Protectorate crypto asset is an ERC-20 token. Nonetheless, from the utility perspective, it’s a governance token (as described within the part above).

PRTC Token Evaluation

The Protectorate coin has been buying and selling since July 3, 2023. The PRTC crypto asset’s preliminary value was $0.1785; nevertheless, as you may see within the above chart, $PRTC’s value plummeted proper after itemizing, with a wick marking a 60%-plus lower in worth.

The token began to seek out its backside on high of the $0.088-ish stage three days after itemizing. The PRTC crypto asset stayed in that low area over the subsequent three days. Nonetheless, on July 10, 2023, the worth of the Protectorate coin practically doubled in a matter of hours. It practically reached the itemizing value however wasn’t capable of keep at that stage. As a substitute, the token’s value truly entered the aforementioned low area for a brief interval once more earlier than turning again up in direction of the $0.16-ish stage.

After discovering help at $0.11-ish, the PRTC crypto asset lastly gained sufficient momentum to interrupt above its itemizing value. $PRTC set its present all-time excessive (ATH) at $0.2573 on July 18, 2023. Subsequent, the worth of the Protectorate crypto token took a downturn once more and reached $0.088-ish once more 15 days later.

Then, the worth stayed beneath the ten-cent mark till August 9, 2023, when it lastly turned upwards once more. Nonetheless, it discovered resistance at $0.16-ish once more. On August 19, 2023, $PRTC bounced off of the $0.11-ish stage and is at the moment sitting at roughly 13 cents.

Protectorate (PRTC) Coin Value Prediction

The probably short-term value predictions for the Protectorate coin can be the degrees of significance outlined within the above chart. Nonetheless, if the PRTC crypto continues its uptrend, it may ultimately break above its present ATH stage.

Whereas that situation might not essentially occur any time quickly, it’s more likely to happen through the upcoming bull market. In that case, the PRTC token would enter the worth discovery mode. As such, we are able to use the Fibonacci retracement device to find out probably the most optimistic value goal by specializing in the “4.236” extension stage. The latter factors to $0.8-ish.

Nonetheless, we’ve seen many NFT-related initiatives cross the one-billion USD market cap within the earlier bull run. As such, the Protecc Labs challenge positively has extra upside potential.

So, presuming that fifty% of the Protectorate coin’s complete provide enters circulation and the asset reaches the one-billion USD market cap, the worth per PRTC crypto token can be $20.

Ought to You Purchase $PRTC?

We’re not monetary advisors, so we can not reply the above query in your behalf. Plus, solely your present monetary state of affairs and your threat tolerance. So, observe these steps to provide you with a dependable reply:

- Use the sections above to find out if the Protectorate crypto asset deserves your consideration.

- Resolve if you happen to simply wish to commerce the token or if you happen to would additionally like to make use of it to take part within the Protectorate DAO.

- Use the Moralis Cash Protectorate ($PRTC) token web page to analysis the asset additional.

- If you happen to resolve that you simply do wish to get a bag of the Protectorate coin, use the alpha metrics (real-time, on-chain information) to get your timing proper.

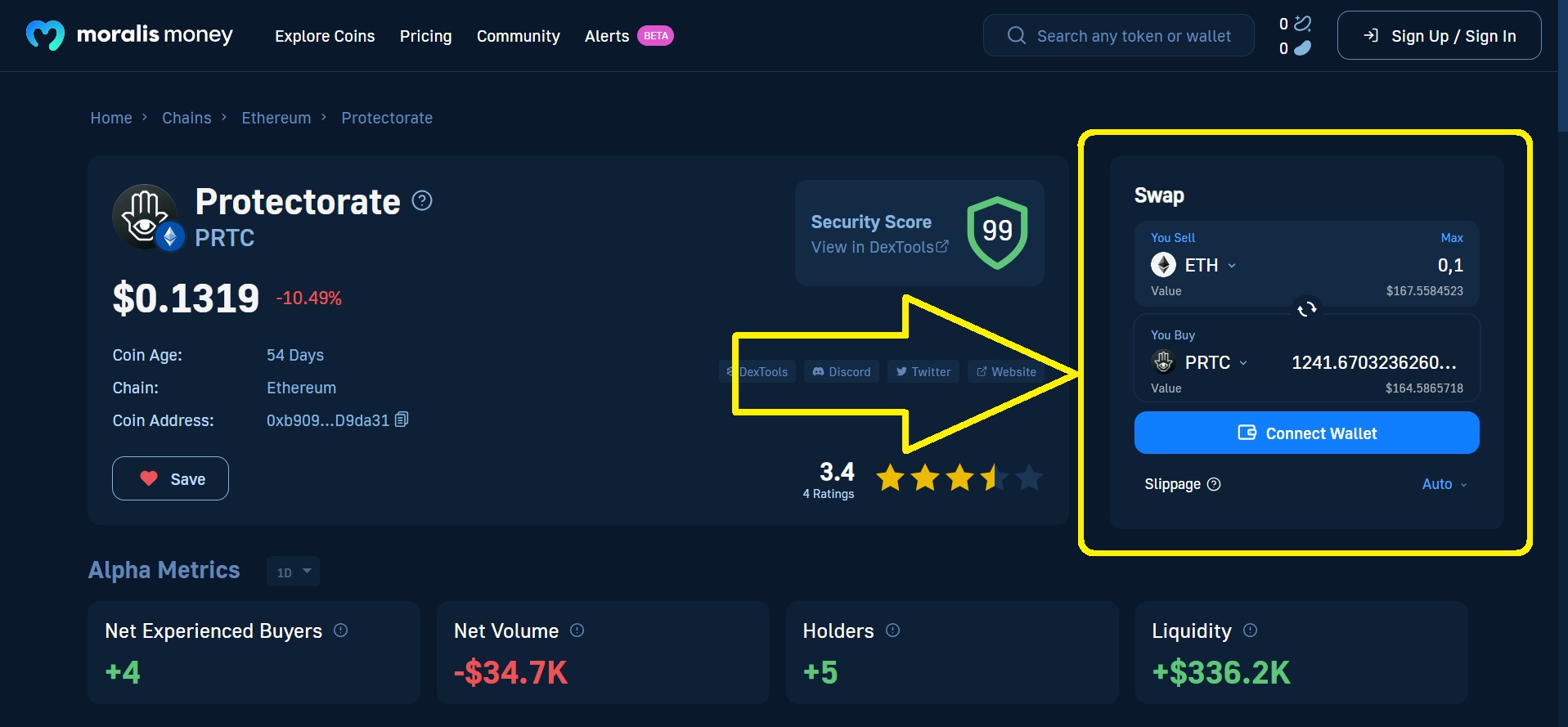

Observe the “$PRTC” hyperlink above or use the interactive widget beneath to find out whether or not or not you can purchase this crypto.

Whether or not you resolve to purchase PRTC or not, understand that there are numerous different altcoin alternatives. For the reason that common alt tends to extend in worth by 50-70x through the bull market, it’s effectively price exploring these alternatives.

Fortuitously, it has by no means been simpler to seek out tokens earlier than they pump. In spite of everything, the core Moralis Cash characteristic, Token Explorer, serves that precise function. Simply by operating preset or distinctive methods, you may generate an inventory of altcoins with potential in seconds! That’s how informal {and professional} merchants have been catching the newest rallies of many cash (e.g., HAKA, ALLIN, CVX, FXS, ILV, and many others.)

Plus, the device is free, so you will get going as we speak. Nonetheless, in case you are critical about your altcoin buying and selling, you’ll wish to go for the Starter or Professional plan sooner somewhat than later!

The Greatest Place to Purchase $PRTC

On the time of writing, there’s just one place that provides a PRTC buying and selling pair: Uniswap. Nonetheless, you would not have to make use of that DEX’s dapp to purchase the Protectorate coin. There’s a a lot safer and user-friendlier path!

Because of Moralis Cash’s immediate crypto swap characteristic that awaits within the top-right portion of the above-presented $PRCT web page, you should purchase the token proper the place you might be conducting extra analysis.

How you can Purchase the Protectorate Coin Safely and with Low Charges – Use Moralis Cash

Relating to utilizing Moralis Cash’s swap characteristic, thighs couldn’t be any less complicated. Particularly if you know the way to swap ERC-20 tokens, then you definately’ll know precisely what to do.

And, since $PRTC is already chosen, you solely want to attach your pockets, choose the asset you wish to use to purchase the Protectorate crypto asset, enter its quantity, approve the spending, and execute the transaction. It’s all only a matter of some clicks!

That stated, in case you’ve by no means swapped crypto earlier than, we advocate you discover our information on how one can swap on the Ethereum community. Nonetheless, simply watching the next animation a number of occasions might be all it’s essential get going:

Exploring Protecc Labs’ Protectorate Protocol and PRTC Token – Key Takeaways

- Protecc Labs got here to life again in 2022 with the purpose of turning into the main simplification layer and ecosystem accomplice for NFTs.

- In 2023, Protecc Labs launched the Protectorate Protocol.

- The purpose of this protocol is to convey a component of cohesion throughout the NFTfi panorama by offering adequate liquidity and enabling customers to earn the very best doable yield.

- Protectorate coin is the protocol’s governance token that follows the ERC-20 token customary on the Ethereum chain.

- The worth of the Protectorate crypto property nonetheless sits beneath the token’s itemizing value.

- If the challenge manages to draw customers, the $PRTC value may enhance considerably within the upcoming bull run.

- To find out if and when you can purchase $PRTC, use Moralis Cash’s web page for that token.

- It’s also possible to use the Moralis Cash swap characteristic to purchase PRTC with out breaking a sweat or the financial institution.

- Don’t overlook to discover different altcoin alternatives with Token Explorer.