Since its inception, Bitcoin has skilled annual worth declines in solely 4 of 14 years.

Regardless of its inherent volatility, this exhibits the general development of development and long-term utility of Bitcoin (BTC) as an asset class. With BTC hitting its all-time excessive of $72,000 at this time, the main cryptocurrency is up by over 260% yearly. However, this isn’t the one time BTC has recorded vital yearly positive factors.

Because the token began first buying and selling in March 2010, BTC has skilled an annual decline solely in 2015, 2019, 2022, and 2023.

“Each investor who has ever entered the Bitcoin market is at the moment having fun with worthwhile returns, as the present worth far surpasses any historic level. Nonetheless, it’s crucial to do not forget that previous efficiency doesn’t assure future outcomes. With the halving occasion looming simply 41 days away, we anticipate a forthcoming provide shock amid escalating demand. This delicate steadiness between diminished provide and heightened curiosity units the stage for unprecedented momentum.”

– Sumit Gupta, Co-founder of CoinDCX

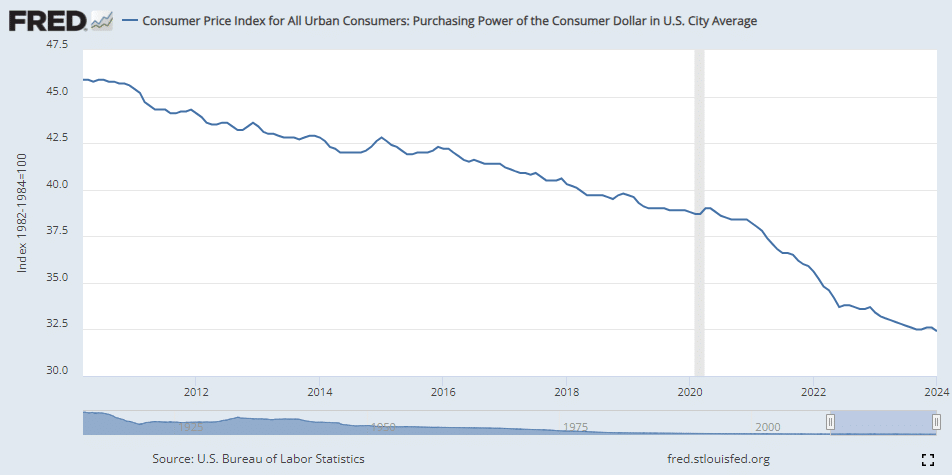

Conversely, the USD has skilled a constant annual inflation fee, resulting in a gradual lower in buying energy over time. The inflation fee has different, with intervals of upper inflation, particularly famous within the early 2020s, reflecting financial challenges, together with the impacts of the COVID-19 pandemic and subsequent restoration efforts. Inflation reduces the worth of cash over time, which means {that a} greenback in 2009 has much less buying energy in 2024.

Since Bitcoin’s debut using Satoshi Nakamoto’s novel whitepaper, there have been no reported years of deflation that will point out a rise in buying energy. So, the USD’s buying energy, broadly thought-about probably the most traded fiat forex, decreased yearly for 14 years.

The stark distinction between Bitcoin’s exponential development and the USD’s reducing buying energy on account of inflation underlines the elemental variations between a decentralized cryptocurrency and a fiat forex. Bitcoin’s rise displays its rising acceptance and the speculative curiosity it attracts, alongside debates about its position as an inflation hedge.

In the meantime, the inflation fee affecting the USD highlights the effect of centralized financial insurance policies, provide chain dynamics, and international occasions on conventional currencies.