Ethereum worth surged to $3,663 on March 26, up 20% from the month-to-month low recorded on March 19: market knowledge exhibits buyers have taken on a extra optimistic outlook forward of the Bitcoin halving.

Ethereum got here inside whiskers of dipping beneath $3,000 final week after the publish Dencun Improve sell-off. However with the Bitcoin (BTC) halving drawing nearer, on-chain knowledge exhibits a major change ETH buyers’ disposition.

Traders shift 200,000 ETH into long-term storage on 30-day Bitcoin halving countdown

After the wholesale sell-offs that heralded the Dencun improve, delays across the extensively anticipated Ethereum ETFs, ETH worth is now again in restoration section with 20% positive factors on the weekly chart.

On-chain knowledge tendencies counsel that the constructive shift in ETH market momentum will be attributed to buyers making strategic strikes to front-run potential impacts of the Bitcoin halving scheduled for April 20.

Notably, because the Bitcoin halving countdown hit the 30-day mark on March 19, Ethereum buyers have switched right into a extra conservative buying and selling strategy.

Cryptoquant’s change reserves metric tracks the variety of cash presently deposited in crypto change hosted wallets and buying and selling platforms. It serves as a proxy for monitoring buyers’ tendency to promote or search profit-taking alternatives within the brief time period or in any other case.

As of March 19, buyers held a complete of 14.2 million ETH cash throughout varied exchanges and buying and selling platforms. However that determine has now declined by 200,000 ETH over the previous week.

Persistent declines in change reserves is usually a prime indicator that merchants want to maintain out and could also be reluctant to promote, conditional on timeframe and/or market situations.

The correlation between this shift within the 30-day Bitcoin halving countdown means that the landmark community occasion could possibly be a key driver behind this shift in Ethereum buyers’ disposition.

Nonetheless, whatever the catalyst, a decline in change reserves usually impacts the underlying asset’s worth positively.

Firstly, valued on the present costs, it basically signifies that inside the previous week over $740 million value of ETH cash have been transferred out of the instant market provide into long-term chilly storage choices or staking contracts.

If demand stays regular and provide retains shrinking, it places upward stress on costs. And unsurprisingly, ETH worth has already surged 20% because the change outflows started on March 19.

Therefore, if extra current ETH buyers sustain the conservative outlook, the Ethereum worth restoration section might additional speed up within the days forward.

Ethereum worth forecast: $3,750 resistance now underneath stress

Drawing insights from the $730 million decline in ETH market provide, Ethereum worth seems poised for a breakout in direction of $4,000 forward of the Bitcoin halving.

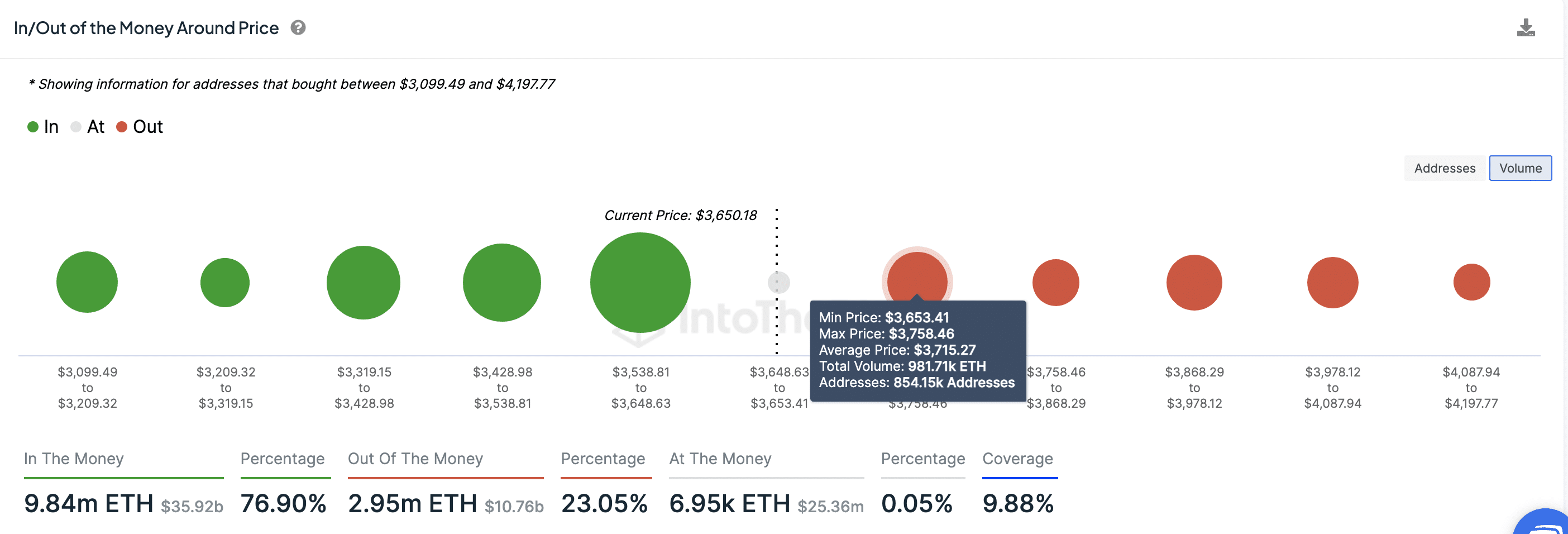

IntoTheBlock’s In/Out of the Cash chart additionally affirms this constructive stance. ETH presently faces a significant resistance cluster from 854,150 addresses that acquired 981,710 ETH on the most worth of $3,758.

However the IOMAP chart beneath exhibits that 76.9% of all buyers that purchased ETH inside the 20% boundaries of the present costs are in worthwhile positions.

With none main macro pressures, nearly all of them could possibly be reluctant to promote, leaving the door open to a $4,000 rebound as predicted.

Nonetheless, within the occasion of one other market downturn, the bulls will possible set-up to defend the $3,500 psychological assist.