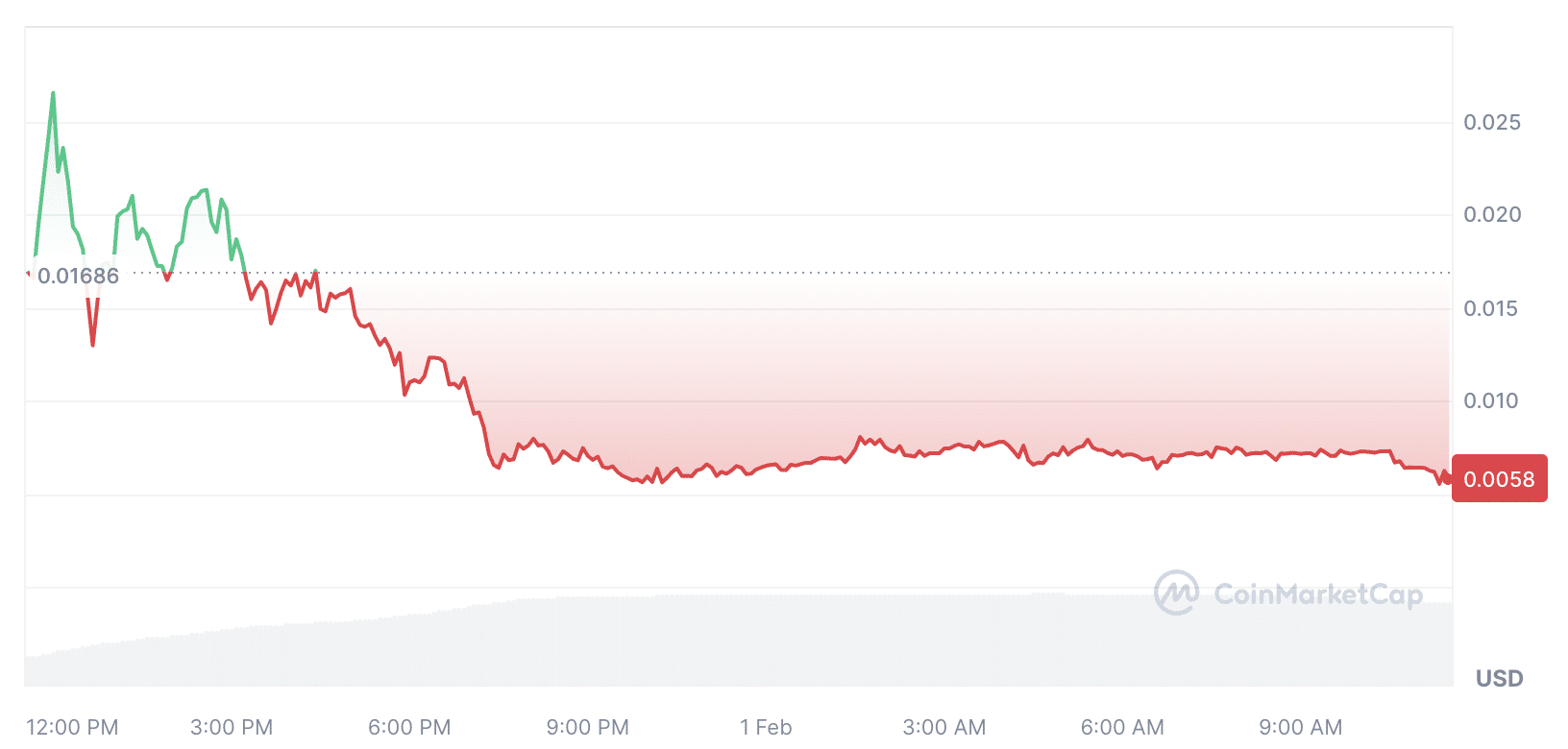

JUP, the native token of Jupiter, a decentralized alternate aggregator on Solana, crashed shortly after itemizing on centralized exchanges.

In keeping with CoinMarketCap, over the previous 24 hours, the token has fallen by 63% to $0.5887. On the opening of buying and selling, JUP was buying and selling at $1.2707.

Main buying and selling platforms Binance, Bitfinex, OKX, and others have registered the token and opened buying and selling. Later, the Binance staff introduced that Binance Futures will launch Jupiter futures. Nonetheless, this didn’t assist JUP get better its worth.

Amid the thrill surrounding the JUP itemizing, Merchants unintentionally carried out a pump and dump scheme with the flawed token. As a result of similarity of the ticker, merchants started to purchase the flawed token, and after realizing the error, the speed began to plummet. The challenge’s web site says it’s not operational.

The collapse within the worth of the Jupiter token was accompanied by a large-scale distribution of JUP value $700 million. In keeping with Jupiter’s plans, 40% of the ten billion JUP tokens shall be distributed amongst members of the Jupiter group. Within the first stage, it’s deliberate to withdraw 1 billion JUP tokens to the wallets of Solana customers.

The founding father of Jupiter Meow commented on the collapse within the token worth after the distribution. In keeping with him, recipients of airdrops get an enormous pool for ongoing gross sales. In distinction, potential patrons get the reassurance that there’s a massive pool that may face up to the appreciable gross sales strain from airdrops, which is able to trigger them to show away en masse instantly.

“We, as a staff, tackle the danger that we’ve zero certainty about how a lot we are going to find yourself with as a result of the group and people who have purchaser regret get first dibs.”

Meow, Jupiter founder

He believes the system stays good as a result of it forces the staff to set an inexpensive worth, prevents wild swings, and offers sturdy confidence in consistency between early patrons, the staff, and group hodlers.