SOL value broke above the $100 milestone on Feb. 8; latest development tendencies in Solana Complete Worth Locked (TVL) recommend extra beneficial properties may observe.

Solana recorded dramatic development with its defi ecosystem over the previous week, even inflicting a quick community outage.

On-chain knowledge evaluation highlights how fast capital inflows and rising community participation fee may propel SOL costs additional up the charts within the coming days.

Solana’s value reclaims $100 after dramatic week

Solana has been the topic of main controversy and volatility in latest weeks. SOL costs ended January strongly with a blistering 35% upswing from $79 to $105 between Jan. 23 and Jan. 31, due to rising defi exercise.

Issues turned unfavorable when the Solana blockchain community skilled a five-hour outage on Feb. 6, triggering unfavorable market sentiment.

Relatively than enter a panic sell-off, bullish SOL holders held their positions, and on Feb. 8, SOL value made one other leg-up, hitting the $105 mark at midday Japanese time.

On-chain knowledge tendencies present the 33.6% value rally over the past 16 buying and selling days might be attributed to Solana’s defi ecosystem attracting tens of millions of {dollars} value of capital inflows.

Solana TVL hits 20-month peak

On Feb. 8, TVL on Solana’s defi ecosystem crossed the $1.8 billion mark for the primary time since June 2022. As per DefiLlama knowledge, it has grown by $500 million within the final 16 days, relationship again to Jan. 23.

This milestone got here from tasks constructed on the Solana layer-1 community which have made large strides in attracting investor consideration in latest weeks.

Whereas the Jupiter (JUP) decentralized trade airdrop has arguably gained essentially the most media notoriety, Jito, Kamino, and Blazestake have acquired the very best capital inflows over the previous month.

When a layer-1 blockchain community receives a lift in TVL, as at the moment noticed on Solana, it strongly signifies rising investor curiosity in its native tasks.

Because the customers of these tasks start to hold out their desired community transactions, starting from liquidity staking and lending to DEX buying and selling, it elicits elevated market demand for the native SOL token and in the end drives up the worth.

SOL value forecast: Clear coast to $120?

Based mostly on the information tendencies analyzed above, the natural $500 million enhance in TVL has been pivotal in driving SOL’s 33.6% value rally between Jan. 23 and Feb. 8.

With the TVL nonetheless trending upwards, SOL might be in line for additional value beneficial properties, probably retesting the $120 coveted territory within the days forward.

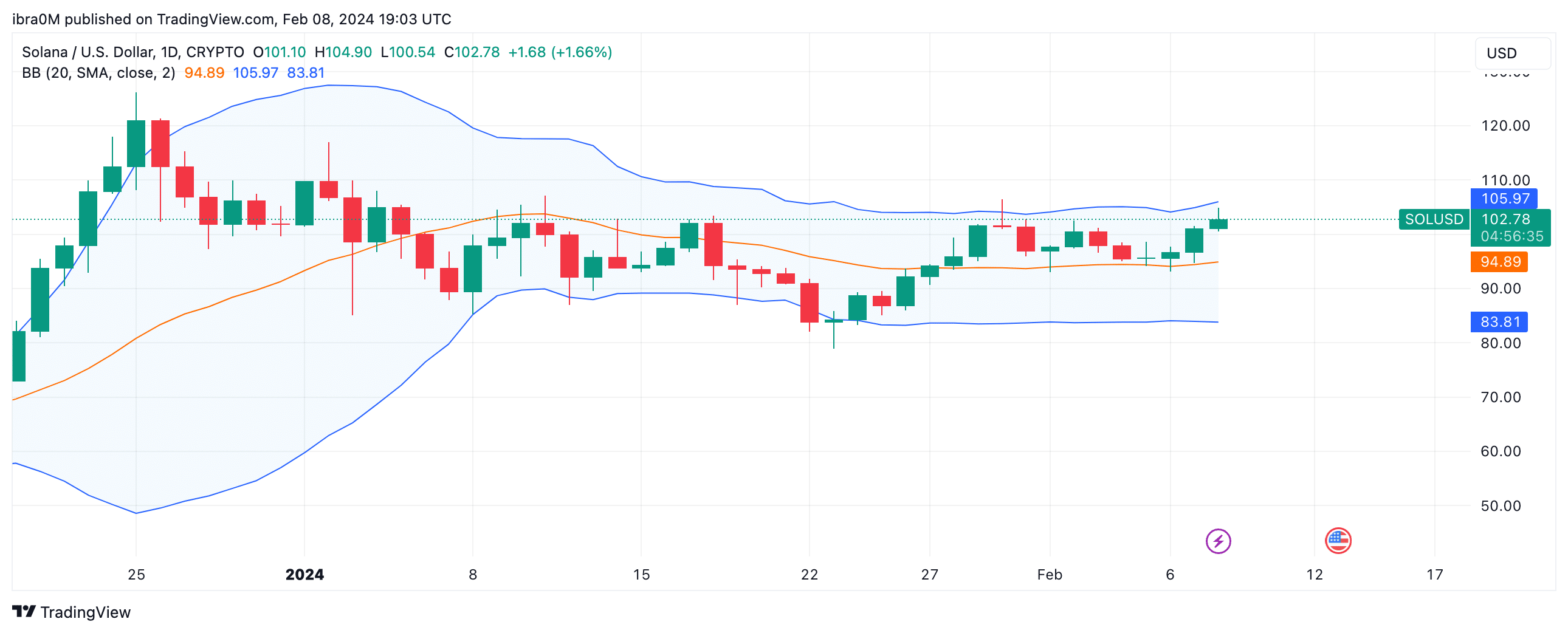

Concerning key resistance factors to look at, the higher Bollinger band technical indicator highlights that the bears may mount a sell-wall across the earlier native prime at $105.

If the bulls can stage a decisive breakout above the world, an audacious transfer towards $120 territory might be on the playing cards.

Conversely, the bears can invalidate this optimistic value prediction in the event that they pressure a downswing under $80. However that appears far-fetched, with the decrease Bollinger band indicator pointing in the direction of a looming assist buy-wall at $83.

If the bulls can maintain that assist degree, they might set off one other rebound section.