In keeping with one choices company, declines in Bitcoin, Ethereum, and the full crypto market cap sparked short-term skepticism amongst merchants.

QCP Capital launched a March 15 replacement pointing to volatility issues in cryptocurrency markets as Bitcoin (BTC), the main token, dropped beneath $66,000 for the first time in practically two weeks.

BTC was down over 5% within the final 24 hours and dipped to $65,565 throughout buying and selling hours. Ethereum (ETH) additionally retraced greater than 5% to around $3,566 earlier than recovering barely at press time. The whole crypto market fell to $2.6 trillion, down 4% on the day, per CoinMarketCap.

QCP Capital analysts stated markets had been “notably nervous” because of the valuation correction throughout crypto’s two largest tokens. The agency stated this destructive threat reversal prolonged to Could, as indicated by giant capital traders.

We’ve additionally seen some sizeable unwinding of calls by institutional gamers who had been those shopping for calls aggressively on the way in which up.

QCP Capital

Spot Bitcoin ETFs recorded $132m web inflows

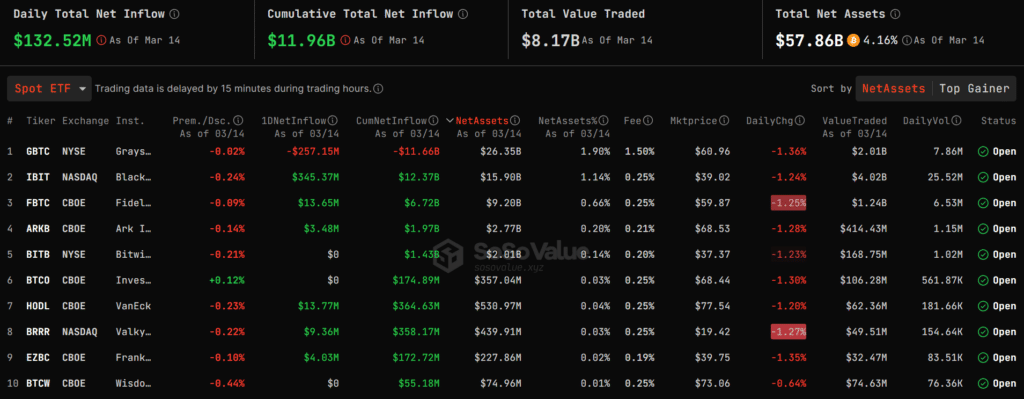

Bitcoin’s market correction was preceded by uncommon lackluster curiosity in spot BTC ETF on March 14. SoSo Worth Knowledge confirmed whole web inflows of $132.5 million throughout 10 tradable funds, with BlackRock once more taking the lead with $345 million.

Nonetheless, $257 million in web outflows from Grayscale’s GBTC dampened the inflow into BlackRock’s iShares Bitcoin ETF (IBIT). Funds issued by Bitwise, Invesco Galaxy, and WisdomTree reportedly had $0 web inflows.