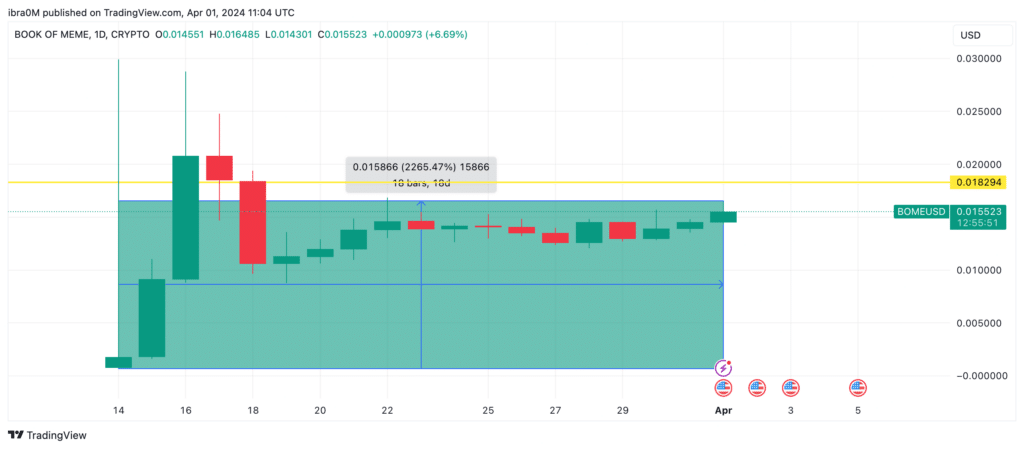

E book of Meme (BOME) value has closed March 2024 at $0.15, with exceptional beneficial properties in extra of two,265%, latest social media developments counsel extra bullish motion may observe in April.

Because the flip of the 12 months, Solana memecoin ecosystem has been on a exceptional run with the likes of Dogwifhat (WIF) and BONK main the charts. Nonetheless, newly-launched E book of Meme (BOME) has been on the forefront of the rally in latest weeks.

E book of Meme social media developments trace at April rally

E book of Meme (BOME) is a Solana (SOL) memecoin launched on March 14. The token made big strides, claiming unicorn standing inside its first week of buying and selling to turn out to be the third largest meme venture on the Solana ecosystem.

Apparently, E book of Meme value motion has flattened since March 19, consolidating inside the slim $0.1 to $0.15 channel, whereas the likes WIF and BONK have surged to new peaks amid large media traction.

Nonetheless, after two weeks in consolidation, away from the key headlines, present media developments counsel BOME has now reached a possible turning level.

Santiment’s weighted sentiment metric pulls knowledge from related crypto media platforms to check the ratio of unfavorable mentions surrounding a venture, to the positives.

Following the euphoria that greeted BOME’ exceptional 2,000% value rally within the week it was launched, the media buzz surrounding the venture has waned.

BOME at present has a unfavorable weighted social sentiment rating of -0.23%, on the time of writing on April 1. This means that unfavorable and pessimistic feedback surrounding BOME now outnumber the constructive and euphoric discourse.

Usually, strategic new entrants who missed out on the two,200% rally in March 2024 perhaps seeking to purchase when market hype cools off. With media feedback now dominantly unfavorable, these strategic merchants may now take into account it good timing to enter the fray.

If this situation performs out, that inflow of recent capital may ship BOME value into one other parabolic breakout in April.

BOME maintains excessive liquidity, regardless of flat value motion

Regardless of E book of Meme’s flat value motion since March 18, important market metric present that traders haven’t proven any indicators of chucking up the sponge. Whereas WIF and BONK have attracted many of the media traction, market liquidity, and investor curiosity in BOME have remained regular at wholesome ranges over the previous two weeks.

In concrete phrases, the Buying and selling Quantity to Market Cap (TVMC) ratio, is a monetary metric used to evaluate the liquidity and buying and selling exercise of a selected crypto asset. It’s calculated by dividing the entire buying and selling quantity of an asset over a selected interval by its market capitalization.

Since inception on March 14, BOME has maintained a median each day buying and selling quantity of $1.1 billion in response to Coingecko begins. When in comparison with the present market cap of $840 million, the it offers a TVMC ratio of 1.3.

An asset is considered undervalued when its TVMC ratio (Buying and selling quantity/ Market Cap) is bigger than 1. And as noticed within the BOME markets, buying and selling quantity has constantly exceeded market cap by roughly 30%.

This places BOME is place for constructive value motion within the close to time period for 2 essential causes. the mixture of a A excessive TVMC ratio and constantly excessive buying and selling quantity, suggests robust liquidity and energetic investor curiosity within the BOME regardless of the two-week lengthy value consolidation part.

Additionally, the buying and selling quantity surpassing market cap signifies favorable circumstances for BOME’s value development within the close to time period as new traders might view BOME as undervalued relative to its buying and selling exercise.

In abstract, the low media hype and excessive TVMC ratio presents a possibility for BOME to draw contemporary capital inflows, doubtlessly kickstarting one other rally in the direction of the subsequent milestone value of $0.02 within the days forward.

Forecast: BOME value heading straight to $0.02 in April?

On the time of writing on April 1, E book of Meme value is hovering simply above the $0.015 space. However low media hype and the 130% TVMC ratio presents a possibility for BOME to draw contemporary capital inflows, doubtlessly kickstarting one other rally in the direction of the subsequent milestone value of $0.02 within the days forward.

Nonetheless, the $0.18 territory poses vital short-term resistance. As seen beneath, BOME traders who exited early had bought off majority of their holdings round that value degree.

But when the E book of Meme bulls can scale that traditionally vital sell-zone, a decisive breakout above $0.02 could possibly be on the playing cards as predicted.

On the flip aspect, BOME may slip into a chronic downtrend if the important help degree $0.10 caves. However this at present appears unlikely, given the brimming market liquidity and general constructive sentiment surrounding the broader Solana memecoin ecosystem.