Ethereum has seen open curiosity in perpetual futures enhance throughout main centralized crypto derivatives exchanges since early February.

The cumulative open curiosity for ETH futures is now over $10.1 billion, as reported by CoinGlass.

Crypto derivatives alternate Derebit has recorded an all-time excessive within the whole variety of excellent perpetual futures contracts for ether, with open curiosity exceeding $690 million.

In contrast to conventional futures, perpetual contracts do not need an expiration date, permitting merchants to keep up positions indefinitely.

The current surge in open curiosity signifies a lift in buying and selling exercise and curiosity in ether derivatives, probably on account of hypothesis, market consideration, or hedging methods associated to the cryptocurrency.

This uptrend coincides with anticipations of potential market-moving occasions, such because the potential approval of a spot Ether ETF by the US Securities and Trade Fee.

Amongst different funding corporations, Franklin Templeton has not too long ago initiated steps in direction of launching a spot ether ETF, indicating rising institutional curiosity.

Moreover, the funding price for ether perpetual futures on Deribit has risen from 0.00045% to 0.035% since February’s begin, signaling an elevated demand for lengthy positions.

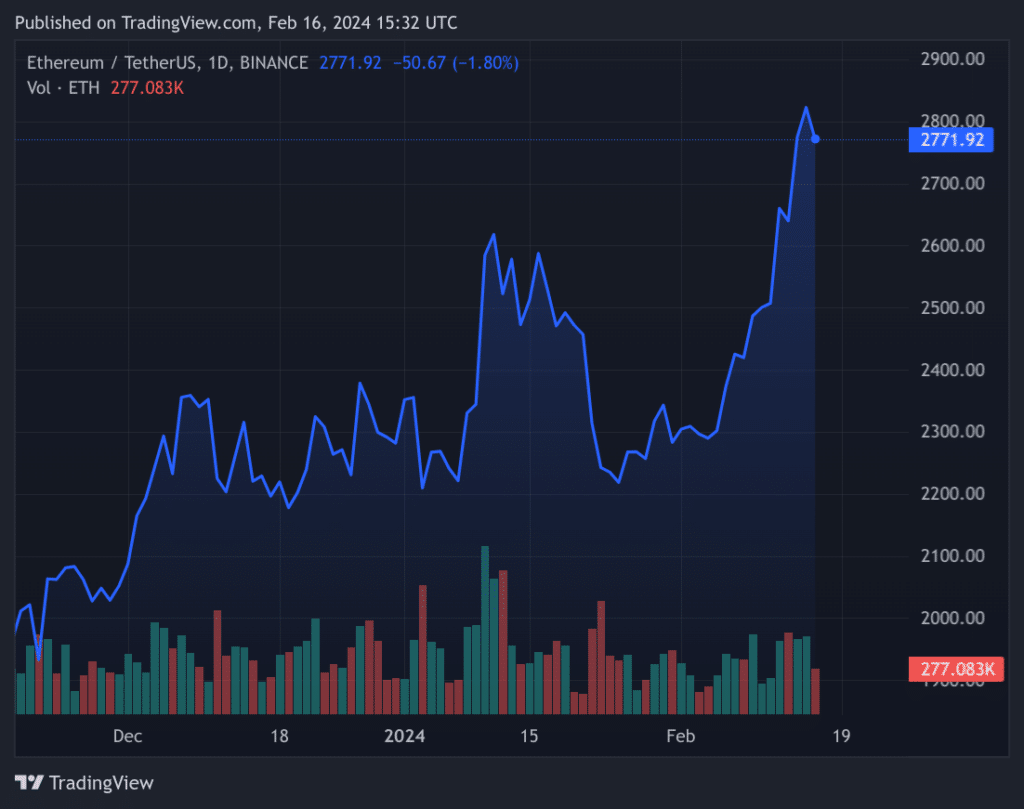

This shift suggests a bullish sentiment amongst merchants, forecasting a possible value enhance for ETH, which not too long ago rose 1.57% to $2,841.