Bitcoin has gained 16% up to now week and over 15% within the final 30 days, however value volatility nonetheless rocks leveraged crypto positions throughout the board.

Whereas Bitcoin (BTC) exchanged fingers above $49,000 on Feb. 12 following eight consecutive inexperienced days, cryptocurrency merchants skilled sweeping liquidations up to now 24 hours.

In accordance with CoinGlass, over $135 million was eradicated from crypto markets, represented by each lengthy and brief positions. Merchants take lengthy bets after they count on larger costs and, conversely, brief bets when the prediction tilts towards decrease ranges.

The one-largest liquidation order occurred on the crypto change OKX and was denominated in an ETH-USD pair value practically $4 million. Nonetheless, the BTC shorts comprised the most important liquidated positions general.

Over $35 million briefly Bitcoin positions had been worn out towards roughly $16 million in lengthy trades. Ethereum (ETH) ranked second, however lengthy positions dominated the asset’s closed leveraged bets. Volatility within the crypto markets stopped greater than $13 million in ETH longs and over $7 million in ETH shorts.

Solana (SOL) liquidations adopted BTC and ETH in third, with lower than $8 million in closed leveraged trades.

Bitcoin surges over $49,000

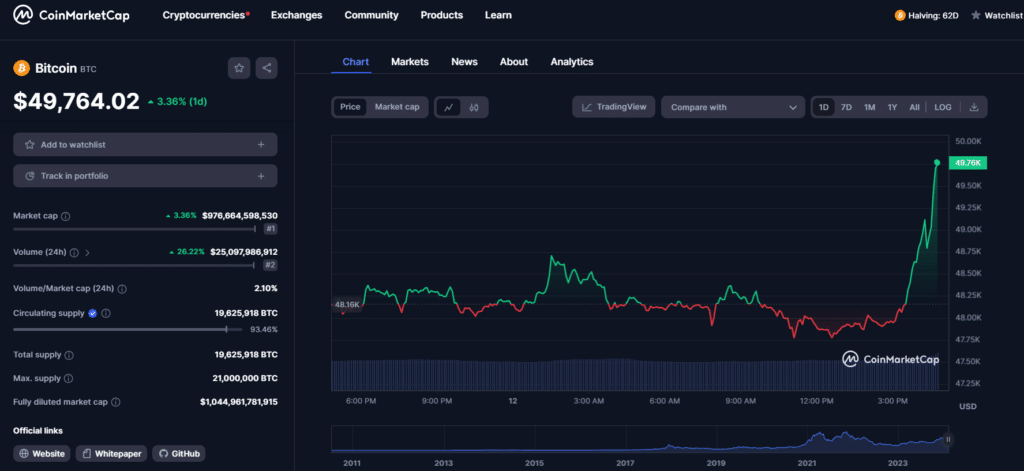

In the meantime, crypto’s largest token broke above $49,000 for the primary time since Jan. 11. BTC had gained over 3% at press time, and consumers might purchase the coin for round $49,700 per CoinMarketCap.

A 26% surge in every day buying and selling quantity accompanied this value enhance, as BTC merchants transacted over $25 billion throughout supported venues. The token’s market capitalization shot as much as $970 billion, solely $30 billion away from reaching a $1 trillion valuation.

Fifteen years after its debut and 62 days earlier than its fourth halving, BTC can be the primary cryptocurrency in historical past to realize this milestone.