The crypto market has reacted little to the U.S. Federal Reserve’s choice to go away rates of interest unchanged, even because it hinted at a remaining hike earlier than 12 months’s finish.

On Sept. 20, the U.S. Federal Reserve (Fed) Chair Jerome Powell held a Federal Open Market Committee (FOMC) press convention, asserting that present rates of interest, ranging between 5.25% and 5.5%, would stay unchanged.

“In gentle of how far we’ve are available in tightening coverage, the committee determined at right now’s assembly to keep up the goal vary for the federal funds price at 5 ¼ to five ½ % and to proceed the method of considerably decreasing our securities holdings.”

Jerome Powell, Federal Reserve Chair

Nonetheless, the Fed hinted at one remaining hike ranging between 5.5% and 5.75% earlier than the top of 2023 to shut the present cycle that may have seen 12 rate of interest hikes since March 2022.

Powell reiterated the Fed’s objective to deliver inflation again all the way down to 2%, including that its choice can be guided by “ongoing assessments” of knowledge.

Crypto market reacts

Following the FOMC’s announcement, the normal monetary market retreated marginally, with the S&P 500 dropping by 0.94% and the Nasdaq Composite dropping roughly 1.5%.

The crypto market additionally reacted barely to the FOMC, shaving off a tiny fraction of its market cap. Most cryptocurrencies, among the many high 50 with the best capitalization, dropped their costs from 0.1% to five%.

Bitcoin (BTC), the main cryptocurrency by market cap, remained largely unaffected, recording an nearly negligible drop of 0.8% within the final 24 hours. Nonetheless, at one level, the coin’s value dipped beneath $26,900 earlier than recouping most of that loss within the following hours, based on knowledge from CoinGecko.

On the time of going to press, Bitcoin was altering arms for $26,700 and had a buying and selling quantity of $12.9 billion.

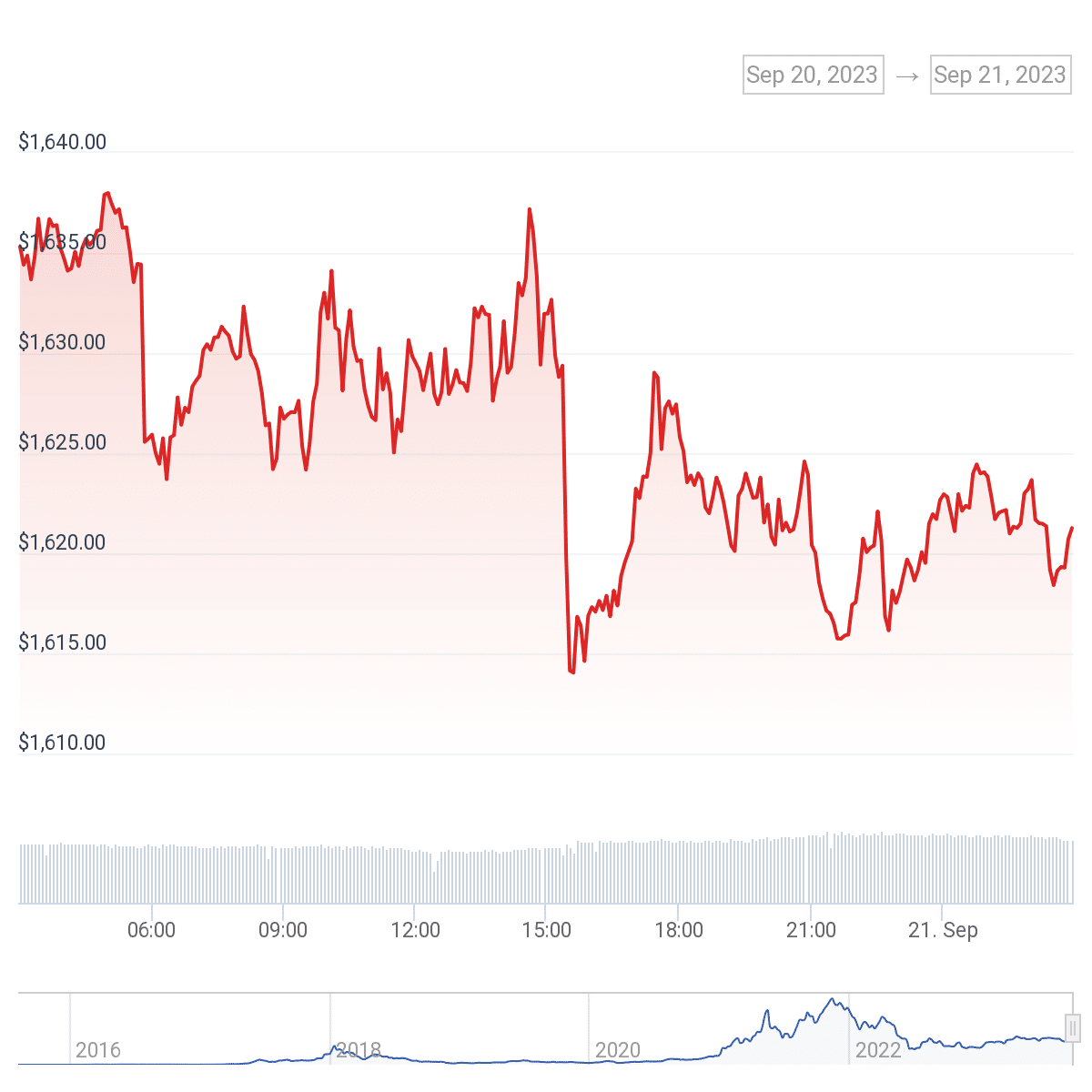

Ethereum (ETH) reacted in almost the identical method as Bitcoin, registering a 24-hour dip of 1%. Within the aftermath of Chair Powell’s press convention, ETH dropped abruptly from $1,629 to $1,614, an nearly 1% loss in worth as BTC had skilled.

Different widespread altcoins, together with Ripple (XRP) and Solana (SOL), additionally noticed little motion. The 2 main stablecoins, Tether (USDT) and USD Coin (USDC) had been additionally largely unaffected by the FOMC pronouncement.

Whereas most destructive value modifications had been beneath 2%, Kaspa (KAS) suffered the most important loss among the many high cash, shaving 4.6% off its worth within the hours following the FOMC press convention. Regardless of the dip, the coin nonetheless registered a 5.1% achieve within the final seven days and 23.8% over two weeks.

Dogecoin (DOGE) did buck the pattern, although, nonetheless barely, making a 0.4% achieve on its value within the final 24 hours. It marked a continuation over the earlier seven days, the place the meme coin has clawed again 2.1% of its worth after principally being within the pink up to now 30 days.