On Nov. 9, Bitcoin handed the $36,000 mark. The quantity of liquidations on futures within the crypto-asset market elevated to round $186.6 million.

Within the final 24 hours, 57,903 merchants’ positions have been liquidated, totaling greater than $186.6 million, in response to CoinGlass. About $154.44 million of losses got here from quick positions.

The most important liquidations have been recorded on the OKX and Binance crypto exchanges – $67.89 million and $58.73 million, respectively. That is adopted by Bitmex – $22.22 million, Bybit – $17.8 million, and Huobi – $16.46 million.

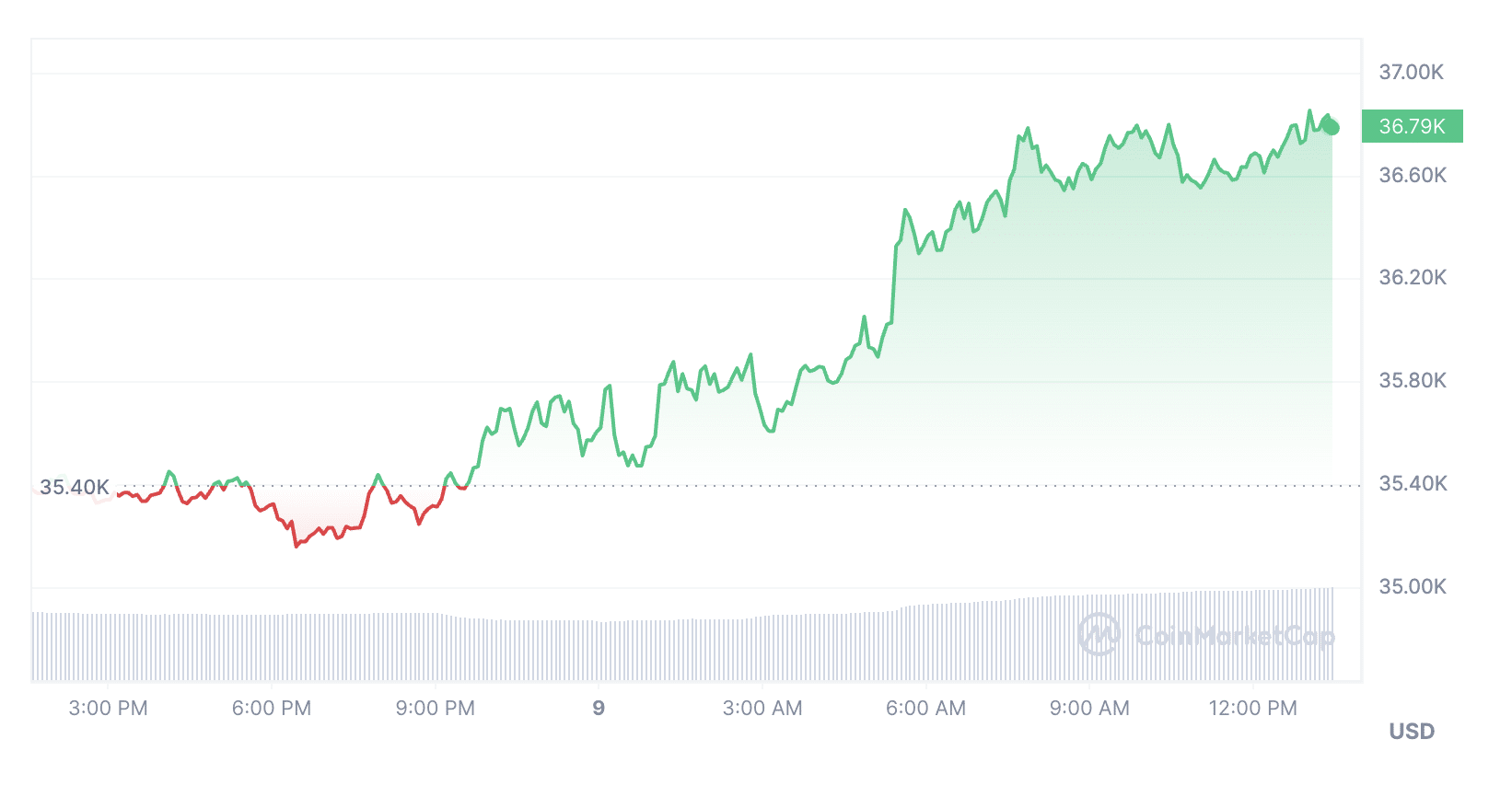

On the time of writing, BTC is buying and selling close to $36,800.

Bitcoin value historical past in November

On the night time of Nov. 2, Bitcoin crossed the $36,000 mark, after which the asset value fell to about $35,200. In opposition to this background, the quantity of liquidations on futures within the crypto-asset market reached $160 million inside 24 hours.

Bitcoin began Nov. 9 with development. In just a few hours, the primary cryptocurrency rose in value by nearly 5%. The final time BTC traded above $ 36,000 was Might 8, 2022. Following BTC, the altcoin market additionally confirmed constructive dynamics.

Bitcoin rose on the information that the US Securities and Change Fee (SEC) entered into negotiations with Grayscale, the subject of which was changing the group’s BTC fund right into a spot Bitcoin ETF. On the finish of August 2023, the court docket sided with Grayscale. The decide ordered the regulator to rethink the corporate’s utility to transform the fund into an ETF. The fee didn’t enchantment the court docket’s choice.