The latest surge in Bitcoin has considerably impacted the efficiency of firms related to crypto mining and buying and selling, most seeing double-digit positive aspects in a month.

February is shaping as much as be a standout month for Bitcoin, because the main cryptocurrency has gained over 45% this month, marking probably the most substantial month-to-month achieve for BTC since December 2020. The bullish uptrend has contributed to a 36% rise in an index monitoring digital asset-related companies, a notable restoration from a greater than 20% lower the earlier month.

The widespread enthusiasm for cryptocurrencies was evident on Wednesday when Coinbase, a number one U.S. cryptocurrency trade, skilled service disruptions as a result of heightened exercise. Regardless of this hiccup, Coinbase has seen its worth improve by over 56% in February alone, its most profitable month since November, after a 26% decline the earlier month.

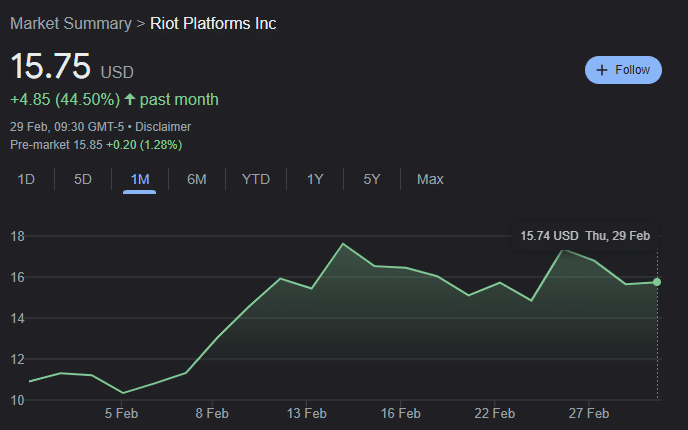

Alongside Coinbase, different crypto-related entities like Marathon Digital Holdings Inc., Riot Platforms Inc., and Bit Digital Inc. are poised to conclude February positively, overturning earlier losses.

Following a difficult January, this group of firms has recovered, thanks partly to the approval of Bitcoin-focused ETFs by the SEC on Jan. 11. This resurgence follows a yr of great rallies for the trade in 2023.

Nevertheless, it’s vital to notice that whereas firms linked to Bitcoin usually profit from its worth will increase, their shares are additionally weak to declines ought to the cryptocurrency’s worth falter.