One in every of Bitcoin’s hottest forks accomplished its halving roughly two weeks forward of BTC’s quadrennial change slated for later this month.

Bitcoin Money (BCH) gained a ten% value enhance in 24 hours following its halving right this moment and was one of many prime gainers amongst cryptocurrencies because the markets lulled. Following the occasion, BCH climbed as excessive as $660 per CoinMarketCap. Regardless of the value hike, BCH traded 84% under its $4,355 all-time excessive, which it reached six years in the past in 2017.

Just like the Bitcoin (BTC) halving, BCH’s mining reward was decreased by 50%, tightening the cap on new tokens getting into circulation. The BTC fork’s new block reward is now mounted at 3.125 BCH till 2028.

Professional: Bitcoin value motion post-halving could also be completely different this time

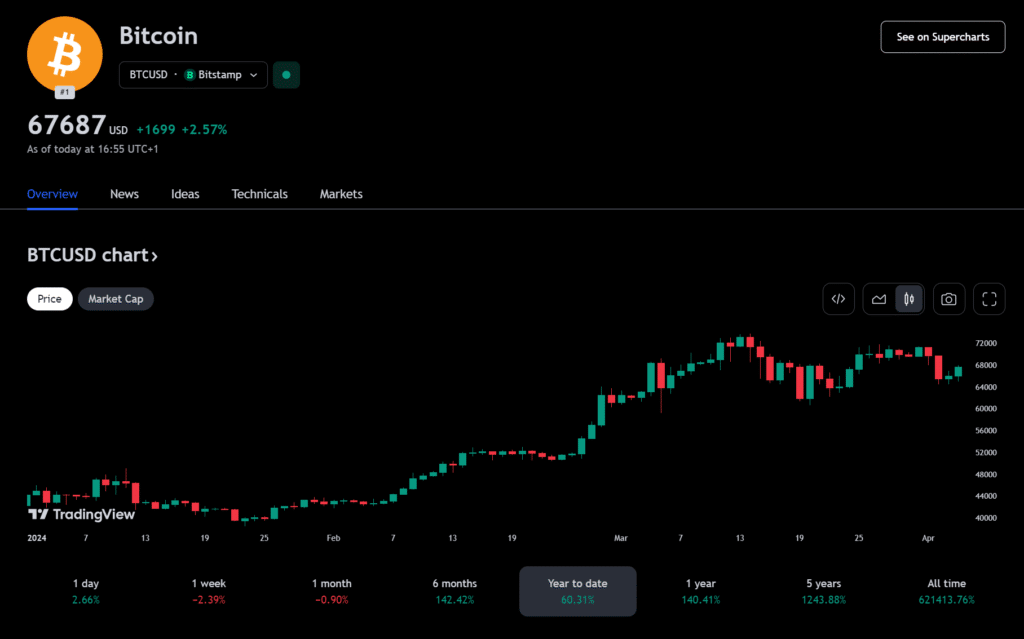

On-chain monitoring instruments level to April 20 as Bitcoin’s halving day amid institutional and retail demand underpinned by spot BTC ETFs, which had been accepted in January. Traditionally, volatility has swayed BTC and the broader crypto market earlier than the halving.

The asset maintained this sample to an extent, retracing as a lot as 14% inside 24 hours early final month. Bitcoin declined 20% earlier than its 2020 halving and over 38% in 2016.

Mirai Labs Co-Founder and CEO Corey Wilton opined that the market could document divergent outcomes post-halving in comparison with earlier cycles.

Whereas there has beforehand been volatility within the months main as much as the halving, I think we’ll see volatility post-halving as institutional buyers digest what the halving is and its results long run. Crypto retail is fast to react, however we have now seen that institutional funds don’t possess the identical pace and this might simply disrupt our “typical” end result.

Corey Wilton, Mirai Labs co-founder and CEO